- United States

- /

- Capital Markets

- /

- NYSE:MSCI

Evaluating MSCI’s Valuation After Strong Q3 Earnings and New Growth Drivers

Reviewed by Simply Wall St

MSCI (NYSE:MSCI) impressed the market this week after reporting third-quarter results that topped expectations. Both revenue and net income climbed year over year, fueled by strong demand for its index products and analytics services.

See our latest analysis for MSCI.

MSCI’s shares saw a surge after the latest earnings beat, but the momentum has been mixed. Despite headline-grabbing buybacks and steady dividends, the 1-year total shareholder return sits just under 1% and year-to-date share price returns remain negative. Still, looking further back, long-term investors have enjoyed a nearly 50% total return over five years, showing the company’s resilience even in the face of near-term volatility.

If you’re curious about other companies building momentum, now’s a great time to check out fast growing stocks with high insider ownership

The real question now is whether MSCI’s impressive results and strategic moves leave its shares undervalued, or if the market is already pricing in much of its future growth potential. Is there still a buying opportunity here?

Most Popular Narrative: 9.6% Undervalued

With MSCI shares last closing at $567.54 and the widely followed fair value narrative putting the company's value at $627.81, there is an intriguing gap. Market watchers are tuning in to see if this room between consensus and price is the market signaling opportunity or caution.

Accelerated development and cross-selling of proprietary data, analytics, and private capital solutions (including recently launched products and business lines like private equity benchmarks and risk tools) will tap into new client bases and increase wallet share among institutional clients, driving durable multi-year compounded revenue growth.

Want to uncover the financial ambitions pushing MSCI’s valuation higher? The narrative is banking on innovations and aggressive growth in core metrics. The full story reveals the assumptions analysts are wagering on, with expectations centered on bigger, broader, and potentially game-changing developments. See what’s behind this number.

Result: Fair Value of $627.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower growth in traditional asset manager subscriptions and the risk of fee compression could present challenges for MSCI's revenue trajectory in the future.

Find out about the key risks to this MSCI narrative.

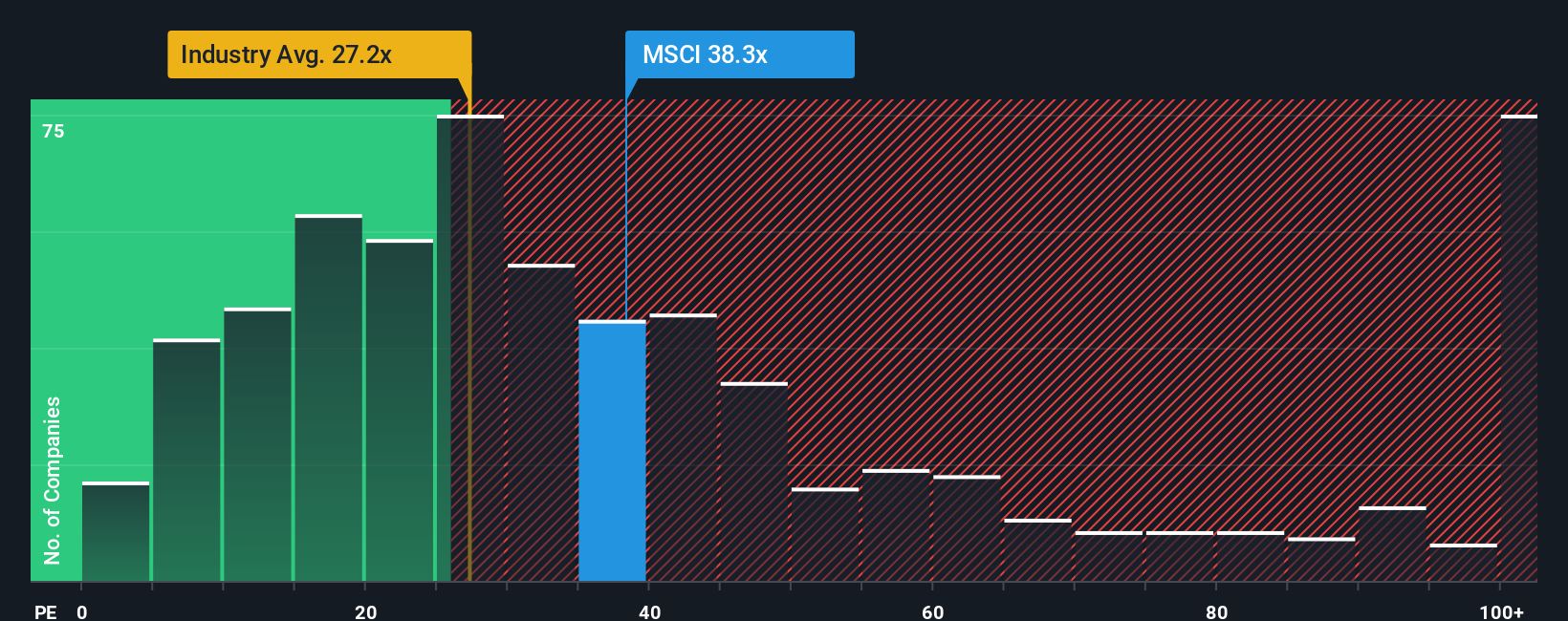

Another View: Market Multiples Suggest a Rich Valuation

Looking through the lens of price-to-earnings, MSCI trades at 34.9 times earnings. This is noticeably higher than the US Capital Markets industry average of 26.7x and its peer average of 33.7x. It is also nearly double its fair ratio of 18.3x, highlighting that investors are willing to pay a significant premium. Is this optimism justified, or could the market realign if growth falters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you want to dig into the details or draft your own conclusions, it only takes a few minutes to build your own view. Do it your way

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one stock when the market is packed with hidden opportunities? Catch the latest momentum, diversify your watchlist, and don’t let the next big winner slip by. These stock lists can be your shortcut to tomorrow’s potential outperformance.

- Tap into the surge of artificial intelligence by checking out these 26 AI penny stocks with their innovations in automation and machine learning.

- Secure steady income and peace of mind by reviewing these 21 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Follow the trail of undervalued gems with these 854 undervalued stocks based on cash flows, where market mispricings could reveal your next opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives