- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Assessing Valuation After CEO Ted Pick’s Market Correction Comments

Reviewed by Simply Wall St

Morgan Stanley (MS) shares have been moving after CEO Ted Pick told investors that market corrections are a healthy part of investing. He suggested that pullbacks of 10% to 20% may be on the horizon.

See our latest analysis for Morgan Stanley.

Morgan Stanley’s share price has posted a sharp year-to-date return of nearly 31%, boosted by stronger earnings and ongoing fixed-income activity. Even as the leadership’s recent caution on potential market corrections has led to some short-term swings, the company’s longer-term momentum remains intact. This is reinforced by an impressive 103% total return over three years and a staggering 245% total return over five years, suggesting investors still see substantial long-term value despite the latest volatility and market warnings.

If recent market warnings have you rethinking your next move, now is a perfect time to expand your search and discover fast growing stocks with high insider ownership

The question now is whether Morgan Stanley’s recent surge leaves the stock undervalued and poised for further gains, or if the market has already priced in its future growth and strong momentum. Is this a buying opportunity, or has optimism run ahead of fundamentals?

Most Popular Narrative: 2.3% Undervalued

With Morgan Stanley trading at $163.42 and the widely followed narrative estimating a fair value of $167.35, the gap between current price and potential upside is narrow. Investors are keen to learn what is driving this modest edge versus the market’s current judgment.

The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions. This is evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth.

What is the full playbook behind this fair value? There are bold assumptions about future profit margins and persistent top-line expansion. Want to know which key levers the narrative is banking on for earnings to reach new highs? Dive in for the hidden figures and the forward-looking bets that support the current price target.

Result: Fair Value of $167.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as intensifying competition from low-fee products and ongoing regulatory uncertainty could undermine the optimistic outlook for Morgan Stanley.

Find out about the key risks to this Morgan Stanley narrative.

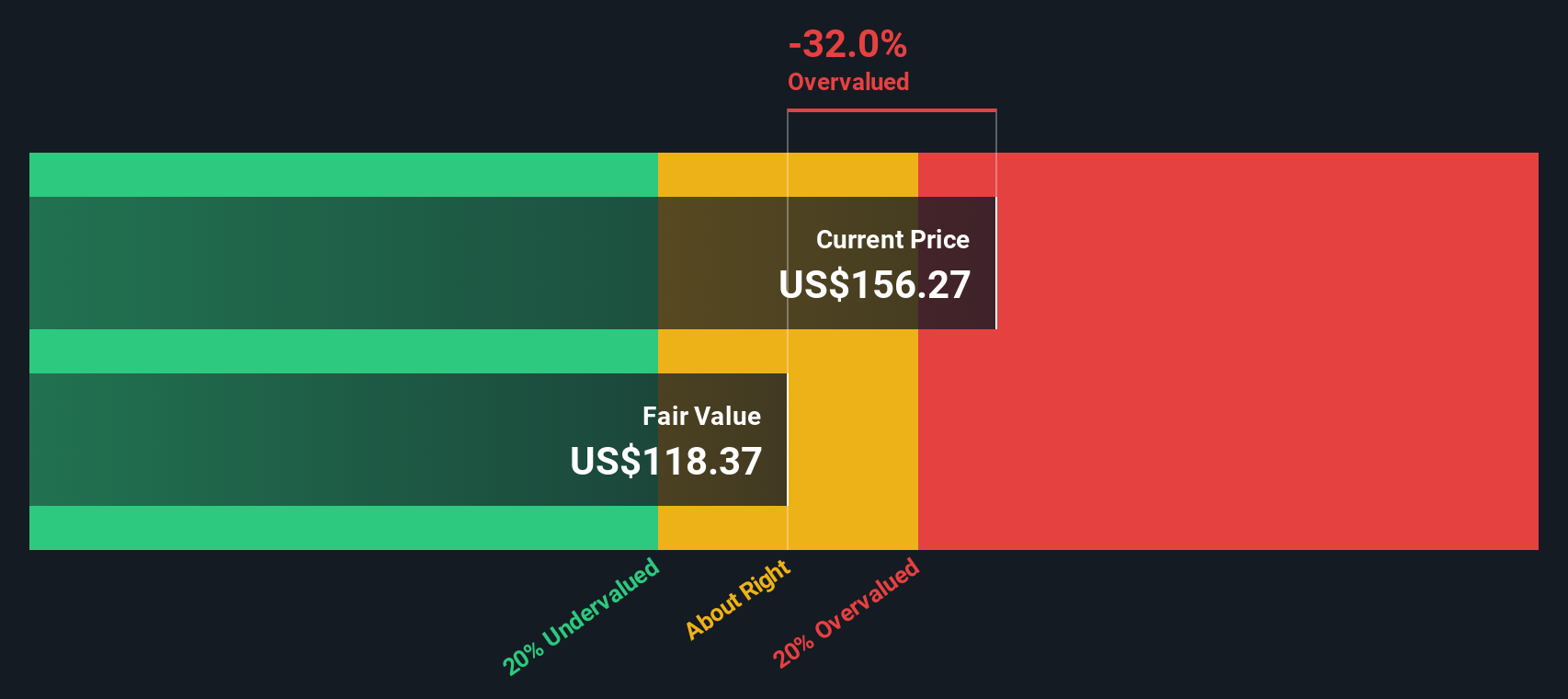

Another View: Testing the DCF Model

While the consensus valuation sees Morgan Stanley as slightly undervalued, our SWS DCF model offers a different perspective. According to this discounted cash flow approach, the stock is trading above its fair value. This suggests less upside than the market narrative indicates. Could the market be overlooking some risks, or is it pricing in future surprises?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morgan Stanley for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morgan Stanley Narrative

If you want to see the numbers from a different angle or put together your own interpretation, you can easily create your narrative in under three minutes with Do it your way

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Moves?

Don’t stop now; smart investors go the extra mile and spot tomorrow’s leaders before the crowd. Start screening for your next great idea and seize these unique advantages:

- Boost your income potential with yields over 3%. Check out these 17 dividend stocks with yields > 3% offering strong dividend returns and reliable financial foundations.

- Tap into the AI wave by tracking innovation leaders via these 25 AI penny stocks thriving at the intersection of technology and disruptive intelligence.

- Capitalize on true bargains by uncovering these 849 undervalued stocks based on cash flows trading below intrinsic value and primed for a turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives