- United States

- /

- Capital Markets

- /

- NYSE:MSCI

Is Goldman Sachs’s Private Equity ETF Collaboration Shaping MSCI’s (MSCI) Index Licensing Growth Outlook?

Reviewed by Sasha Jovanovic

- Goldman Sachs Asset Management recently launched the Goldman Sachs MSCI World Private Equity Return Tracker ETF in partnership with MSCI, offering investors exposure to private equity-like returns via an index of about 1,500 global stocks.

- This collaboration highlights MSCI's expanding presence in index licensing and its efforts to reach a broader base of institutional and retail clients.

- We'll examine how the introduction of this innovative ETF could influence the expectations for MSCI's revenue growth and market positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

MSCI Investment Narrative Recap

MSCI shareholders often believe in the accelerating adoption of passive investment products and growing demand for private assets data driving recurring revenues. The recent Goldman Sachs ETF partnership, offering private equity-like returns via an MSCI index, is a positive sign for index licensing growth, but does not materially change the near-term risk that persistent budget constraints among active asset managers could hold back subscription revenue growth.

Among recent announcements, the October launch of MSCI PACS reinforces the company's investment in private markets transparency, supporting its push into higher-value private assets solutions. This directly complements the index innovations seen in the new ETF launch and addresses evolving institutional client needs, potentially underscoring catalysts around wallet share expansion and revenue diversification.

However, it's worth remembering that as MSCI expands further into private assets, challenges around future access to private markets data still raise important questions for investors to consider as...

Read the full narrative on MSCI (it's free!)

MSCI is expected to reach $3.8 billion in revenue and $1.6 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 8.5% and a $0.4 billion increase in earnings from the current $1.2 billion level.

Uncover how MSCI's forecasts yield a $627.81 fair value, a 16% upside to its current price.

Exploring Other Perspectives

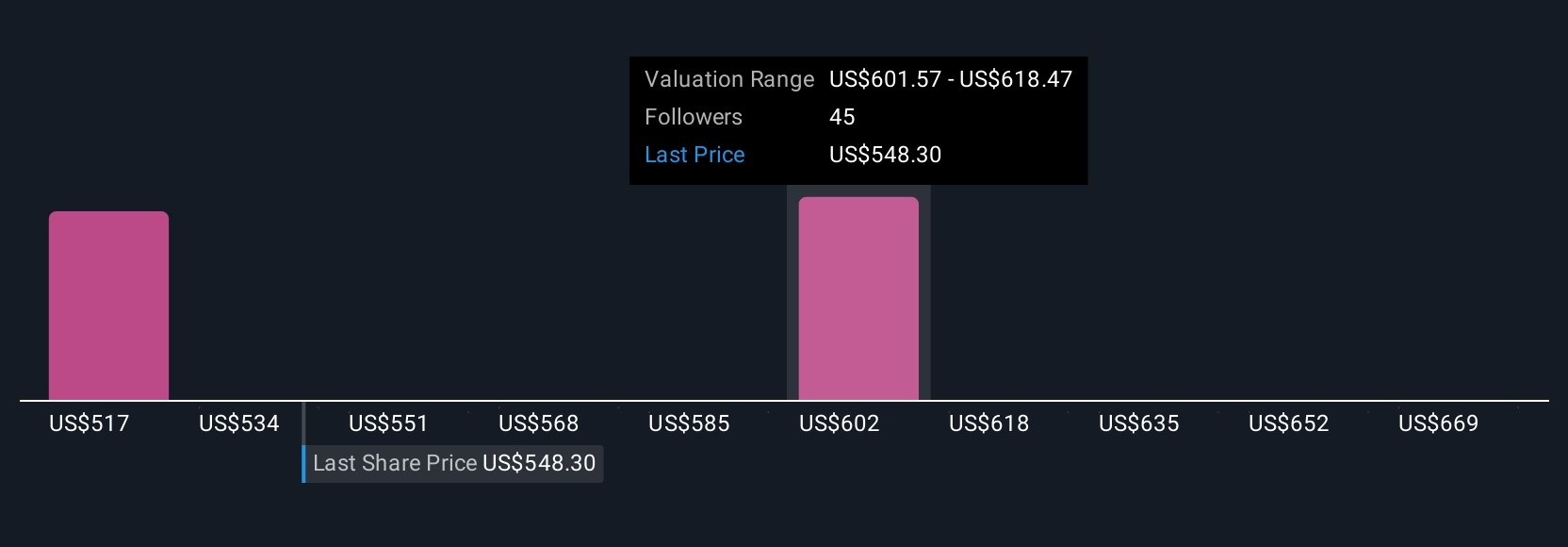

Simply Wall St Community members provided seven fair value estimates for MSCI between US$497.58 and US$686.08 per share, revealing a broad span of investor opinions. With downside risk from budget pressure among active asset managers, perspectives on the company's potential performance vary and you might want to see how others approach these scenarios.

Explore 7 other fair value estimates on MSCI - why the stock might be worth as much as 27% more than the current price!

Build Your Own MSCI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSCI research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MSCI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSCI's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives