- United States

- /

- Diversified Financial

- /

- NYSE:MA

Mastercard’s Valuation in Focus After Digital Payments Expansion and 64% Three-Year Gain

Reviewed by Bailey Pemberton

- Wondering if Mastercard is worth its hefty price tag? You are not alone, as many investors are debating whether this financial powerhouse still offers value.

- Despite slipping by 1.3% over the past week and 2.7% for the month, Mastercard has delivered a strong 64.2% gain in the last three years and sits 4.5% higher year-to-date.

- In the financial sector, Mastercard has recently made headlines by pushing further into open banking solutions and expanding its partnerships to accelerate digital payments worldwide. These strategic moves have investors buzzing about future growth, but they also raise questions about evolving risks and the company's adaptability.

- When we use our six-point valuation check, Mastercard scores a modest 2 out of 6 for being undervalued right now. We will explore the methods behind that number, and also discover an even more insightful way to figure out if Mastercard is really worth your attention.

Mastercard scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mastercard Excess Returns Analysis

The Excess Returns model evaluates whether a company generates returns above its cost of equity, indicating strong profitability and value creation. For Mastercard, this method shows impressive figures and helps clarify whether its current valuation reflects its underlying financial health.

Based on analyst consensus, Mastercard’s Book Value per share stands at $8.78, while its projected stable Earnings Per Share (EPS) is $26.76. Its Cost of Equity per share is $0.94, resulting in a substantial Excess Return of $25.82 per share. This suggests that Mastercard is producing significant returns on the money its shareholders have invested, with an average Return on Equity of 210.29%. Looking further, the projected stable Book Value climbs to $12.73 per share, supported by future estimates from eight analysts.

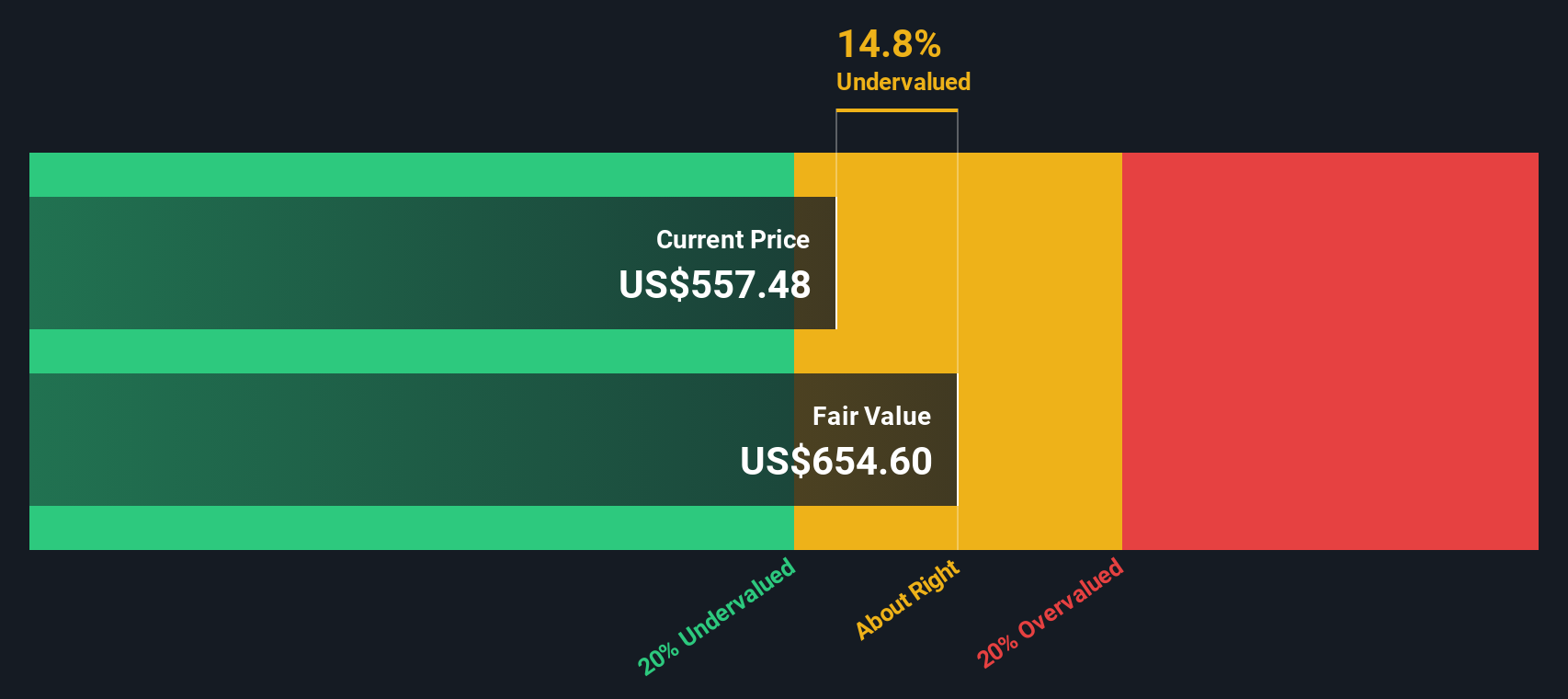

The model arrives at an intrinsic value for Mastercard suggesting the stock is currently trading at a 14.6% discount to fair value. In practical terms, this means Mastercard appears undervalued relative to what its impressive return numbers would suggest it is worth.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mastercard is undervalued by 14.6%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Mastercard Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for evaluating profitable companies like Mastercard because it directly reflects how much investors are willing to pay for a dollar of the company’s earnings. When a company has steady profits, the PE ratio offers a straightforward way to gauge its valuation relative to those profits.

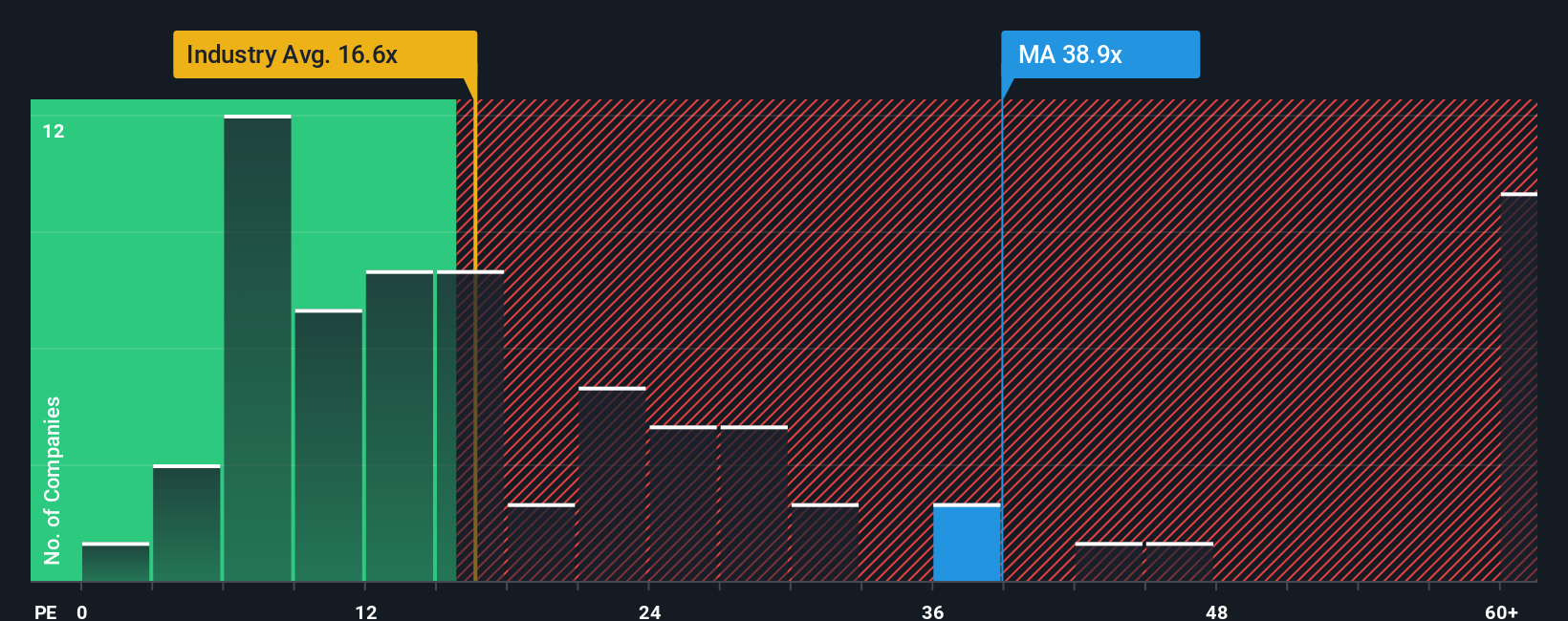

What counts as a “normal” PE ratio varies by industry, expectations for future growth, and risk profile. Higher growth or stronger competitive advantages can justify a higher PE, while greater risks or industry pressures often call for a discount. At the moment, Mastercard trades at 34.39x earnings, which is substantially above both its peer average of 16.24x and the diversified financial industry’s average of 13.16x. However, surface-level comparisons can be misleading without context on growth and profitability.

This is where the “Fair Ratio” comes in. Simply Wall St calculates this proprietary metric by factoring in Mastercard’s earnings growth, industry trends, profit margins, market cap, and risks to estimate a multiple more tailored to its specific situation. For Mastercard, the Fair PE ratio is 20.39x. Unlike raw peer or industry benchmarks, the Fair Ratio provides a more nuanced tool to assess if a stock is truly over- or undervalued, especially for standout companies in their sector.

Comparing Mastercard’s current PE of 34.39x to its Fair Ratio of 20.39x suggests the stock is trading at a significant premium to what the business fundamentals would warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mastercard Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story backed by numbers. It is your own perspective on Mastercard's future, reflected in your unique estimates for its revenue, earnings, margins, and fair value.

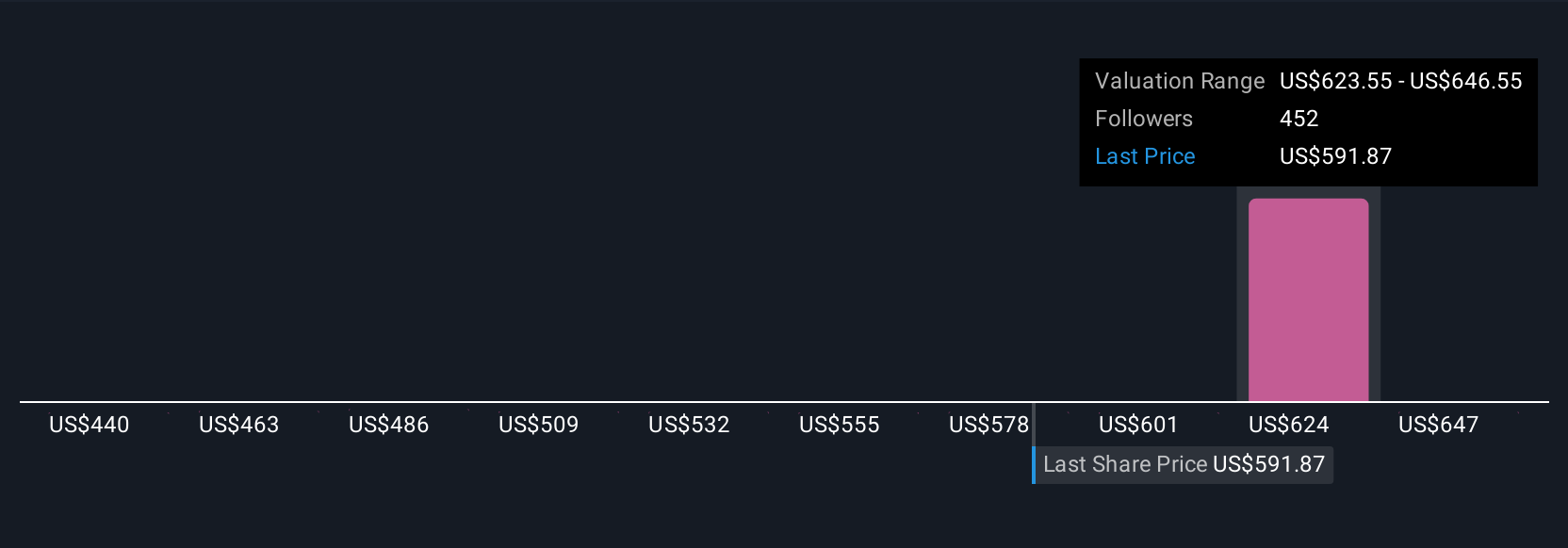

Narratives link a company’s story (why it might grow or face challenges) to a financial forecast, which then connects directly to whether the stock looks undervalued or overvalued based on your beliefs. On Simply Wall St’s Community page, millions of investors use Narratives to easily create and share their view of a company, making this an accessible and practical tool for modern investing.

With Narratives, you can see at a glance if your assessment of fair value is higher or lower than the current price, helping you decide whether to buy, hold, or sell. These stories are updated automatically as new earnings, news, and market events roll in, so your investment thesis always stays fresh and relevant.

For example, some Mastercard investors see massive upside and set a fair value as high as $690 per share, while more cautious voices have targeted $520. This shows how Narratives capture diverse viewpoints and help you invest with conviction.

Do you think there's more to the story for Mastercard? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives