- United States

- /

- Consumer Finance

- /

- NYSE:NNI

Nelnet (NNI): Taking Stock of Current Valuation After a Year of Steady Returns

Reviewed by Simply Wall St

See our latest analysis for Nelnet.

Nelnet’s impressive year-to-date share price return of nearly 23% comes as no surprise to investors who have watched it steadily climb. Momentum continues to build despite only modest one-day and weekly movements. Over the longer term, total shareholder returns have also been robust, highlighting consistent value creation for those who stuck with the stock.

If Nelnet's steady climb has you thinking bigger, this could be the perfect moment to broaden your perspective and explore fast growing stocks with high insider ownership

But with the share price near analyst targets and multi-year returns already strong, investors must ask whether there is still hidden value left on the table or if Nelnet’s future growth is fully reflected in today’s price.

Price-to-Earnings of 14.2x: Is it justified?

Nelnet is currently trading at a price-to-earnings (P/E) ratio of 14.2x, which places it well above the US Consumer Finance industry average of 11x. At its last close of $129.80, this suggests that investors are paying a premium relative to peers for each dollar of Nelnet’s earnings.

The P/E ratio measures what investors are willing to pay today for a company’s earnings. For a diversified financials business like Nelnet, this multiple is central in assessing whether its future growth outlook and earnings quality warrant a higher or lower valuation compared to other industry players.

While a higher P/E can reflect market confidence in stronger growth or higher quality, Nelnet’s multiple surpasses not just the industry average but also the estimated fair price-to-earnings ratio of 11.5x. This implies the market could be overpricing current earnings potential, especially considering Nelnet’s forecasted profit growth is set to trail the broad market’s pace.

Compared to both peers and the calculated fair ratio, Nelnet’s valuation looks rich. This elevated P/E signals that investors may be expecting more robust performance ahead than what recent or forecasted numbers suggest.

Explore the SWS fair ratio for Nelnet

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, if revenue or profit growth continues at its modest pace, Nelnet’s premium valuation could come under scrutiny and prompt a reassessment from investors.

Find out about the key risks to this Nelnet narrative.

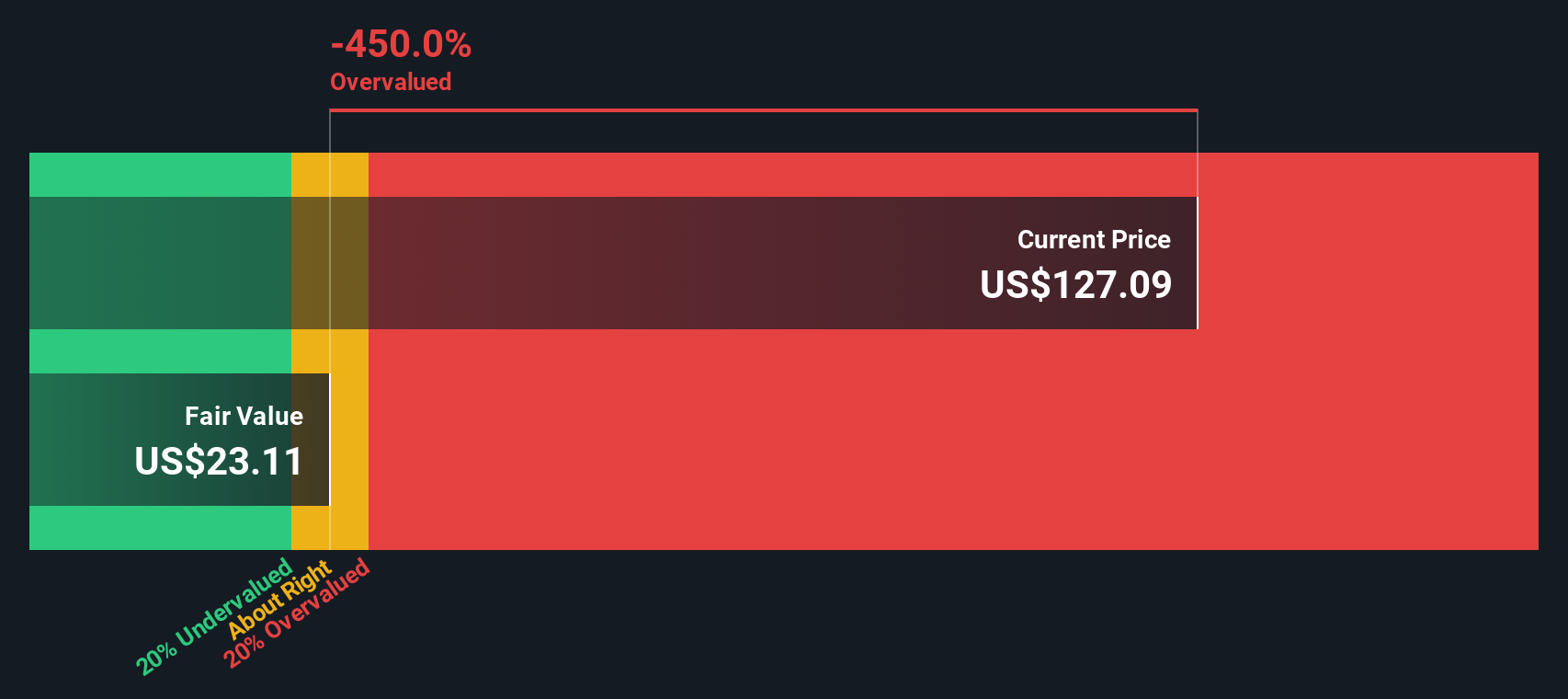

Another View: Discounted Cash Flow Tells a Different Story

Our DCF model, which estimates Nelnet’s present value using its expected future cash flows, arrives at a much lower fair value of $22.54 compared to the current share price of $129.80. This wide gap calls into question whether the market is being rational. Does the market see something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nelnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nelnet Narrative

If you have a different take or want to see how your own analysis stacks up, you can quickly craft your own story in just a few minutes. Do it your way

A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Expand your investment strategy by seeking out stocks with untapped growth and income potential. These hand-picked lists give you a real edge, so don’t let the next opportunity slip away.

- Maximize your income potential and secure steady yields when you review these 17 dividend stocks with yields > 3% with proven payouts above 3%.

- Capitalize on the latest financial trends and emerging markets as you consider these 82 cryptocurrency and blockchain stocks shaping the digital economy.

- Stay ahead of the curve in artificial intelligence by examining these 25 AI penny stocks poised for rapid expansion in tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives