- United States

- /

- Capital Markets

- /

- NYSE:OPY

Oppenheimer Holdings (OPY) Earnings Surge 42.9%, Challenging Long-Term Bearish Narratives

Reviewed by Simply Wall St

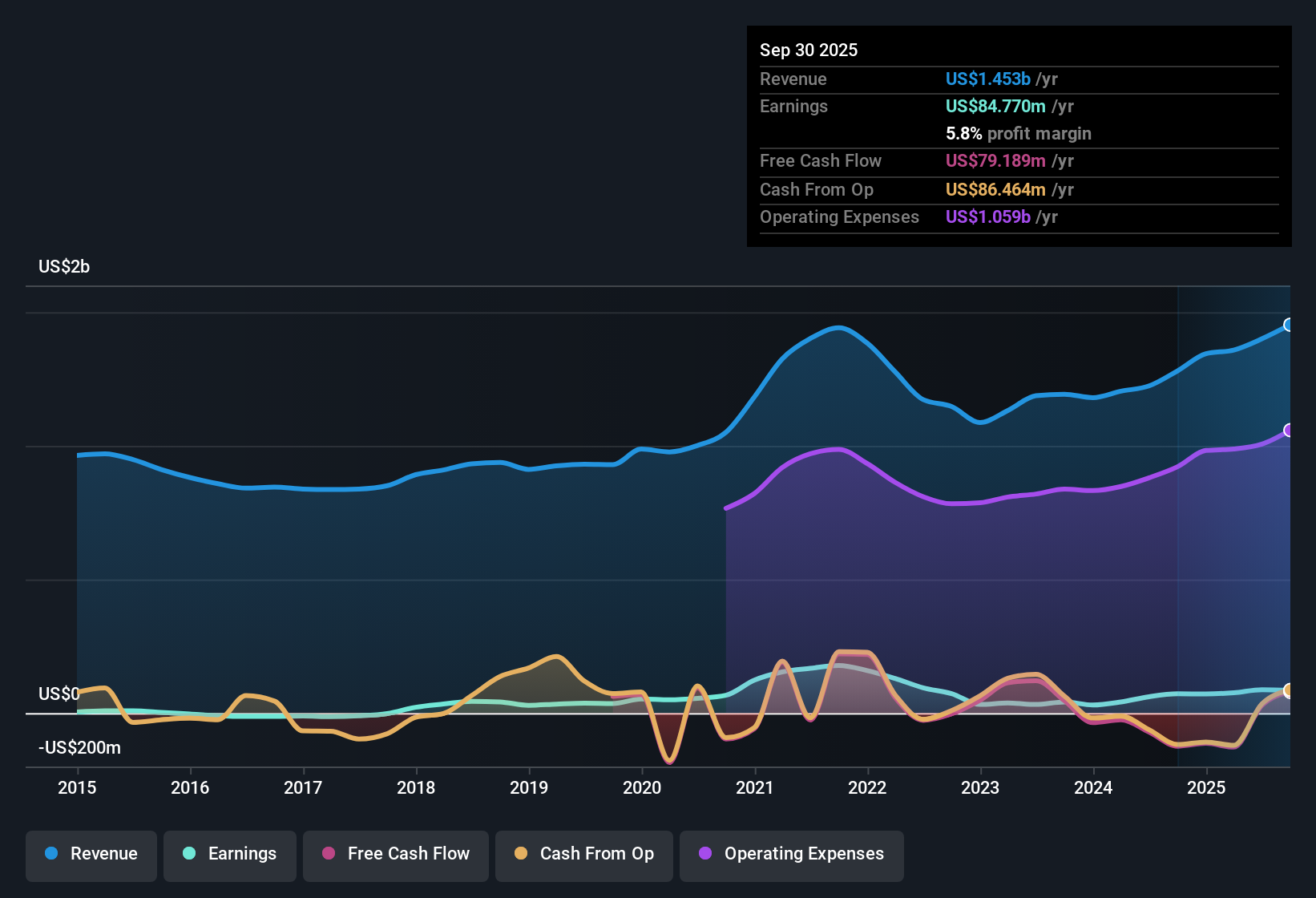

Oppenheimer Holdings (OPY) posted a robust year-over-year earnings growth of 42.9%, lifting net profit margins to 6.3%, up from 5% a year ago. Despite this impressive uptick, the company’s longer-term track record shows annual earnings have declined by 21.9% over the last five years. The share price currently stands at $69.76, well above the estimated fair value of $26.45, and the price-to-earnings ratio of 8.4x remains significantly lower than both industry and peer averages. While recent profit momentum and an earnings multiple below market peers hint at potential upside, the substantial gap between market price and fair value gives value-focused investors pause as they weigh the company’s risks and rewards.

See our full analysis for Oppenheimer Holdings.Next, we will compare these results to the most widely followed narratives investors use to interpret the numbers, highlighting where the story may differ.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Edge Up to 6.3%

- Net profit margins rose to 6.3%, up from 5% last year, offering a notable glimpse of improved operational efficiency even as the five-year trend reflects annual earnings declines averaging 21.9%.

- Building on recent momentum, the prevailing market view highlights short-term optimism as profitability edges higher. However, this remains in tension with the long-term negative trajectory:

- The sharp margin improvement bolsters hopes for a sustained turnaround. At the same time, the fact that annual earnings have fallen 21.9% per year over the last five years complicates the bullish case for a true rebound.

- Investors watching for a durable recovery may be encouraged by margin expansion, but the lack of clarity on future revenue trends leaves the strength of this turnaround open to question.

P/E Ratio Undercuts Industry Averages

- The company’s price-to-earnings ratio stands at 8.4x, which is significantly below both the US Capital Markets industry average of 25.6x and the peer group’s 15.6x. This suggests a sharp discount on earnings relative to the broader sector.

- What is surprising is that while this discount supports value-driven narratives, the prevailing market view points out a disconnect:

- A sub-10x P/E is typically seen as a value opportunity. However, with annual earnings dropping 21.9% per year over the past five years, some argue the low multiple may be justified rather than signaling a mispricing.

- This challenges the notion that OPY is simply “cheap,” as the risk that margins and growth may not be sustainable tempers hopes of an easy upside.

Share Price Premium Far Above DCF Fair Value

- Shares currently trade at $69.76, well above the DCF fair value estimate of $26.45. This reflects a 164% premium that sharply contrasts with its valuation models and below-industry multiples.

- While bulls might cite recent margin gains to justify market optimism, the prevailing market view underscores a material gap between sentiment and fundamentals:

- The high market premium signals confidence in near-term profit growth. Yet the lack of forward-looking guidance and the persistently negative longer-term earnings trend raise the question of whether this optimism is warranted.

- For value-focused investors, this premium challenges the usual narrative that a lower P/E ratio equals undervaluation, since the share price is so far above the DCF fair value benchmark.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Oppenheimer Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite recent improvement in margins, Oppenheimer Holdings faces persistently declining annual earnings and a share price trading far above its estimated fair value.

Concerned about paying too much for modest growth? Use these 833 undervalued stocks based on cash flows to focus on stocks with stronger value signals and better upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OPY

Oppenheimer Holdings

Operates as a middle-market investment bank and full-service broker-dealer in the Americas, Europe, the Middle East, and Asia.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives