- United States

- /

- Diversified Financial

- /

- NYSE:NATL

NCR Atleos (NATL): Assessing Valuation After Revenue Beat but Earnings Miss in Recent Results

Reviewed by Simply Wall St

NCR Atleos (NATL) recently drew investor attention after posting quarterly results that delivered 5% revenue growth year on year, edging past expectations. However, the company fell short on profitability as earnings per share lagged forecasts.

See our latest analysis for NCR Atleos.

NCR Atleos has seen some momentum build recently, with a 3.2% gain in share price over the past week and an 8.8% year-to-date increase, despite a dip after its earnings miss. Its total shareholder return for the past 12 months stands just under 10%, signaling steady progress as the company continues to expand its banking technology footprint and attend notable industry events such as the recent Stephens Annual Investment Conference.

If you're interested in how other fast-growing companies with strong insider backing are performing, this could be the moment to discover fast growing stocks with high insider ownership

With its recent modest gains and a share price still sitting over 20% below analyst targets, the question now is whether NCR Atleos remains undervalued or if the current price already reflects all of its future growth prospects.

Most Popular Narrative: 17% Undervalued

With the most widely followed narrative estimating a fair value of $44.67, NCR Atleos last closed at $37.07. This positions the stock well below the narrative’s price target. Investors are now looking closely at the factors behind this gap between the market and expectations.

High recurring revenue mix (over 70% in Q2), significant productivity gains through AI-driven service optimization, and a rapidly scaling backlog are driving strong margin expansion and robust free cash flow. These factors underpin announced share buybacks and sustained EPS growth, suggesting current valuation does not reflect enhanced long-term earnings power.

Curious which profit drivers and growth scenarios command a value higher than today’s market price? Get the full scoop on future revenue, margins, and a bold earnings outlook propelling this surprisingly high target. The narrative might have a twist you don’t expect. Uncover it within.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising digital banking adoption and growing fintech competition could limit NCR Atleos's recurring ATM revenue and present challenges to the bullish long-term outlook.

Find out about the key risks to this NCR Atleos narrative.

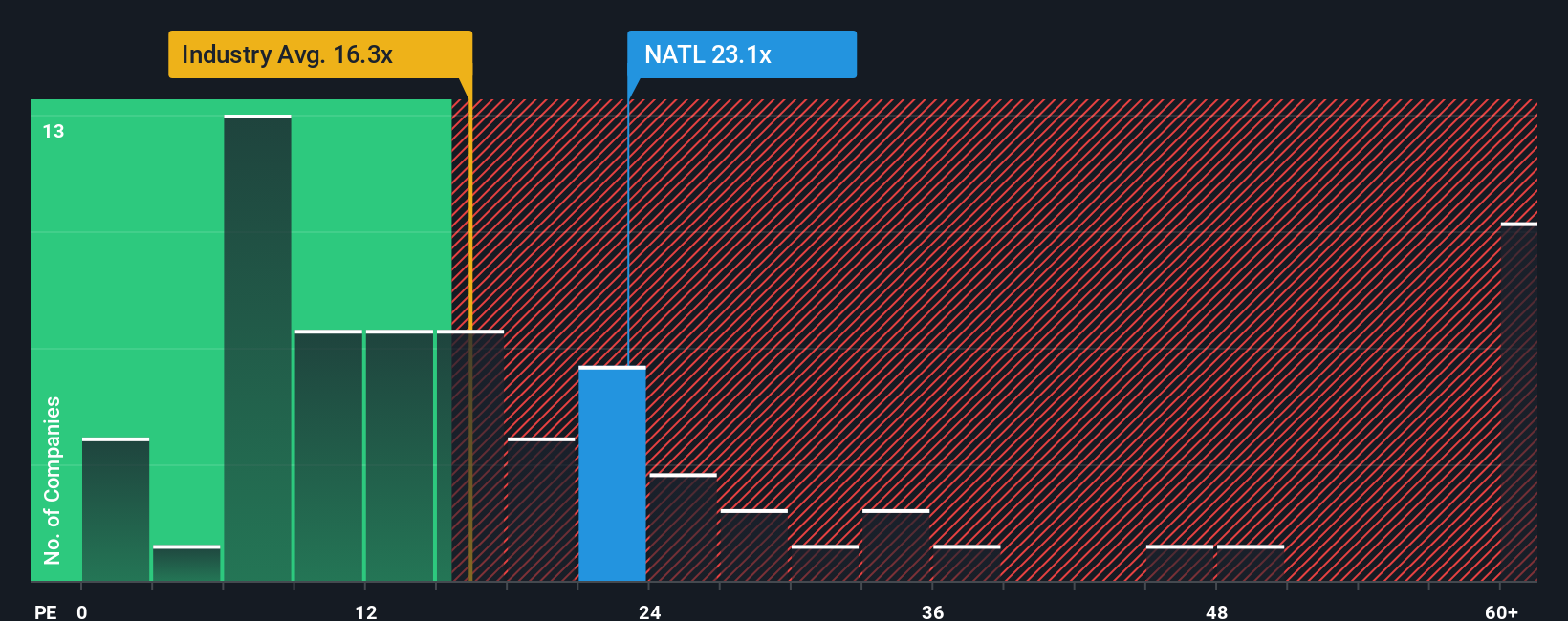

Another View: Market Ratios Signal a Caution

Looking at market ratios offers a different lens. NCR Atleos trades at 20.9 times earnings, which is notably higher than both the industry average of 14x and its peer group at 12.4x. In comparison to the fair ratio of 20.4x, the current valuation appears stretched, potentially raising concerns about downside risk if expectations change. Could the market be overestimating future growth, or is there more to the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NCR Atleos Narrative

If you think there's another angle to the story or want to dive in and build your own insight from the data, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your horizon and take charge of your financial journey. Savvy investors are acting now to seize opportunities others overlook. Don’t let these potential winners pass you by.

- Unlock exclusive access to steady income by reviewing these 15 dividend stocks with yields > 3% that consistently yield over 3% and help build a reliable portfolio foundation.

- Seize the chance to target companies poised for the future as you evaluate these 25 AI penny stocks shaping the AI revolution and tech-driven growth trends.

- Strengthen your position with untapped value by searching through these 916 undervalued stocks based on cash flows identified as attractive based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026