- United States

- /

- Capital Markets

- /

- NYSE:OWL

A Fresh Look at Blue Owl Capital’s Valuation Following $5.5 Billion GP Stake Distributions and Strong Revenue Growth

Reviewed by Simply Wall St

Blue Owl Capital (OWL) just announced over $5.5 billion in distributions from its GP stakes funds during the past 18 months. This was highlighted by a major strip sale contributing more than $2.5 billion in proceeds.

Alongside this, the company’s recent quarterly earnings revealed revenue growth compared to last year, signaling continued momentum in business activity despite a notable drop in net income.

See our latest analysis for Blue Owl Capital.

Blue Owl Capital’s announcement of over $5.5 billion in GP stakes fund distributions and a record-breaking strip sale have underscored the firm’s liquidity strength, but these moves have not halted the recent market slide. The share price is down more than 33% year-to-date, although strong revenue growth has sparked fresh interest among investors. Still, the company’s three-year total shareholder return stands at an impressive 53%, highlighting long-term momentum even as the current sentiment remains cautious.

If Blue Owl’s recent moves have you rethinking your portfolio, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With the stock down sharply even as revenues climb and major distributions bolster liquidity, investors must ask whether Blue Owl Capital is undervalued after this selloff or if the market is already looking ahead to future growth.

Most Popular Narrative: 34% Undervalued

With Blue Owl Capital trading at $15.66, the narrative's fair value estimate of $23.73 highlights a substantial upside potential relative to the latest closing price. The narrative points to the firm's recent performance drivers as a significant factor for future re-rating.

Bullish analysts have highlighted the emergence of strong and durable trends following the most recent quarterly results. They suggest these trends will support sustainable earnings growth over the next several reporting cycles.

Curious about what’s fueling this projected price surge? The answer lies in bold financial forecasts tied to margin evolution and long-term earnings expansion. Want to see which growth levers and profit assumptions power this valuation narrative? Unlock the full story to discover the financial logic that is setting Blue Owl Capital’s trajectory.

Result: Fair Value of $23.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps following rapid acquisitions or a downturn in capital inflows could quickly challenge the optimistic growth and margin outlook for Blue Owl Capital.

Find out about the key risks to this Blue Owl Capital narrative.

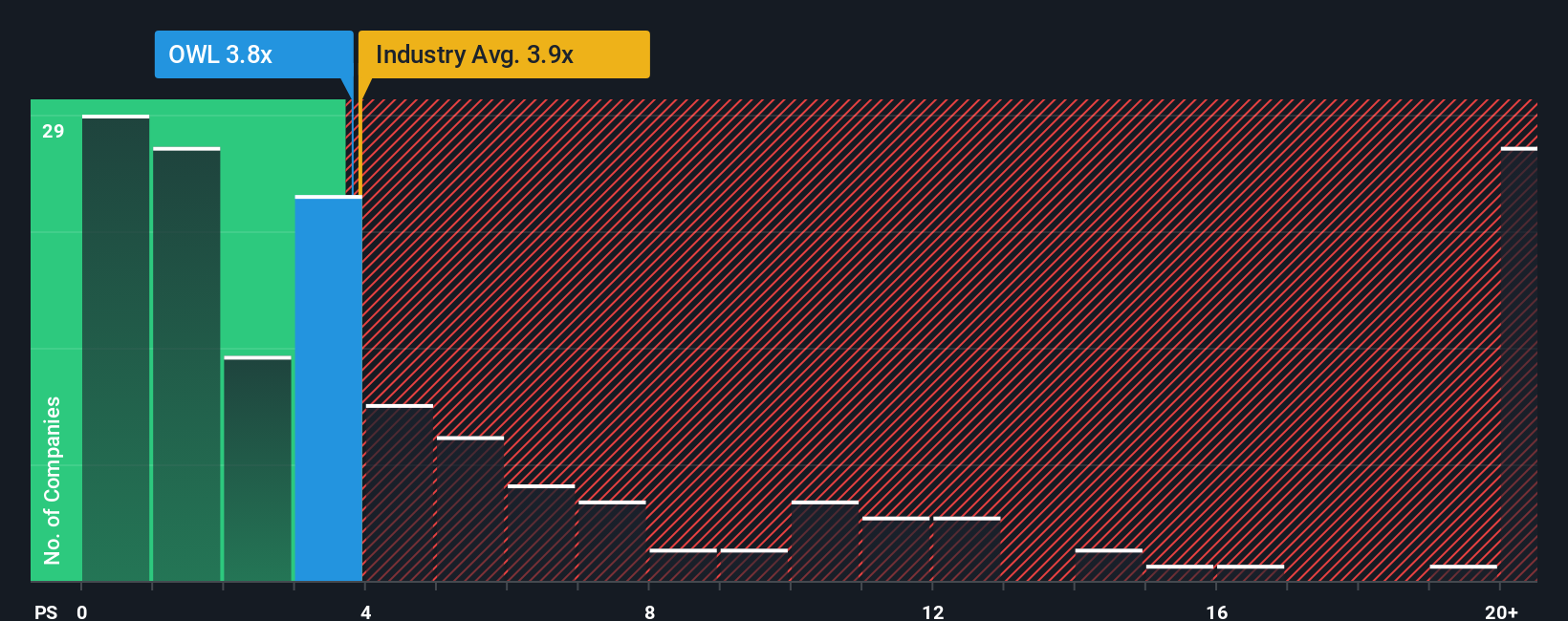

Another View: Sizing Up Value by Sales Multiples

While valuation narratives point to upside, Blue Owl Capital’s price-to-sales ratio of 3.8x exactly matches the US Capital Markets average. However, it sits above the peer average of 3.4x. The current level is also below the fair ratio estimate of 4.1x, suggesting further potential if sentiment improves. Does this gap hint at opportunity or lingering valuation risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Blue Owl Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Blue Owl Capital Narrative

If the current analysis doesn’t match your view or you prefer your own deep dive, you can craft a custom narrative in just a few minutes: Do it your way

A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means finding tomorrow’s winners before everyone else does. Let Simply Wall Street help you uncover exciting stocks with real potential, tailored to your goals.

- Target big yield opportunities by starting with these 20 dividend stocks with yields > 3%, packed with companies offering standout dividend potential and reliable income streams.

- Accelerate your search for the next tech frontier with these 28 quantum computing stocks, featuring cutting-edge innovators at the forefront of quantum computing.

- Boost your watchlist by locking in these 840 undervalued stocks based on cash flows, that our analysis suggests may be trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives