- United States

- /

- Mortgage REITs

- /

- NYSE:LADR

Ladder Capital (LADR): Assessing Valuation After Third Quarter Earnings Release

Reviewed by Simply Wall St

Ladder Capital (LADR) just released its third quarter earnings, drawing the market’s attention with sales of $26.7 million and net income of $19.2 million. Investors often look closely at earnings reports for signals on future performance.

See our latest analysis for Ladder Capital.

Ladder Capital’s latest earnings report arrives after a year of ups and downs, with the share price recently closing at $10.72. While the 1-year total shareholder return stands at 2.88%, which is not spectacular but positive, long-term holders have seen momentum build significantly as the 5-year total return has climbed a robust 82.28%. Short-term moves have been mixed, but the long-term view still looks constructive for patient investors keeping an eye on both income and price trends.

If tracking the latest performance in financials has sparked your curiosity, you might want to broaden your outlook and discover fast growing stocks with high insider ownership

With shares trading about 17% below average analyst targets and steady revenue growth, is Ladder Capital currently flying under the radar, or is the market already factoring in all the future upside?

Most Popular Narrative: 16.5% Undervalued

With Ladder Capital’s most popular narrative assigning a fair value of $12.83, the last close at $10.72 suggests undervaluation. Momentum is building around the company’s changing access to capital and urban lending demand, so let’s look at a key driver cited by analysts.

Becoming investment-grade with credit ratings upgrades and successful unsecured bond issuances has significantly reduced Ladder Capital's cost of debt. This has expanded access to deeper capital markets and enabled reinvestment into higher-yielding assets. This structural shift is expected to drive long-term earnings growth and improve net margins as incremental debt becomes less expensive.

Want to know what sets this thesis apart? At its core: a new cost of capital, and bold growth projections for future revenue and profits. See how analysts justify their bullish price target. There is one make-or-break assumption at the heart of this call, and it may surprise you.

Result: Fair Value of $12.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as falling multifamily rents or slowdowns in commercial lending could limit Ladder’s earnings momentum and challenge the bullish thesis.

Find out about the key risks to this Ladder Capital narrative.

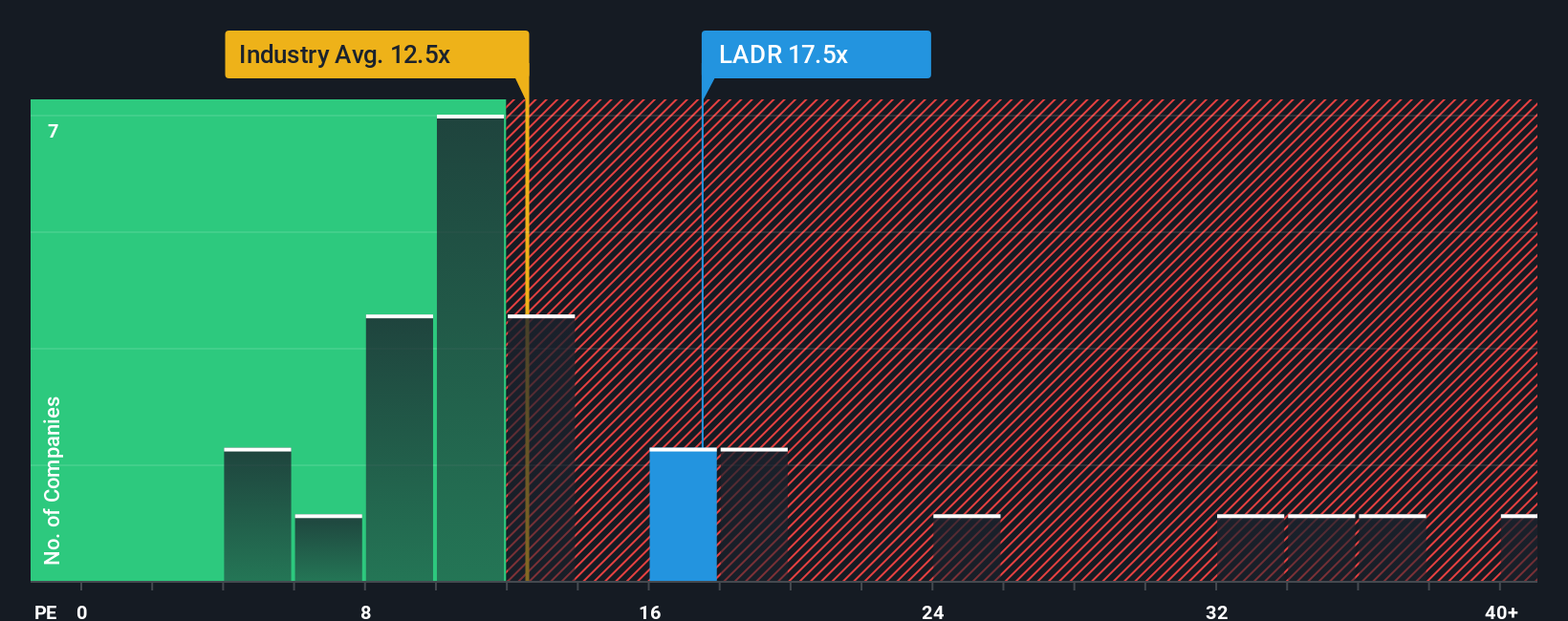

Another View: Multiples Raise a Caution Flag

Looking at Ladder Capital’s valuation through the lens of its price-to-earnings ratio tells a different story. While the stock is trading at 17.1 times earnings, this is much higher than the peer average of 11.8 and even further above the fair ratio of 10.3. In practical terms, this means investors are paying a premium compared to similar companies, which could limit future upside if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ladder Capital Narrative

If you see the story differently or want to dive deeper into the numbers, you can craft your own Ladder Capital narrative in just a few minutes. Do it your way

A great starting point for your Ladder Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Whether you want income, innovation, or unique opportunities, now is your chance to move ahead and find your next winner using these tailored stock ideas.

- Tap into uncrowded value by searching for stocks trading below their true worth through these 844 undervalued stocks based on cash flows and spot tomorrow’s outperformers before the crowd.

- Power up your growth portfolio by exploring these 27 AI penny stocks that are making waves in artificial intelligence and defining the next era of technology.

- Grow your passive income streams by targeting reliable yields over 3%. See which companies stand out in these 20 dividend stocks with yields > 3% and put your cash to work.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LADR

Ladder Capital

Operates as an internally-managed real estate investment trust in the United States.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives