- United States

- /

- Capital Markets

- /

- NYSE:MSCI

Is MSCI Positioned for Growth After ESG Data Expansion and Recent Price Gains?

Reviewed by Bailey Pemberton

Thinking about what to do with MSCI stock right now? You are not alone. With its recent price of $538.75, the stock has been making some investors second-guess their moves. Over the last week, MSCI edged up by 1.0%, offering a glimmer of hope after a choppier 30 days that saw shares slip by 5.3%. Longer-term holders have seen the stock dip 9.8% year-to-date and 7.6% over the last year, but let’s not overlook an impressive return of 22.5% over three years and 63.9% in five. That kind of performance history gets people talking, especially when news stories start swirling around the company’s expansion into climate data offerings and ongoing investments in index innovation. Recent headlines have also focused on MSCI’s push to enhance ESG data tools, which some analysts argue positions the company for future growth as investors pivot toward sustainability. But with all this action, is the stock really undervalued today?

Here is where things get interesting. According to a straightforward value scoring system, MSCI picks up a 0, meaning it is not undervalued according to any of the six valuation checks typically used by analysts. So where do we go from here? Before making any big decisions, let's break down what these valuation approaches really say about MSCI, and why a fresh perspective on what “value” means might be even more helpful for investors like you.

MSCI scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MSCI Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate the true value of a business by projecting its future cash flows and then discounting those sums back to their present value. The goal is to figure out what the company is realistically worth today, based on expected cash it will generate down the line.

For MSCI, the latest reported Free Cash Flow (FCF) is $1.37 billion. Analysts project steady growth, reaching $2.07 billion by 2029, with further extrapolations extending out a decade. Each year’s cash flow is estimated first and then adjusted to reflect its current value, accounting for risk and time. The DCF model here uses a Two Stage Free Cash Flow to Equity method. This approach incorporates both near-term analyst estimates and longer-term forecasts to capture MSCI’s evolving financial profile.

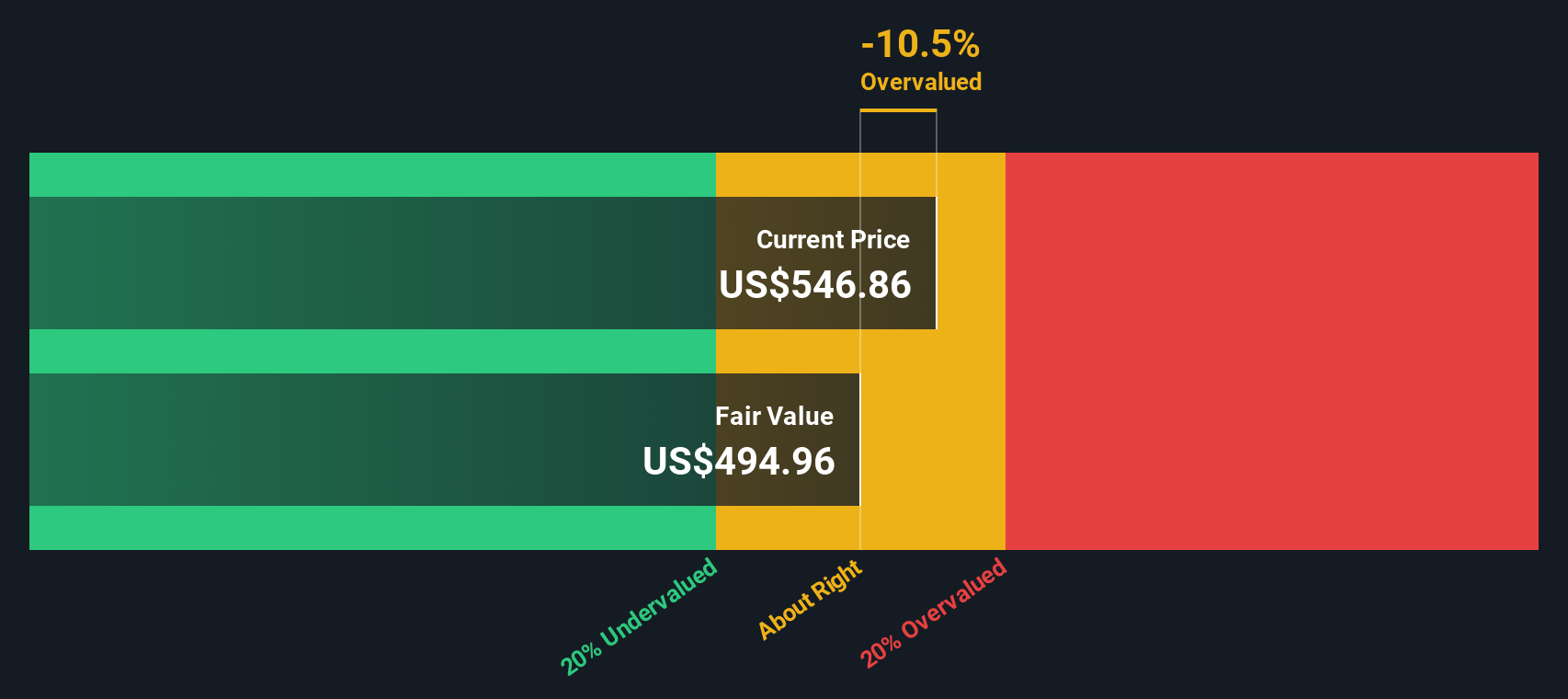

The outcome is that the DCF model calculates an intrinsic share value of $498.00. This figure is about 8.2% lower than the current MSCI share price, suggesting the stock is trading slightly above what the cash flow projections would justify.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out MSCI's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: MSCI Price vs Earnings

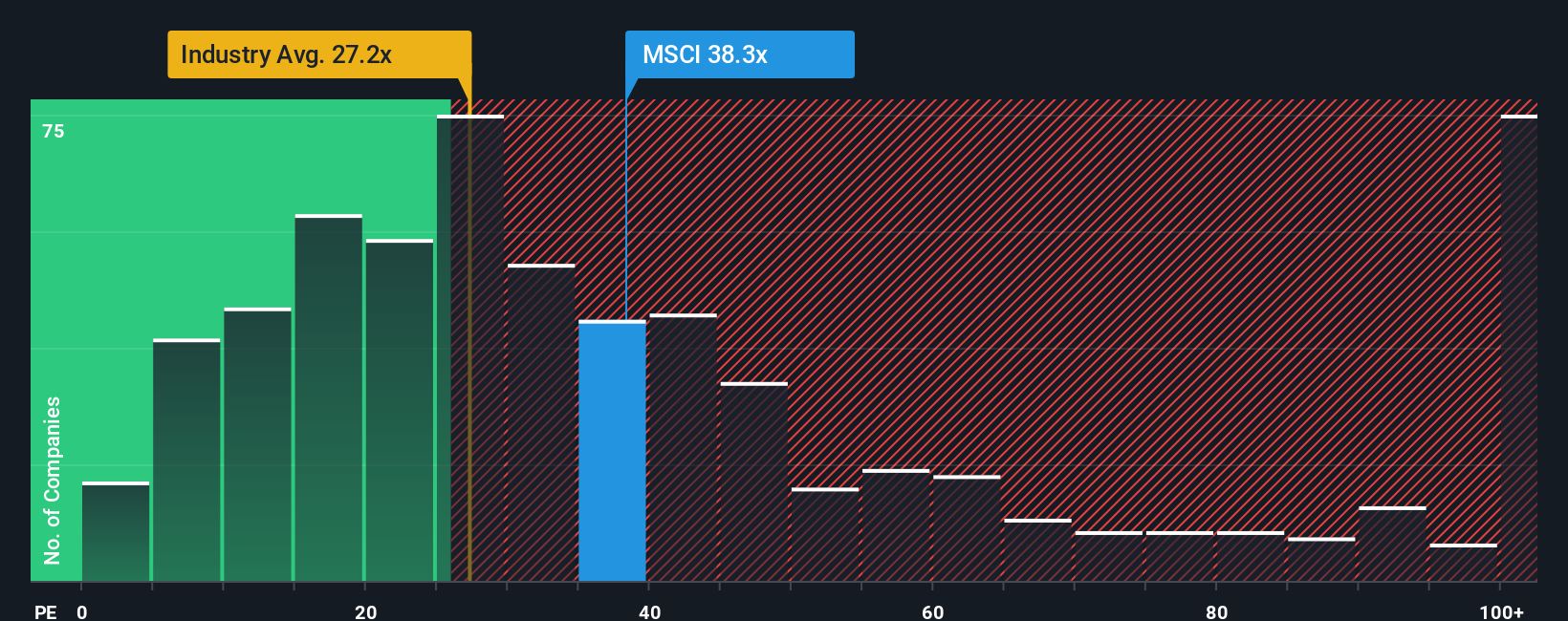

The Price-to-Earnings (PE) ratio is a widely used valuation metric for companies that are consistently profitable, like MSCI. It tells investors how much they are paying for each dollar of the company’s earnings, making it a simple way to compare companies across similar industries. In general, higher growth expectations or lower risk will justify a higher “normal” PE, while slower-growing or riskier companies typically see lower multiples.

Currently, MSCI trades at a PE ratio of 35.4x, which is slightly higher than both its peer average of 34.9x and the Capital Markets industry average of 26.1x. However, comparing MSCI exclusively against broad industry or peer averages does not fully account for the unique aspects that influence what a fair PE should be for the company.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio estimate for MSCI stands at 18.0x, a figure that incorporates its expected earnings growth, risk profile, margins, industry, and market capitalization. These factors provide a more rounded basis for valuation than plain benchmarking. Despite the similarities to peer multiples, MSCI's share price now sits considerably higher than its Fair Ratio, indicating that the market currently prices in a premium for the stock that may be difficult to justify with fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MSCI Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives.

A Narrative is a story you tell about a company, putting your perspective behind the numbers by combining your own estimates of future revenue, earnings, and profit margins into a financial forecast and then calculating a fair value for the stock.

This approach connects what you believe about the company’s direction with real financial outcomes, helping you see exactly how your expectations compare to market price. This makes the reasoning behind “buy” or “sell” crystal clear.

Narratives are easy to use and available right now on Simply Wall St’s Community page, where millions of investors share and refine their outlooks together.

One of the biggest advantages of Narratives is that your fair value updates automatically as new information, such as news or earnings, becomes available. This allows you to react intelligently rather than emotionally.

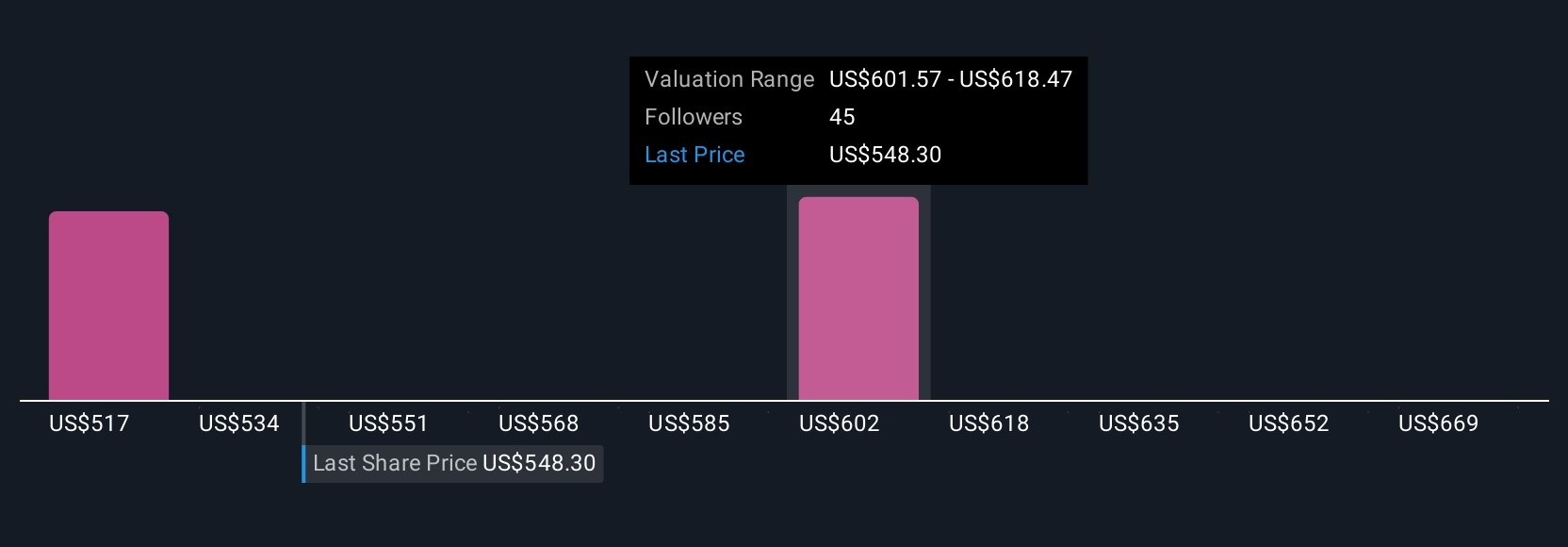

For example, some investors constructing Narratives for MSCI see global ETF demand and ESG mandates driving robust growth, landing at a fair value target as high as $700 per share. Others highlight risks like intensifying competition and margin pressure, resulting in far more cautious valuations closer to $520.

Do you think there's more to the story for MSCI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives