- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Should Annaly’s Lower Earnings and Consistent Economic Returns Shift NLY Investors’ Focus on Portfolio Strategy?

Reviewed by Simply Wall St

- Annaly Capital Management reported half-year results showing net income of US$181.32 million, down from US$453.41 million a year earlier, with earnings per share from continuing operations at US$0.18 compared to US$0.76 previously.

- Despite the decline in earnings, the company underscored positive economic returns for seven consecutive quarters and significant capital raising, focusing on growth in agency mortgage-backed securities and residential credit portfolios.

- We'll explore how Annaly's ongoing positive economic returns, despite lower earnings, may influence its future investment story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Annaly Capital Management Investment Narrative Recap

For investors in Annaly Capital Management, the core belief centers on the company’s ability to generate recurring economic returns from its focus on agency mortgage-backed securities and residential credit, even when headline earnings fluctuate. The recent earnings decline appears not to materially shift the near-term catalyst, the continued appeal of agency MBS yields, though it does keep the spotlight on interest rate volatility as the key risk that could impact portfolio performance.

Annaly's announcement of raising over US$750 million in accretive capital in Q2 stands out, as it supports the company's stated strategy of expanding its agency portfolio to capture favorable yield opportunities. By maintaining low leverage and ample liquidity, Annaly positions itself to respond flexibly to changing market technicals, directly tying back to the market’s current focus on upcoming rate trends and regulatory shifts.

Yet, with wider mortgage spreads still a concern, investors should be aware that...

Read the full narrative on Annaly Capital Management (it's free!)

Annaly Capital Management is projected to reach $2.5 billion in revenue and $1.9 billion in earnings by 2028. This scenario assumes a 26.4% annual revenue growth rate and a $1.05 billion increase in earnings from the current $847.4 million level.

Uncover how Annaly Capital Management's forecasts yield a $20.84 fair value, in line with its current price.

Exploring Other Perspectives

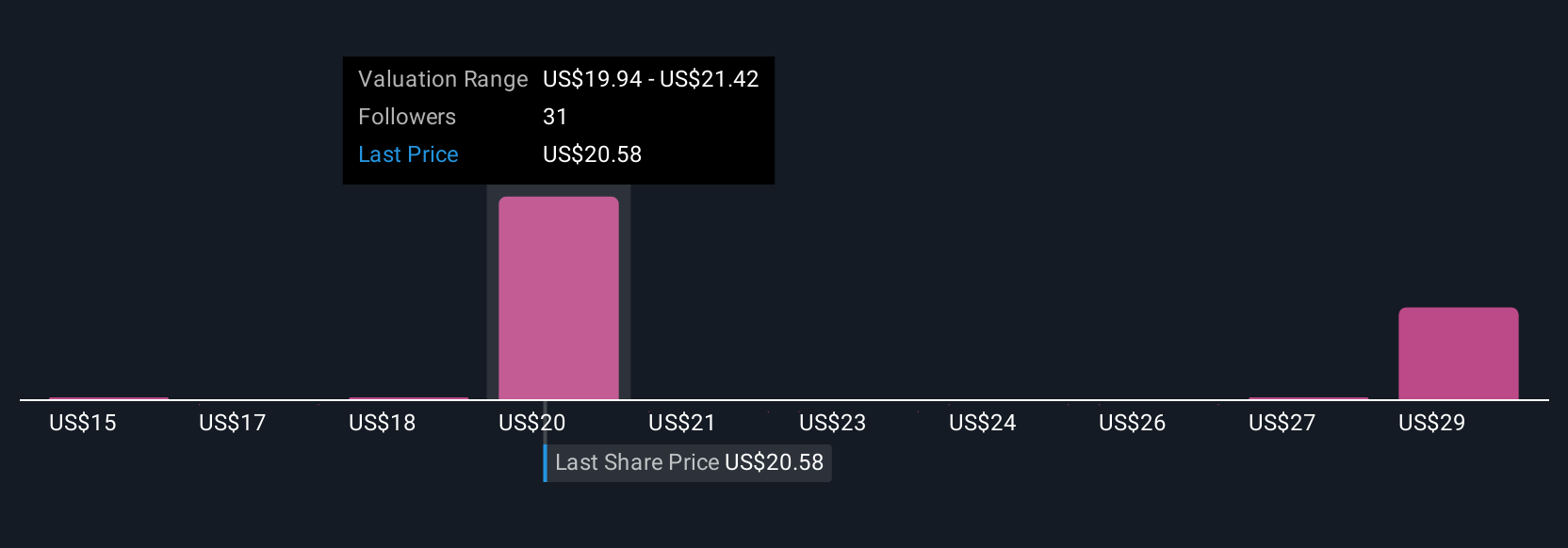

Simply Wall St Community members put forward 13 fair value estimates for Annaly, ranging from US$15.49 to US$33.58 per share. While many see compelling investment cases amid projected earnings growth, interest rate volatility is still a central talking point affecting long-term performance outlooks, explore several viewpoints on what this could mean for returns.

Explore 13 other fair value estimates on Annaly Capital Management - why the stock might be worth as much as 61% more than the current price!

Build Your Own Annaly Capital Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Annaly Capital Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Annaly Capital Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Annaly Capital Management's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives