- United States

- /

- Capital Markets

- /

- NYSE:MSCI

MSCI (MSCI): Examining Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for MSCI.

MSCI’s share price has experienced some ups and downs, with the recent dip reflecting a broader trend of fading momentum over the past year. While the stock logged a 1-year total shareholder return of -3.5%, its longer-term 3- and 5-year returns continue to outpace the market. This suggests underlying growth potential and resilience even as near-term sentiment remains uncertain.

If you’re curious about other market standouts, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

This raises a key question for investors. With MSCI’s price still below analyst targets, but long-term growth intact, does the current dip offer an attractive entry point, or is the market already factoring in its future prospects?

Most Popular Narrative: 13.7% Undervalued

Compared to its latest closing price of $565.15, the most widely followed narrative argues that MSCI’s fair value sits notably higher. This valuation gap highlights the potential optimism behind analysts’ future assumptions for revenue, earnings, and margins.

“Expanding mandates and product innovation in the climate, sustainability, and ESG domains are positioning MSCI to benefit from rising regulatory and asset owner requirements for ESG/climate data. This is expected to translate into higher subscription revenue and increased pricing power over time, supporting both top-line growth and net margins.”

Want to know what fuels that bullish price? One underlying forecast could change your perspective on MSCI’s upside. It comes down to bold expectations for future revenue, improved profit margins, and even dwindling share count. Find out why the narrative thinks these numbers justify a premium valuation.

Result: Fair Value of $655.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in Sustainability product growth or lower client retention could challenge MSCI’s premium. These factors could act as key catalysts to watch for this narrative.

Find out about the key risks to this MSCI narrative.

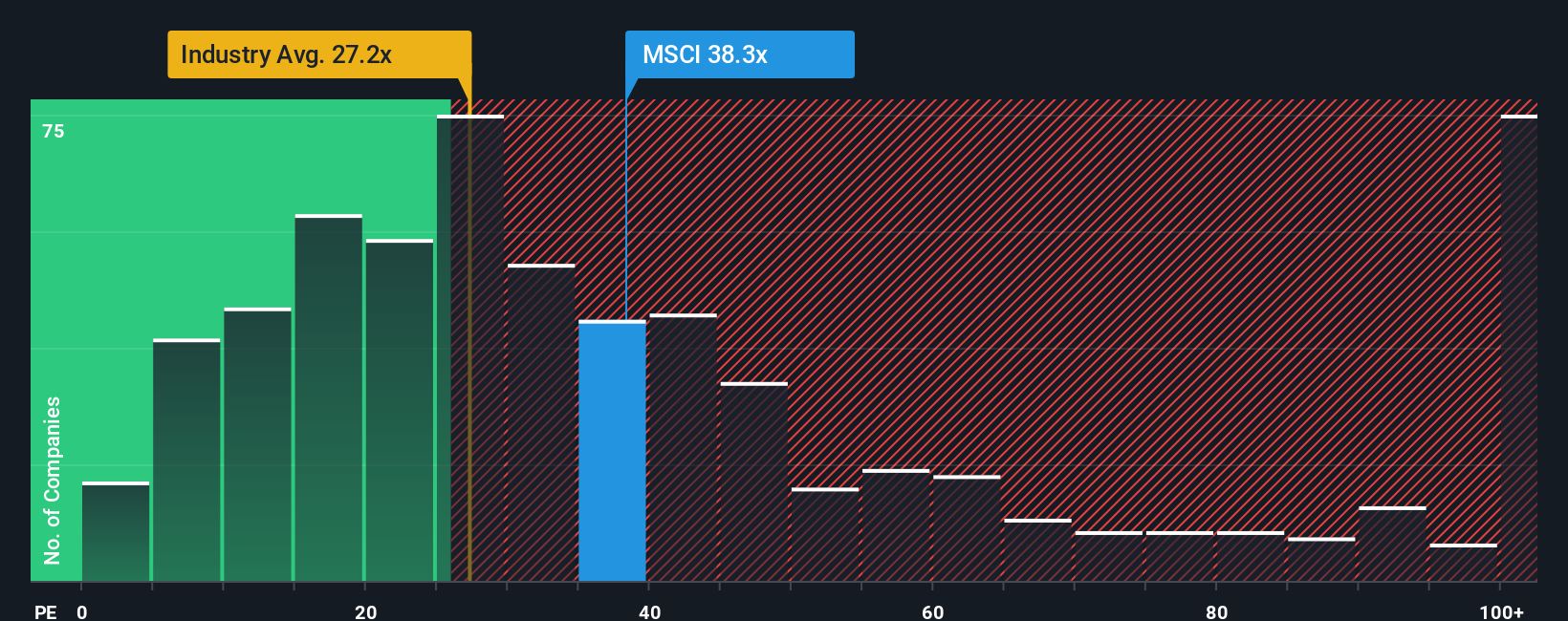

Another View: A Multiples Reality Check

While optimistic long-term narratives suggest MSCI is undervalued, our look at the current price-to-earnings ratio suggests caution. At 34.7 times earnings, MSCI trades well above both its peer average of 30.7 and the broader industry at 24.9. In comparison to a fair ratio of 16.6, the premium is considerable, raising the risk that investor expectations are already high. Could this mean MSCI's upside is already priced in, or does the company's quality still justify the stretch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you’d rather draw your own conclusions or want to dig into the numbers yourself, you can build a personalized MSCI story in just a few minutes. Do it your way.

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Open yourself up to the next wave of potential by checking out these powerful stock ideas. Don’t miss out on what’s ahead.

- Tap into high-growth sectors by targeting these 26 AI penny stocks poised to benefit from rapid breakthroughs in artificial intelligence.

- Secure steady income streams while finding these 16 dividend stocks with yields > 3% offering attractive yields greater than 3% and reliable fundamentals.

- Position your portfolio for the future with these 82 cryptocurrency and blockchain stocks riding the momentum of cryptocurrency advancements and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives