- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Is Annaly Capital’s (NLY) Variable Rate Dividend Approach Reshaping Its Income Strategy?

Reviewed by Sasha Jovanovic

- Annaly Capital Management's Board recently declared fourth-quarter 2025 cash dividends for its Series F, G, I, and the newly issued J preferred stocks, with payout rates closely tied to the three-month CME Term SOFR and series-specific spreads.

- This marks the first dividend for the Series J preferred stock, reflecting continued focus on high-yielding but variable income streams for investors in a shifting interest rate climate.

- We'll examine how Annaly’s new preferred dividend declarations underscore its variable income approach and affect the company’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Annaly Capital Management Investment Narrative Recap

To be a shareholder in Annaly Capital Management, you need to believe in the company’s ability to capitalize on mortgage-backed securities and generate returns through a variable income model, especially in a fluctuating rate environment. The recent preferred dividend declarations, including the inaugural payout for Series J, reinforce Annaly’s focus on floating-rate, high-yield capital, but do not materially alter the most important short-term catalyst: the strength of agency MBS spreads. However, ongoing interest rate volatility remains the biggest risk facing Annaly’s earnings and margins, and that risk is not impacted by these new announcements.

Among recent company announcements, Annaly’s third-quarter 2025 results stand out, showing net income improvement to US$832.45 million from US$66.45 million a year earlier. These earnings help support variable preferred and common dividends, and complement Annaly’s approach of seeking total returns, even as dividend streams remain responsive to changes in short-term rates. For investors, this underscores the company’s dependence on strong distributable earnings, especially as it sustains high but variable payout levels.

In contrast, investors should be aware that periods of elevated rate volatility could quickly erode returns on Annaly's agency MBS investments and...

Read the full narrative on Annaly Capital Management (it's free!)

Annaly Capital Management's outlook anticipates $3.4 billion in revenue and $3.2 billion in earnings by 2028. This reflects a 46.9% annual revenue growth rate and a $2.6 billion increase in earnings from the current $575.1 million.

Uncover how Annaly Capital Management's forecasts yield a $22.10 fair value, in line with its current price.

Exploring Other Perspectives

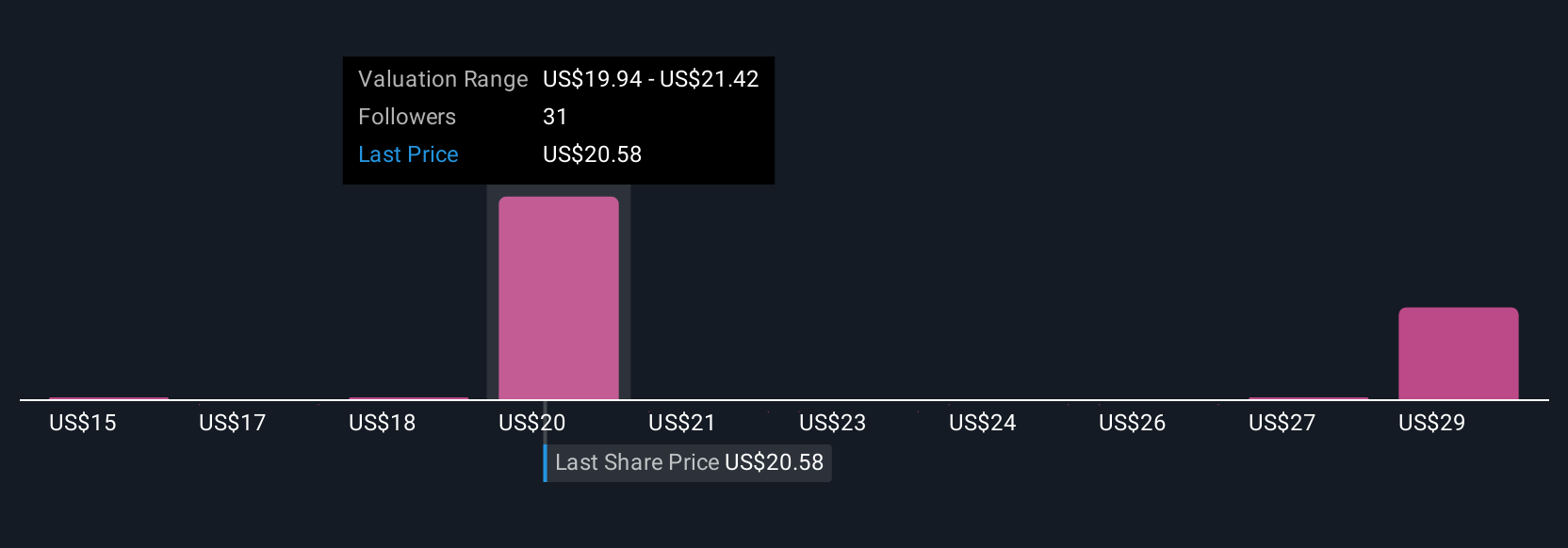

Twelve different fair value estimates from the Simply Wall St Community span US$16 to US$41.58 per share. Given the importance of stable mortgage spreads and Annaly’s variable dividends, you may want to review several alternative viewpoints before making decisions.

Explore 12 other fair value estimates on Annaly Capital Management - why the stock might be worth 26% less than the current price!

Build Your Own Annaly Capital Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Annaly Capital Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Annaly Capital Management's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives