- United States

- /

- Capital Markets

- /

- NYSE:MCO

Moody’s (MCO) Margin Win Reinforces Quality Narrative Despite Premium Valuation Concerns

Reviewed by Simply Wall St

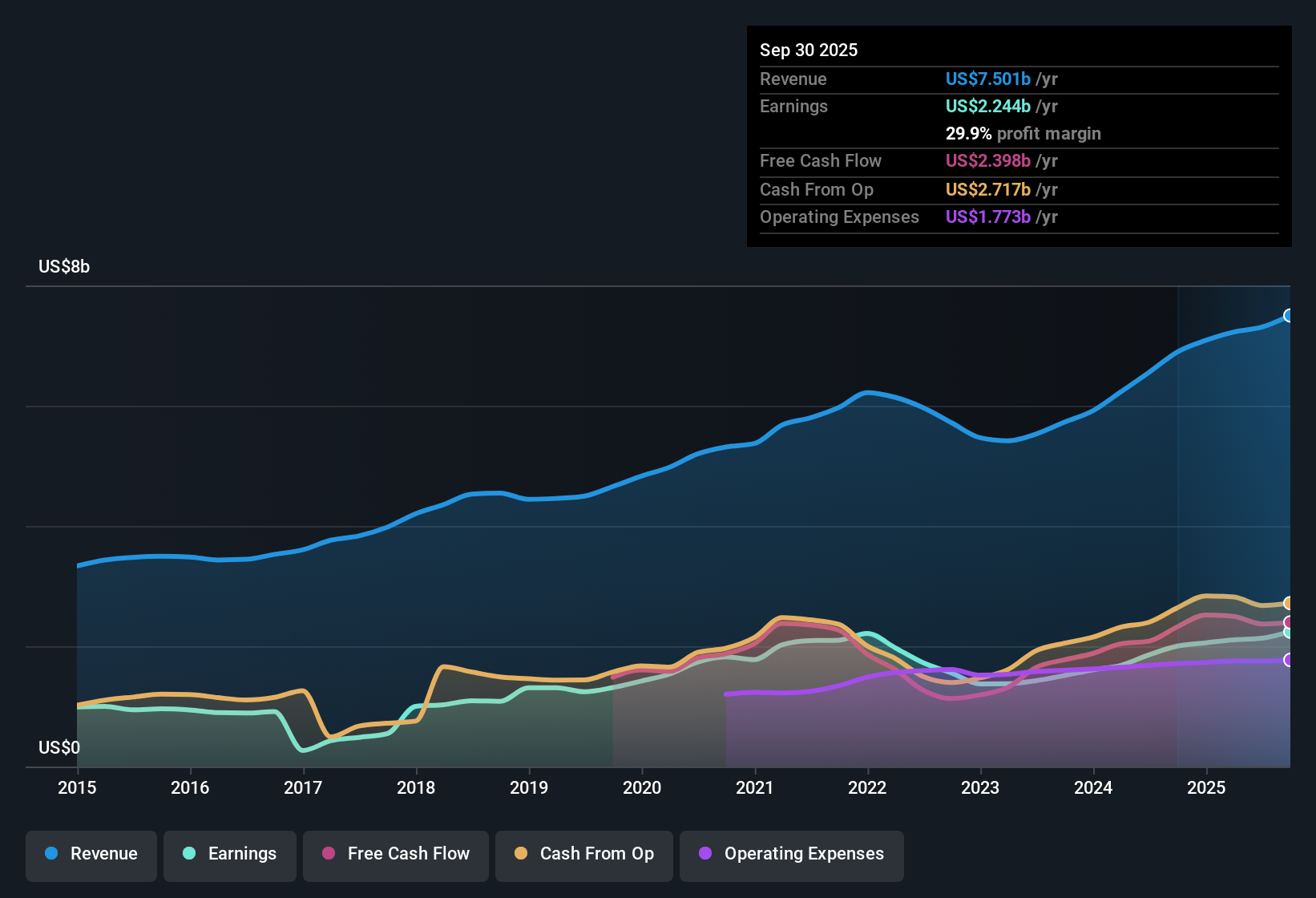

Moody’s (MCO) reported net profit margins of 29.9%, up from 29% a year ago, and delivered earnings growth of 12% for the year. Forecasts call for annual earnings growth of 11.2% and revenue growth of 7%, both trailing the broader US market’s expected rates. Investors are weighing these high-quality profits and steady growth against a premium valuation, with shares trading at $479.3, which is well above the estimated fair value.

See our full analysis for Moody's.Next, we’ll see how these headline results stack up against the prevailing narratives and forecasts in the community. Some expectations will be confirmed, while others are sure to be re-examined.

See what the community is saying about Moody's

Private Credit Revenue Soars 75%

- Private credit revenues grew 75% year-over-year, with 25% of first-time mandates now coming from this segment. This signals that Moody’s is benefiting from rapid expansion in this market niche.

- Analysts' consensus view highlights that this strong momentum, together with resilient issuer and investor demand for independent risk assessments, should drive ongoing revenue growth and reinforce Moody’s earnings resilience.

- Consensus expects revenue growth of 7.3% annually over the next three years, sustained by these tailwinds even as growth lags the broader market.

- The recurring nature of private credit income supports margin expansion, directly addressing analysts’ optimism for profit growth (margins climbing from 29.2% to 33.3% by 2027).

- Consensus narrative points out that the shift to private credit and investments in analytics could deliver steadier earnings than many peers.

See if Moody’s booming private credit business and margin gains are enough to support analyst expectations in the full Consensus Narrative. 📊 Read the full Moody's Consensus Narrative.

GenAI Investments Double Analytics Spend

- Moody’s reports that 40% of its Analytics products now feature Generative AI, with GenAI-related spending growing twice as fast as the rest of Moody’s Analytics. This represents a strategic bet on operational efficiency and product innovation.

- Analysts' consensus narrative notes that higher GenAI adoption is expected to improve recurring revenue and drive margin upside, echoing the guidance for net margins to increase to 33.3% over the next three years.

- Bulls may cite how automation from GenAI supports cost discipline and operational leverage, as shown by a 360 basis point rise in MA adjusted margins year-over-year.

- However, consensus still sees Moody’s revenue and earnings growth trailing the broader US market (forecasts: 7% revenue vs. 10% US average; 11.2% earnings vs. 15.5%).

Valuation Premium Widens Over Peers

- Moody’s trades at a 38.1x price-to-earnings ratio, a steep premium compared to the US Capital Markets industry average of 25.9x and a DCF fair value of $310.57. Its $479.3 share price exceeds even the highest analyst target ($541.95).

- The analysts' consensus narrative questions whether consistent profit margin gains and expansion into growth markets are enough to justify this valuation disconnect.

- While ongoing growth is acknowledged, analysts suggest the relatively modest 6.5% upside to target price implies Moody's is already fairly valued based on current and expected performance.

- Investors are urged to scrutinize whether mid-single-digit revenue growth and premium margins can continue to support this elevated multiple above peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Moody's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Share your outlook and shape a fresh narrative in just a few minutes with your unique perspective. Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Moody’s robust margins and sector leadership are offset by concerns that its current valuation is stretched, with forecast growth lagging the broader market.

If you want more compelling value for your investment dollar, discover companies trading well below their intrinsic worth with these 876 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives