- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Annaly Capital Management (NLY) Earnings Growth Forecast Surpasses US Market, Underscoring Bull Case

Reviewed by Simply Wall St

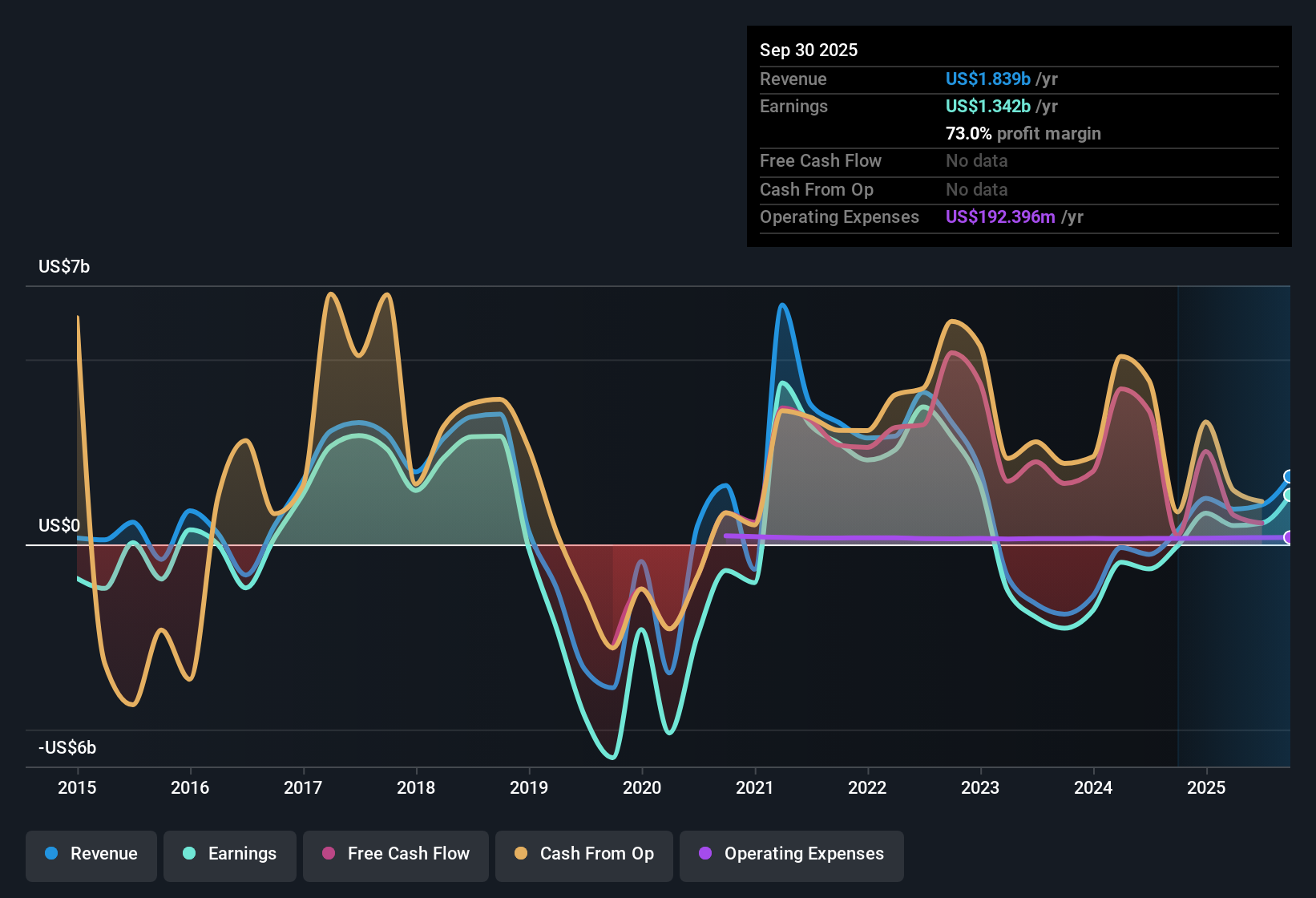

Annaly Capital Management (NLY) just posted forecasts pointing to annual earnings growth of 28.07% and revenue set to climb by 21.8% each year, both comfortably ahead of US market averages. The company became profitable over the past year, with net profit margins improving during the period. For investors, strong growth prospects and a track record of high-quality earnings are balanced by some caution around financial stability and dividend sustainability.

See our full analysis for Annaly Capital Management.Next, we will see how these headline numbers stack up against the widely followed narratives at Simply Wall St, highlighting where the story holds up and where it might be challenged.

See what the community is saying about Annaly Capital Management

Analysts Forecast Margin Expansion to 95.3%

- Consensus estimates call for Annaly’s profit margins to climb from 53.7% currently to 95.3% within three years, highlighting a major shift in expected profitability.

- According to the analysts' consensus view, this margin expansion is bolstered by two factors:

- Improved financing terms and $400 million in equity raised allow for greater earnings distribution and stronger revenue growth.

- Strategic positioning in higher coupon segments within Agency MBS portfolios aims to capture more attractive spreads and support sustained margin gains, even as the market faces tighter credit spreads.

- Expectations for margin growth reinforce why many see Annaly’s business model as unusually resilient in today’s environment. 📊 Read the full Annaly Capital Management Consensus Narrative.

Peer Valuation Discount Stands Out

- Annaly is trading at a price-to-earnings ratio of 10x, below the Mortgage REITs sector average of 13x and below peers at 12.8x. This suggests the current $20.89 share price offers a notable valuation discount.

- The analysts’ consensus view credits this discount to Annaly’s improved net margins and sustained revenue growth, but also cautions that analyst price targets are tightly clustered near current trading levels:

- With the analyst consensus price target at $21.73, only about 4% above the most recent share price, most believe shares are fairly valued unless growth continues to outpace sector peers.

- DCF fair value is considerably higher at $41.39, pointing to further upside if optimistic assumptions play out. However, prevailing consensus treats these as best-case scenarios rather than base expectations.

Rising Share Count and Dividend Risks Remain

- Analysts expect Annaly's share count to increase by 7% annually over the next three years, even as there is concern over dividend sustainability and the company’s overall financial stability.

- The consensus view is that while new equity supports acquisition opportunities and earnings growth, it may dilute per-share metrics if profit expansion does not keep pace:

- Bears point to elevated hedging costs and potential for prolonged rate volatility as threats to margins, potentially weakening future dividends.

- However, there is no recent indication of equity dilution events beyond planned issuance, which reduces some of the worst-case risk around share inflation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Annaly Capital Management on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there's another angle to the story? Turn your unique interpretation into a personal narrative in just a few minutes with Do it your way.

A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Annaly’s upside, concerns remain about the sustainability of its dividend and vulnerability to elevated volatility and liquidity risks.

If reliable payouts are a priority for you, discover these 1979 dividend stocks with yields > 3% that combine attractive yields with steadier financial health and fewer nagging questions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives