- United States

- /

- Capital Markets

- /

- NYSE:MCO

Moody’s (MCO): Valuation Insights After Upbeat Q3 Earnings and Upgraded Full-Year Outlook

Reviewed by Simply Wall St

Moody's (MCO) posted better-than-expected third quarter earnings and sales, citing a pickup in leveraged finance and private credit activity. The company also raised its full-year earnings guidance, reflecting sustained operational momentum.

See our latest analysis for Moody's.

Shares of Moody’s have seen a mild uptick recently, with a 1-day share price return of 2.40% and a 4.20% gain over the past week. Investors responded positively to record Q3 results, a dividend affirmation, and fresh buyback activity. Over the last year, total shareholder return stands at a solid 6.84%, with momentum building due to strong revenue growth and strategic moves to expand the company’s credit ratings reach and analytics capabilities.

If you are interested in what else is driving growth in the market, now is a great time to broaden your outlook and discover fast growing stocks with high insider ownership

After a string of record results and upbeat guidance, investors are now left to wonder: Is Moody’s stock still trading on compelling value, or has the market already priced in all the future growth?

Most Popular Narrative: 10% Undervalued

With Moody's closing at $490.82 and the most followed narrative estimating fair value at $545.50, the stock is perceived to have noticeable upside. This difference hinges on projected growth, recurring revenues, and margin expansion as core drivers.

"Moody's is experiencing accelerating demand from the rapid evolution and expansion of private credit markets, evidenced by 75% year-over-year growth in private credit revenues, 25% of first-time mandates coming from private credit, and ongoing issuer/investor demand for independent risk assessment. This strongly supports future revenue growth and earnings resilience as private credit's share in global financing expands."

Curious about what’s fueling this bullish scenario? Only a select few bold forecasts about revenue growth, profit margins, and shrinking share count make this valuation pop. Want to see why the math could stack up to tech-level premium multiples? The underlying assumptions might surprise even seasoned investors.

Result: Fair Value of $545.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, evolving regulations or rapid advances in competitor AI could threaten Moody's pricing power and margins in ways investors have yet to price in.

Find out about the key risks to this Moody's narrative.

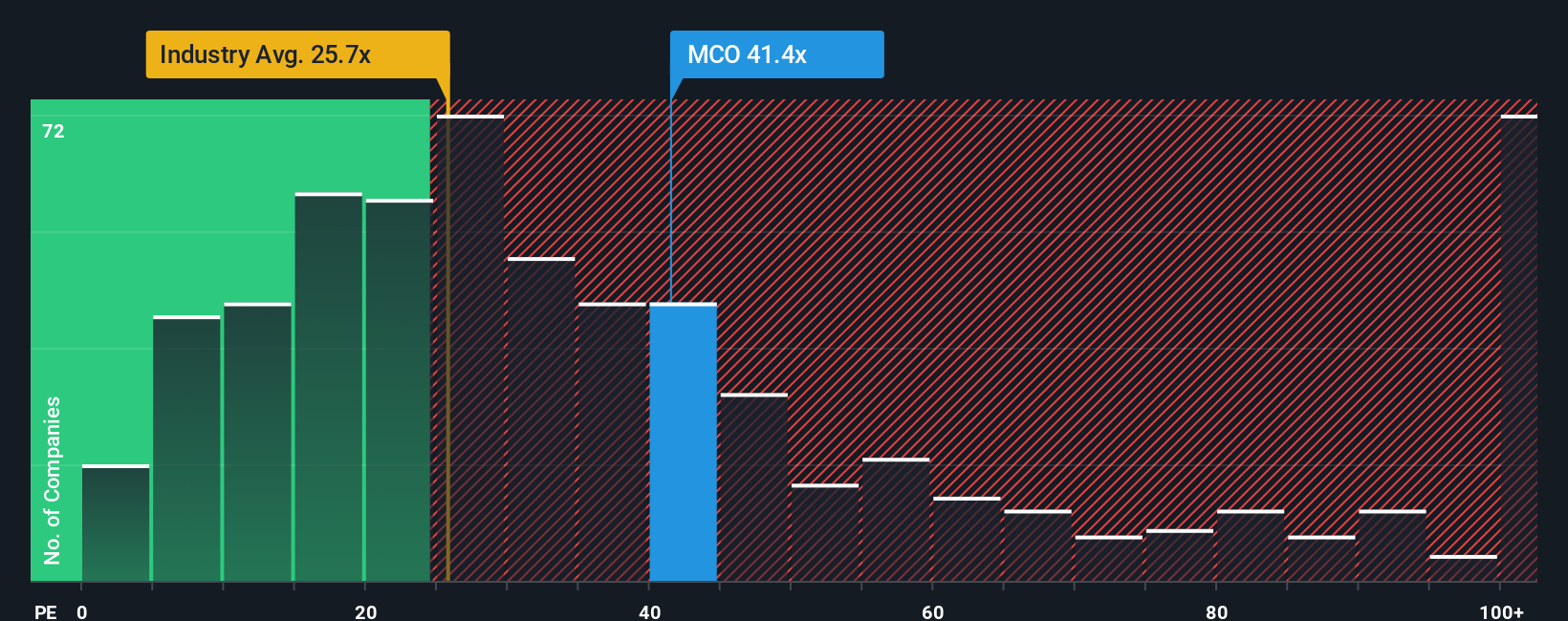

Another View: Multiples Suggest a Pricey Stock

While the consensus price target and growth outlook point to upside, a look at Moody’s price-to-earnings ratio paints a different picture. The company trades at 39x earnings, markedly higher than both the peer average of 29.8x and the broader industry at 26.1x. The fair ratio stands at just 19.5x. This suggests that investors are paying a substantial premium for Moody's consistency and brand, which may leave less margin for error if growth slows. Does this premium signal confidence or set up disappointment if the story changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If you want to dig into the numbers and shape your own outlook, you can analyze the latest data and craft your narrative in just a few minutes. Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock new opportunities and stay a step ahead. Expand your portfolio with ideas other investors might overlook. Tap into fresh themes that could shape tomorrow’s winners.

- Supercharge your pursuit of steady income by sizing up these 17 dividend stocks with yields > 3% with yields over 3% and see who’s rewarding shareholders today.

- Catch the next wave of medical innovation by checking out these 33 healthcare AI stocks, where healthcare meets AI for growth potential and breakthrough impact.

- Capitalize on the digital frontier and chart your path in digital assets with these 80 cryptocurrency and blockchain stocks, featuring companies powering blockchain and crypto trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives