- United States

- /

- Diversified Financial

- /

- NYSE:KLAR

Klarna Group (NYSE:KLAR): Assessing Valuation Versus Growth Potential in a Shifting Market

Reviewed by Simply Wall St

Klarna Group (NYSE:KLAR) shares have seen some movement over the past month, as investors consider recent performance alongside market sentiment. The stock closed at $36.61, reflecting modest changes within a generally steady environment.

See our latest analysis for Klarna Group.

Although Klarna’s share price has dipped 20.1% year-to-date and remained subdued in recent weeks, the broader story is one of shifting sentiment as investors weigh the company’s growth potential against an evolving risk landscape.

If you’re watching momentum and want to expand your search, now’s a smart time to discover fast growing stocks with high insider ownership.

With Klarna posting annual revenue growth and still trading below its calculated intrinsic value, the question persists: is the market overlooking its potential, or is its future growth already reflected in the share price?

Price-to-Sales of 4.7x: Is it justified?

With Klarna trading at a Price-to-Sales (P/S) ratio of 4.7x at $36.61 per share, the market is valuing the company higher than most competitors in its sector.

The P/S ratio measures how much investors are willing to pay for each dollar of the company’s revenue, a common valuation method for fast-growth financial technology companies that are not yet profitable. This metric is particularly relevant for Klarna, as the company is still loss-making but delivering consistent revenue growth.

Despite Klarna’s unprofitability, its above-average P/S ratio signals that investors are banking on strong future growth. However, the valuation appears stretched when compared to the broader US Diversified Financial industry, which averages a P/S ratio of 2.3x. This could indicate optimism about Klarna’s market position, or it might reflect heightened growth expectations already priced in.

While Klarna appears expensive against the industry, it does compare favorably to its peer average P/S of 5.1x, suggesting the stock is attractively valued within its direct peer group.

See what the numbers say about this price — find out in our valuation breakdown.

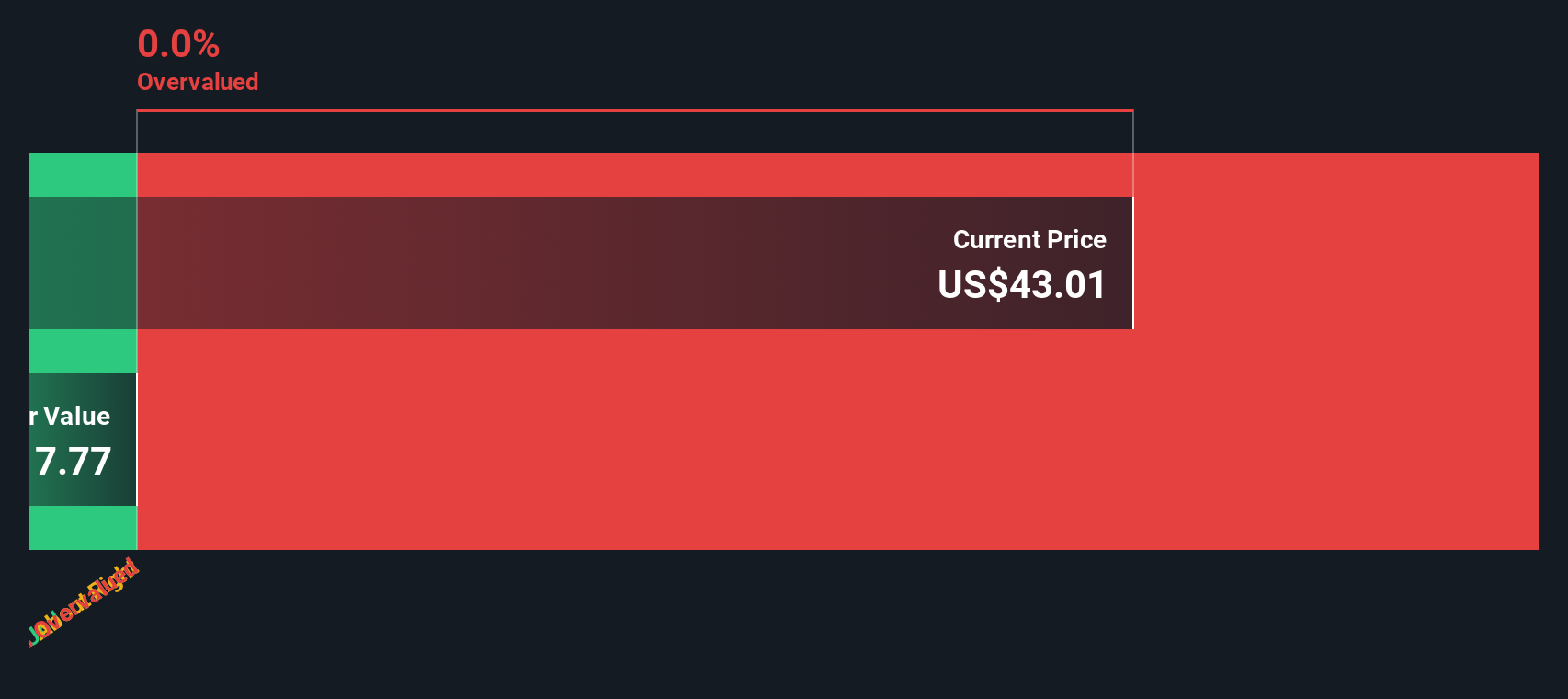

Result: Price-to-Sales of 4.7x (OVERVALUED)

However, slowing revenue momentum or persistent losses may limit investor confidence and could challenge the current valuation narrative for Klarna.

Find out about the key risks to this Klarna Group narrative.

Another View: Discounted Cash Flow Tells a Different Story

While the current price seems steep based on revenue multiples, our SWS DCF model presents an even starker picture. The model estimates Klarna’s fair value at just $3.22 per share. This indicates the stock is trading well above what its future cash flows might justify. Are investors missing something, or is the market focused on the long-term growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klarna Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 853 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klarna Group Narrative

If you'd rather form your own perspective or want to dive deeper into Klarna's numbers, crafting your personal analysis takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Klarna Group.

Looking for More Smart Investment Ideas?

Why settle for just one stock when the market is full of potential? Uncover other unique opportunities from expert-curated lists and get ahead of the crowd.

- Capture steady earnings by checking out these 22 dividend stocks with yields > 3% with attractive yields to strengthen your income strategy.

- Spot tomorrow’s tech trailblazers by accessing these 26 AI penny stocks featuring companies transforming industries with artificial intelligence.

- Maximize value by tapping into these 853 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klarna Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KLAR

Klarna Group

Operates as a technology-driven payments company in the United Kingdom, the United States, Germany, Sweden, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives