- United States

- /

- Diversified Financial

- /

- NYSE:MTG

A Fresh Look at MGIC Investment (MTG) Valuation Following Recent Performance Trends

Reviewed by Simply Wall St

MGIC Investment (MTG) has drawn renewed attention as investors digest its latest numbers and look for fresh clues about the company's trajectory. The stock recently showed mixed performance over the past month and quarter, which has sparked curiosity about the underlying drivers.

See our latest analysis for MGIC Investment.

MGIC Investment’s share price climbed steadily for much of the year and currently sits at $27.38, with momentum cooling slightly over the past month. However, longer-term investors are still enjoying a 12.35% total shareholder return in the last year and a substantial 205.64% over five years. Sentiment appears to ebb and flow with industry risk perceptions, but the long-term picture suggests the stock has rewarded patient holders.

If you’re curious where else strong returns and changing momentum might be found, now’s a perfect chance to expand your search and discover fast growing stocks with high insider ownership

With solid gains behind it and a current share price just below analyst targets, the question for investors now is whether MGIC Investment is trading at a bargain or if the market has already factored in its future prospects.

Most Popular Narrative: Fairly Valued

Compared against the last close at $27.38, the narrative consensus points to MGIC Investment reflecting its intrinsic worth rather precisely. This sets up a focus on whether the conditions shaping this verdict are sustainable in the years ahead.

Urbanization, new household formation, and persistent pent-up demand for homeownership in the U.S. signal a robust long-term need for mortgage credit and insurance, underpinning resilient premium revenue and supporting revenue growth over time. MGIC's continued strong portfolio credit performance, prudent risk management, and lower-than-expected claim frequencies suggest lasting improvements in net margins and lower loss ratios, which contributes to higher future earnings stability.

Want to know the economic forces and management tactics that underpin such a precise valuation call? The most popular narrative incorporates future profitability, policy growth, and credit risk dynamics. It is the analyst projections, not market averages, that form the backbone of this price target. The key factors driving this assessment are revealed by specific quantitative metrics included in the analysis.

Result: Fair Value of $27.33 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently slow insurance growth and ongoing affordability challenges could quickly shift MGIC Investment’s outlook if these headwinds persist or become more severe.

Find out about the key risks to this MGIC Investment narrative.

Another View: Market Multiples Test the Consensus

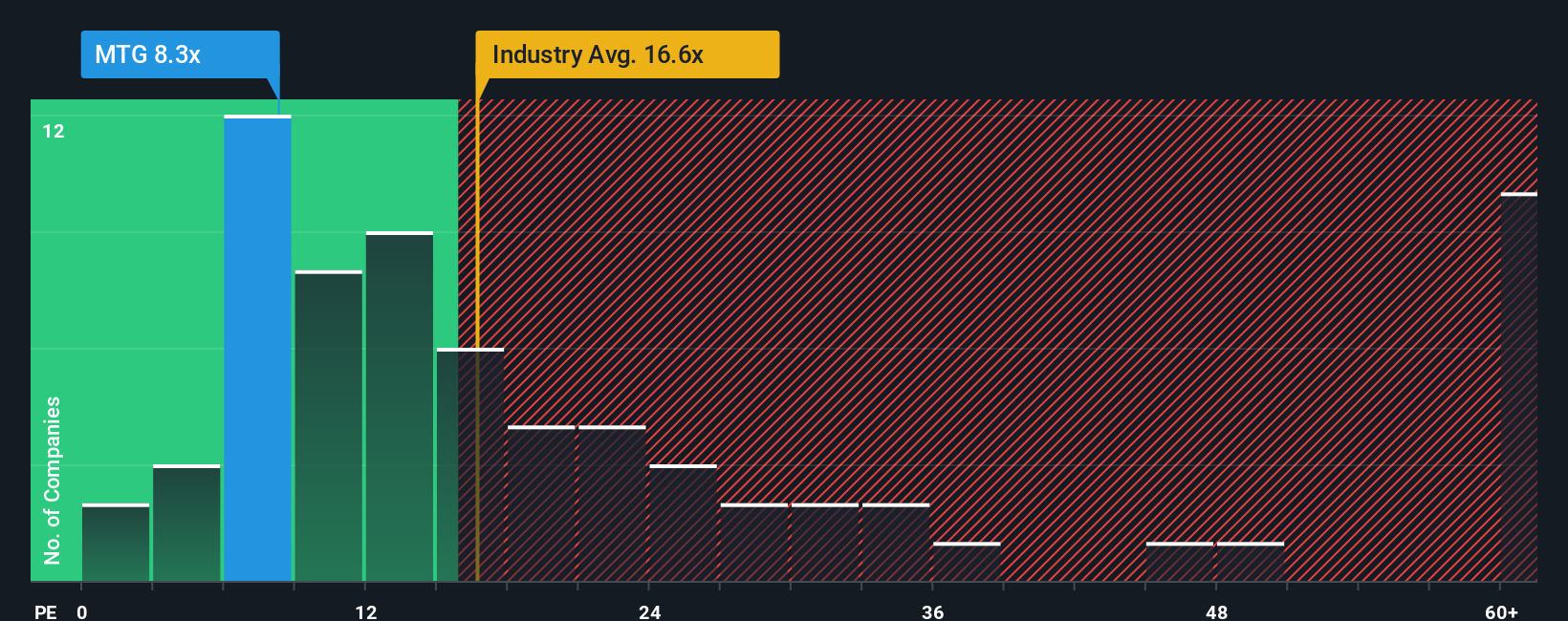

While analysts see MGIC Investment as fairly valued, another lens casts it in an even brighter light. At 8.3x earnings, the company’s price tag is well below the industry’s 16.6x average and the peer average of 33.1x. Even compared to its own fair ratio of 12.4x, the current multiple shows significant room for upward movement. This suggests the market may be leaving value on the table. Does this gap signal a missed opportunity, or is there hidden risk the consensus is capturing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGIC Investment Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can shape your own MGIC Investment story in just minutes. Do it your way

A great starting point for your MGIC Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search. Some of the biggest wins hide where most investors aren’t looking. Unlock the next potential standout by exploring these handpicked opportunities:

- Spot industry leaders delivering consistent income and get started with these 17 dividend stocks with yields > 3% that offer yields above 3% and robust balance sheets.

- Tap into breakthrough innovations in artificial intelligence by checking out these 27 AI penny stocks, where young disruptors are rewriting the rules of tomorrow’s markets.

- Boost your portfolio with hidden value by targeting these 877 undervalued stocks based on cash flows, featuring stocks trading below their fair value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTG

MGIC Investment

Through its subsidiaries, provides private mortgage insurance, other mortgage credit risk management solutions, and ancillary services in the United States, the District of Columbia, Puerto Rico, and Guam.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives