- United States

- /

- Consumer Finance

- /

- NYSE:OMF

A Fresh Look at OneMain Holdings (OMF) Valuation Following Earnings Beat, Dividend Hike, and New Buyback

Reviewed by Simply Wall St

OneMain Holdings (OMF) delivered a trio of shareholder-friendly updates that turned heads recently. The company posted higher third quarter earnings, increased its quarterly dividend, and introduced a new share repurchase program.

See our latest analysis for OneMain Holdings.

After these shareholder-friendly moves, OneMain Holdings’ stock has built up notable momentum, with a 1-month share price return of nearly 15% and the one-year total shareholder return reaching over 18%. Accelerating buybacks, stronger earnings, and a steady dividend boost appear to be fueling renewed optimism for both short- and long-term investors.

If these robust results have you thinking beyond just one company, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with OneMain Holdings’ shares rallying and strong fundamentals in play, the real question is whether investors are looking at an undervalued stock with more room to run, or if the market has already factored in tomorrow’s growth story.

Most Popular Narrative: 6.6% Undervalued

With OneMain Holdings closing at $59.95, the most-watched narrative values shares at $64.21. This suggests the stock still trades below its estimated fair value. This setup is likely to interest investors who track price targets in relation to recent momentum.

Continued growth in consumer borrowing, particularly among non-prime consumers facing higher costs and stagnant real wages, supports long-term loan demand. OneMain's high-quality origination growth and expansion into debt consolidation and auto finance are positioned to capture this, driving sustained revenue and receivables growth.

What is powering this upbeat valuation? The explanation lies in rapid growth assumptions, strong conviction on future income, and earnings multiples that are rarely assigned to this sector. Want to see the specific levers analysts are using to reach that price? Dive in for a detailed breakdown of projections that could reshape how you view OMF’s potential.

Result: Fair Value of $64.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic stress for non-prime borrowers and rising funding costs could quickly challenge the positive valuation and growth story highlighted above.

Find out about the key risks to this OneMain Holdings narrative.

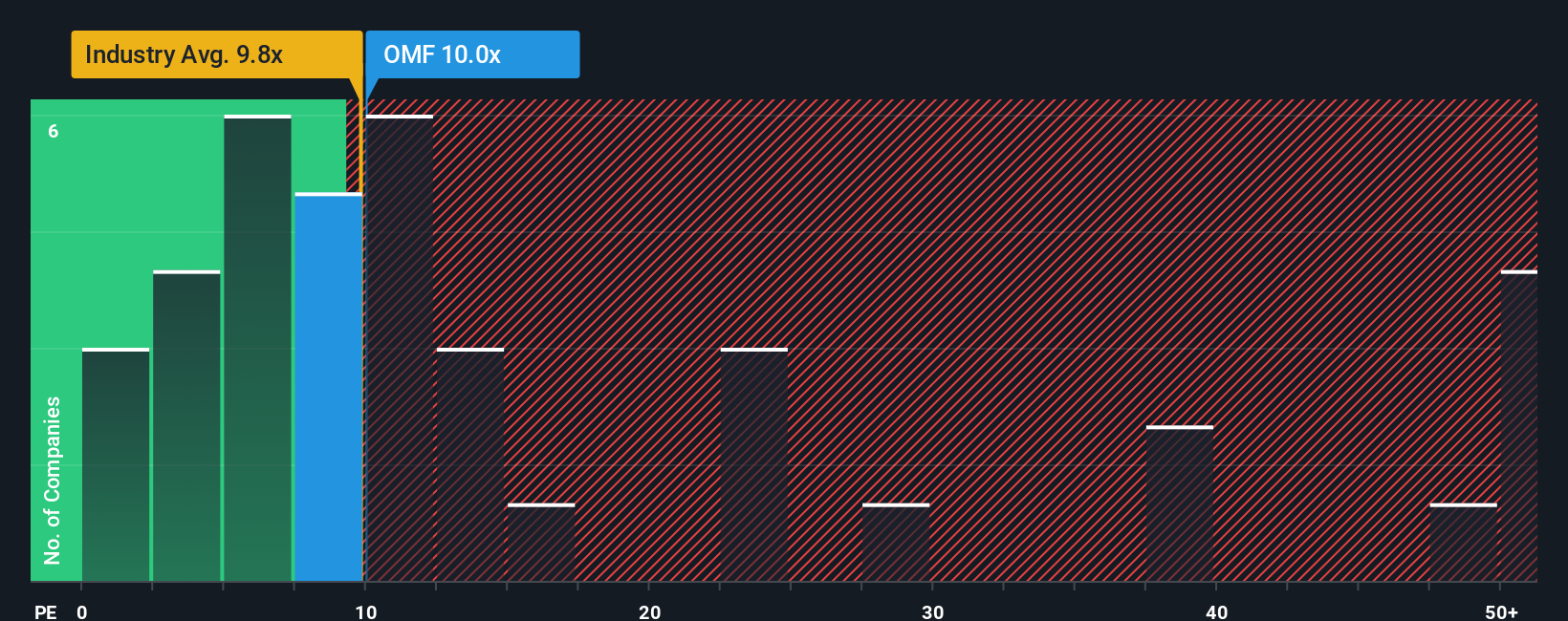

Another View: Value Signals From Earnings Multiples

Looking from an earnings ratio perspective, OneMain Holdings trades at 10x, which is below its peer average of 46.6x, the industry average of 10.3x, and comfortably under the fair ratio of 17.4x that the market might eventually adopt. This wide gap suggests an embedded skepticism or overlooked upside. Could this signal hidden value, or is it a sign that risks remain underappreciated?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OneMain Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OneMain Holdings Narrative

If you see the story unfolding differently or want to dig into the details yourself, you can easily craft a custom view in just a few minutes, and Do it your way.

A great starting point for your OneMain Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock when you could be ahead of the curve. The right tools can help you seize tomorrow’s winners now.

- Seize opportunities in healthcare innovation and breakthroughs by checking out these 32 healthcare AI stocks before the market spots the next big thing.

- Capitalize on strong, consistent yields by finding these 16 dividend stocks with yields > 3% offering over 3% returns for steady income potential.

- Get ahead of the curve in emerging tech by uncovering these 28 quantum computing stocks leading the transformation of computing as we know it.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Exceptional growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives