- United States

- /

- Diversified Financial

- /

- NYSE:MA

Mastercard (MA): A Fresh Look at Valuation After Recent Share Price Moves

Reviewed by Simply Wall St

Most Popular Narrative: 9% Undervalued

According to the most widely followed research narrative, Mastercard’s stock is currently trading about 9% below what analysts consider its fair value. This assessment is based on careful projections of its future earnings and business trends.

Mastercard is benefiting from the accelerating global shift from cash to digital payments. This is evidenced by strong growth in payment volumes, increased contactless and online transaction penetration, and ongoing expansion into underpenetrated verticals and regions, supporting sustained revenue and earnings growth.

Want to know what’s fueling this bullish view? There is one key set of forecasts in this narrative that could change how you see Mastercard’s upside. It centers on ambitious growth targets and a premium valuation multiple that rivals market leaders. Think you can guess what analysts are banking on? Dive deeper for the full playbook behind this fair value call.

Result: Fair Value of $644.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from new payment systems and growing regulatory scrutiny could challenge Mastercard’s earnings momentum and cast doubt on its current valuation narrative.

Find out about the key risks to this Mastercard narrative.Another View: Market Valuation

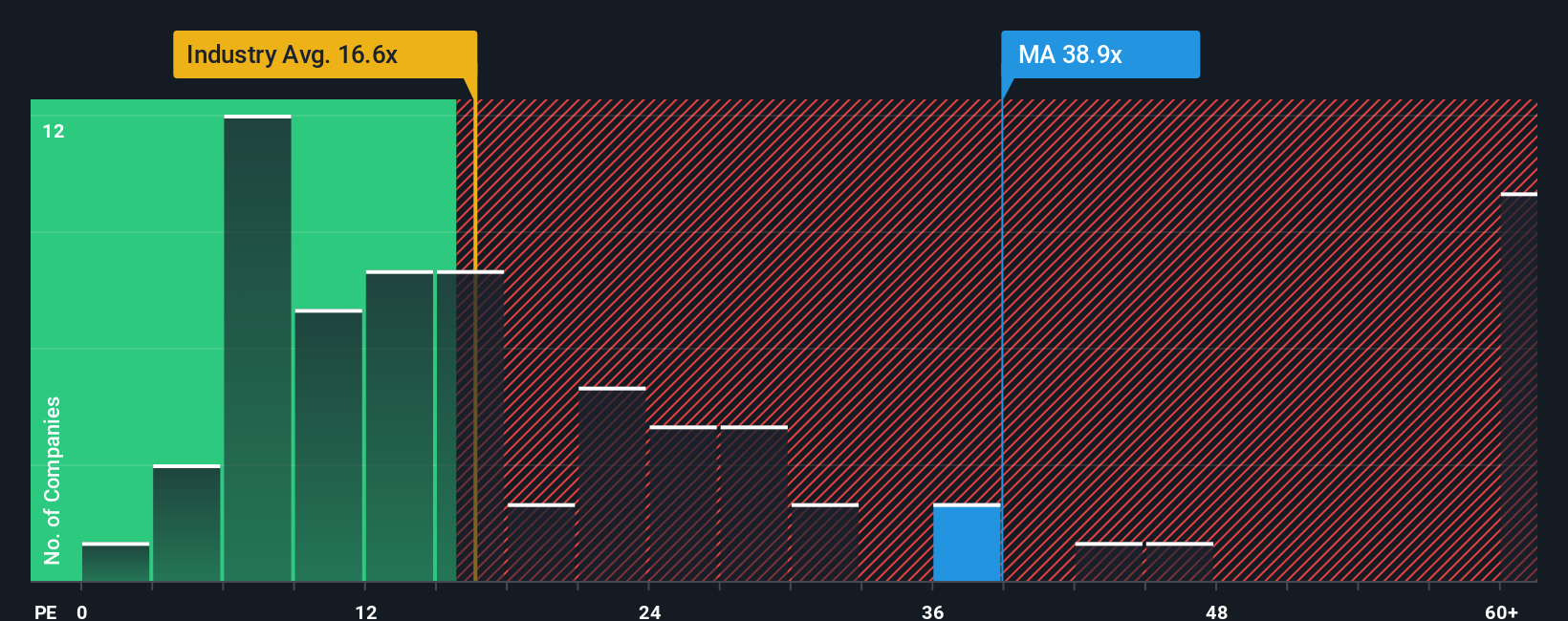

While analysts point to Mastercard trading below their estimate of fair value, the market’s current pricing, based on its earnings multiple, tells a different story. This method suggests Mastercard may actually be expensive. Which narrative should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Mastercard to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Mastercard Narrative

If you have a different perspective or want to go hands-on with the numbers yourself, building your own thesis is faster than you might think. Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next winning idea slip through the cracks. Expand your search and seize new trends with these powerful stock ideas, all tailored for investors ready to make bold moves:

- Discover potential in up-and-coming companies showing strong financial momentum by checking out penny stocks with strong financials.

- Explore the growth story behind future health breakthroughs with healthcare AI stocks to track companies revolutionizing medicine through artificial intelligence.

- Find stocks trading below their value with a screen focused on undervalued opportunities using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion