- United States

- /

- Diversified Financial

- /

- NYSE:MA

A Closer Look at Mastercard’s (MA) Valuation After Recent Gains

Reviewed by Simply Wall St

Mastercard (MA) shares have been on the move lately, catching the attention of both long-term holders and fresh investors. The stock has delivered an 8% total return over the past year and has outpaced many peers in the space.

See our latest analysis for Mastercard.

Mastercard’s share price has steadily climbed throughout the year, with fresh highs recently as investors digest continued double-digit revenue and profit growth. While momentum paused in the last quarter, the 8.2% one-year total shareholder return and robust multi-year gains reflect resilient performance and optimism for long-term growth.

If Mastercard’s positive run has you rethinking your next move, now is a good time to broaden your scope and discover fast growing stocks with high insider ownership

But with shares near all-time highs and growth momentum still strong, is Mastercard currently undervalued compared to its fundamentals, or has the market already factored in every bit of its future potential?

Most Popular Narrative: 14.3% Undervalued

With Mastercard trading at $561.23, the consensus narrative puts its fair value at $654.98. This suggests there is more room for upside than the current market price implies.

"Mastercard is benefiting from the accelerating global shift from cash to digital payments, as evidenced by strong growth in payment volumes, increased contactless and online transaction penetration, and ongoing expansion into underpenetrated verticals and regions, supporting sustained revenue and earnings growth."

Want to know the real driver behind this valuation boost? It is not just headline growth, but the bold forecasts for earnings acceleration, new digital partnerships, and future margins. What is really behind these numbers? Dig deeper and discover the financial assumptions analysts are betting on.

Result: Fair Value of $654.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory scrutiny and the rapid adoption of alternative payment platforms could present meaningful headwinds. These factors could potentially alter Mastercard’s growth outlook.

Find out about the key risks to this Mastercard narrative.

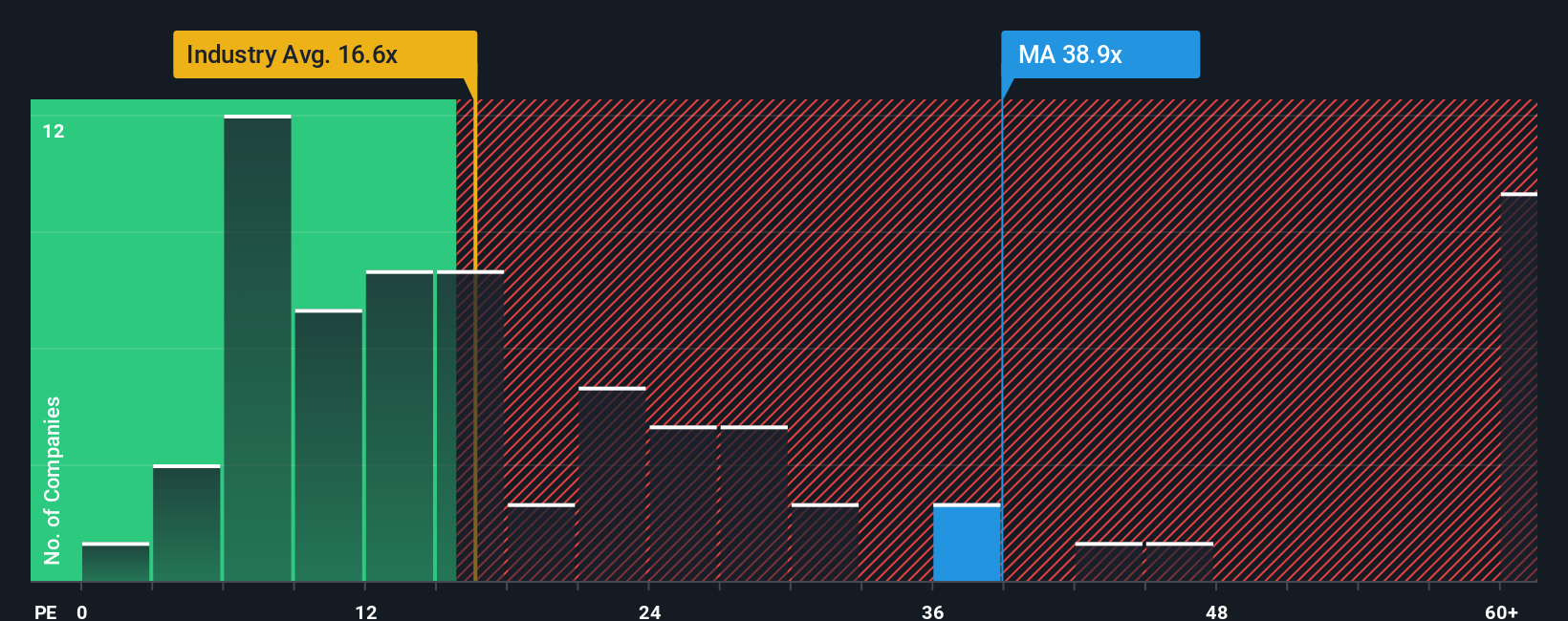

Another View: Market Ratios Tell a Different Story

Looking at Mastercard through a price-to-earnings lens, the story shifts. Shares trade at 35.4 times earnings, which is far higher than the industry average of 13.3 and the peer average of 17. Compared to the fair ratio of 20.4, this premium price signals possible overvaluation by traditional benchmarks. Does this suggest the market is too optimistic, or are investors right to pay up for quality and growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

Not convinced by the prevailing view or keen to dive in yourself? You can explore the numbers and shape your own analysis in just a few minutes, so why not Do it your way

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Successful investing does not stop with just one stock. Give yourself the edge by uncovering other promising opportunities tailored to fast movers, innovators, and income seekers.

- Unlock growth potential by scanning for high-yield opportunities among these 14 dividend stocks with yields > 3%, which stand out for their strong payouts and reliability.

- Spot the next disruptors shaking up the digital landscape with these 27 AI penny stocks, redefining what’s possible in technology and automation.

- Capture early-stage value with these 3585 penny stocks with strong financials, offering unique upside for those ready to seize untapped market breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives