- United States

- /

- Capital Markets

- /

- NYSE:OWL

A Look at Blue Owl Capital’s Valuation as Forced Fund Merger Sparks Investor Concerns

Reviewed by Simply Wall St

Blue Owl Capital (NYSE:OWL) has frozen investor withdrawals from a longstanding private credit fund, just before merging it with a larger, publicly traded counterpart. Fund investors now face forced conversion at about a 20% valuation loss.

See our latest analysis for Blue Owl Capital.

This move comes as Blue Owl’s share price has plummeted, posting a 19.4% decline over the past month and an eye-catching 41.8% loss year-to-date, even as the three-year total shareholder return remains up more than 33%. Recent events, such as redemptions being blocked and the forced fund conversion, seem to have accelerated the negative momentum and amplified both investor jitters and focus on the firm’s elevated risk profile.

If you’re thinking about expanding beyond Blue Owl, this could be a perfect moment to explore fast growing stocks with high insider ownership.

So with shares sitting at a steep discount after headline-grabbing turbulence, is Blue Owl Capital an overlooked bargain, or is the market wisely pricing in risks and curbed growth potential?

Most Popular Narrative: 35.5% Undervalued

With Blue Owl Capital trading at $13.74 and the most followed fair value estimate at $21.30, there is a striking gulf between market price and narrative projection. This gap has made the narrative’s valuation a major talking point, and the details behind it are stirring debate.

Exceptional long-term opportunities in digital infrastructure, fueled by generational investment in data centers and AI-related assets where Blue Owl has industry leadership, are catalyzing large-scale fundraising and deployment. This supports robust growth in management fees and recurring revenues over the next several years.

Want to know what earnings growth rates and margin assumptions power this bold price target? The narrative claims Blue Owl’s role in reshaping next-generation infrastructure transforms its earnings and profit profile. Curious what future milestones and projections make up this fair value? Unpack the full narrative to see the numbers that fuel the upside case.

Result: Fair Value of $21.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower pace of fundraising or missteps in integrating new acquisitions could quickly derail Blue Owl’s ambitious growth prospects.

Find out about the key risks to this Blue Owl Capital narrative.

Another View: Peeling Back the Layers on Value

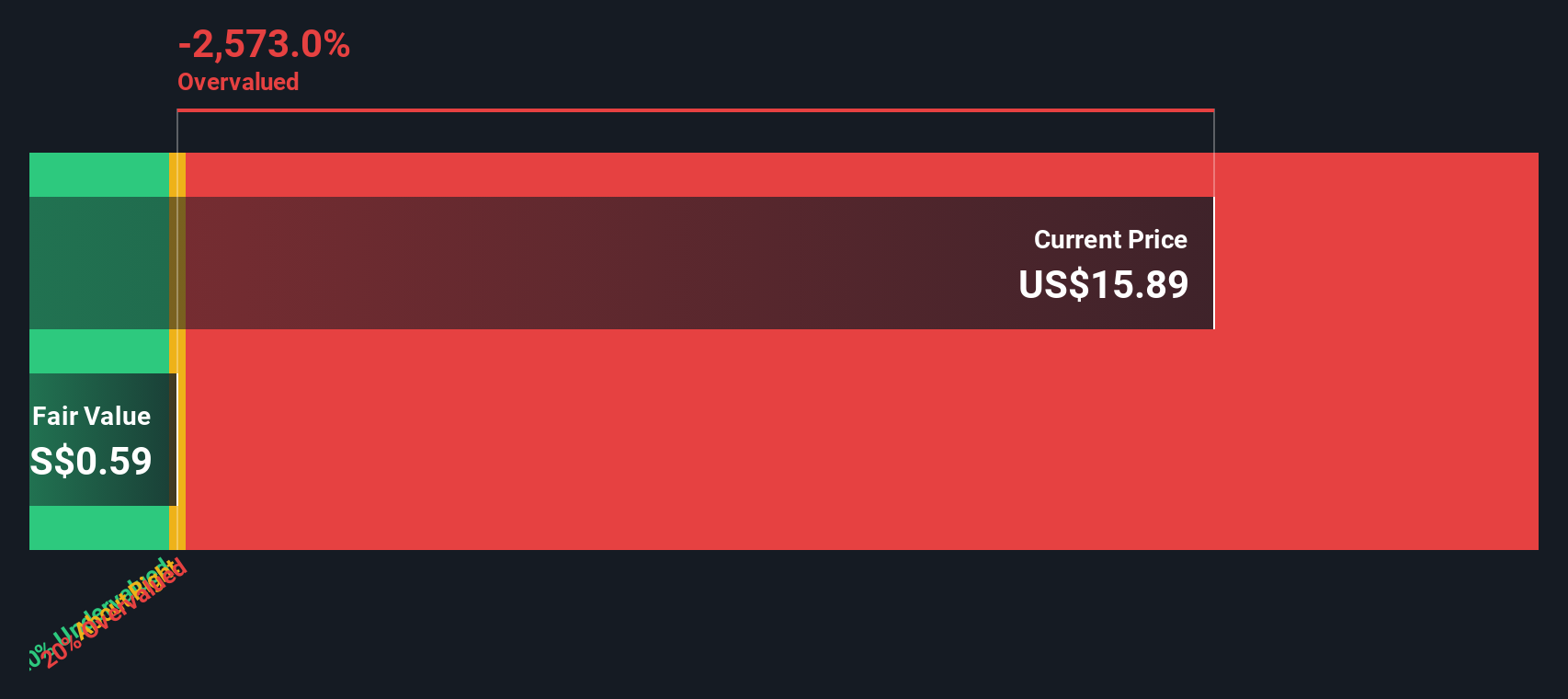

Taking a step back from narrative-driven fair value, our DCF model offers a pragmatic perspective. It suggests Blue Owl Capital’s current price is notably above its intrinsic value, introducing caution for those pursuing the upside story. Is the market’s pessimism a warning, or an overreaction?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Blue Owl Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Blue Owl Capital Narrative

If you see the story differently, or want to challenge these conclusions with your own analysis, you can generate your own narrative in just a few minutes. Do it your way.

A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always having fresh options on your radar, so don’t miss out on unique stocks shaping the market right now. Actively expand your opportunities and see what you’ve been overlooking with the power of the Simply Wall Street screener.

- Jumpstart your search for the next breakthrough. Scan these 26 AI penny stocks gaining momentum amid transformative artificial intelligence innovations.

- Capture stable income streams by reviewing these 16 dividend stocks with yields > 3% that consistently deliver yields above 3% for income-focused portfolios.

- Take advantage of attractive prices. Review these 915 undervalued stocks based on cash flows currently trading well below their intrinsic value, backed by solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives