- United States

- /

- Diversified Financial

- /

- NYSE:KLAR

Evaluating Klarna After 4.9% Price Rise and New Retail Partnerships in 2025

Reviewed by Bailey Pemberton

If you are at a crossroads with Klarna Group stock, you are not alone. Investors everywhere are sizing up whether this recent tech sector favorite is now primed for a comeback or facing further headwinds. In the past week, Klarna shares have edged up by 4.9%, giving bullish watchers a glimmer of optimism after a tough stretch. Looking at the last month, though, the stock is still down 2.6%, and the year-to-date tally sits at a sobering -15.1%. That tug-of-war in price is stirring up all sorts of debates about how much growth Klarna really has in the tank, and if the market is fairly pricing the company's risk and ambition.

Recent headlines have only added to the intrigue. Klarna’s ongoing expansion into new markets and its fresh partnerships with global retailers have been cited as possible drivers behind the recent uptick in share price. On the other hand, some analysts still point to increased competition and evolving regulatory landscapes as reasons the stock might be struggling to find consistent footing.

With so many narratives swirling, it makes sense to turn to valuation metrics. Klarna currently notches a score of just 1 out of 6 on our value assessment checklist, indicating it is undervalued in only one key area. Is that a sign the market has it right, or is something being missed?

Let us dig deeper into these valuation measures, see how they hold up, and then discuss an even sharper lens for understanding what Klarna is really worth.

Klarna Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Klarna Group Excess Returns Analysis

The Excess Returns model offers a focused look at whether Klarna Group is generating more profit from its invested capital than it costs the company to obtain that capital. This approach zeros in on how well management is turning shareholders’ investments into sustainable profits, rather than simply tracking earnings growth or cash flow.

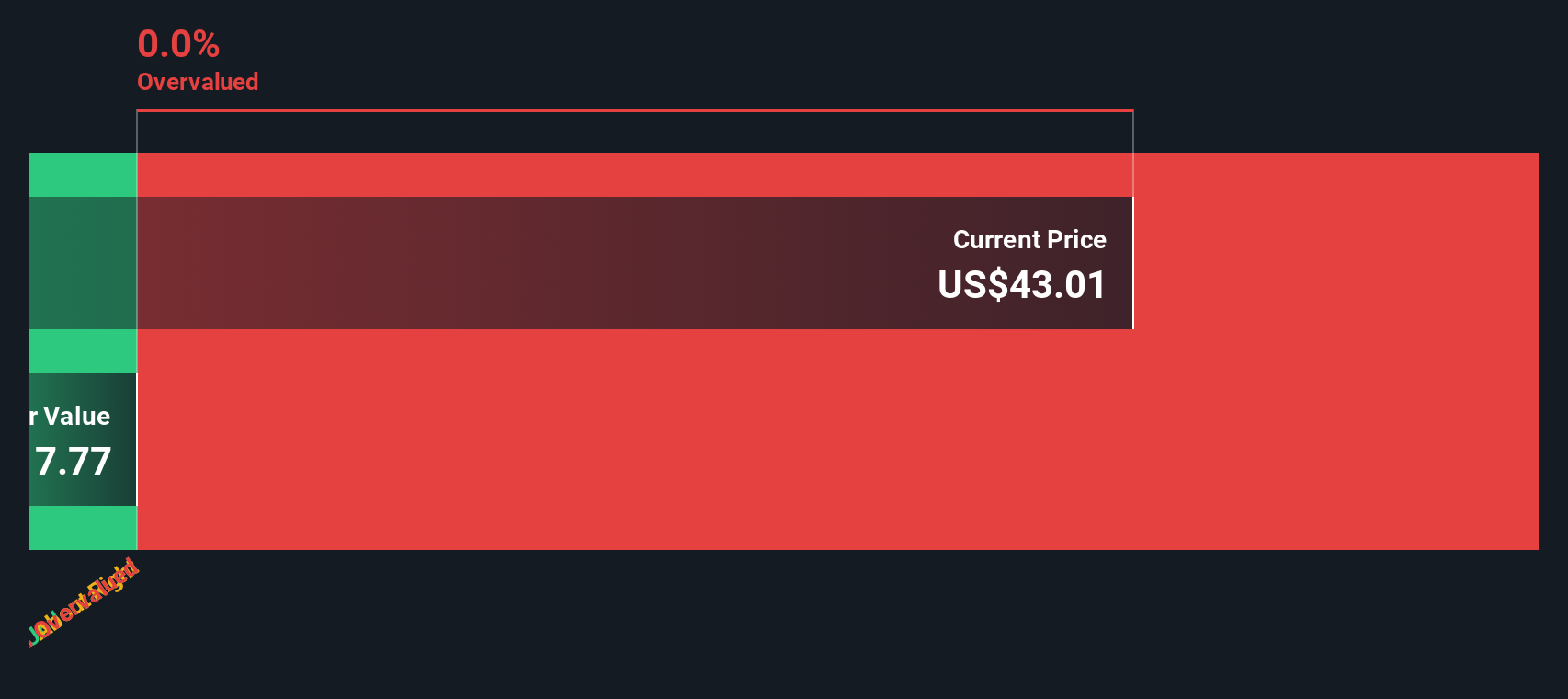

For Klarna, the key numbers are revealing. The company boasts a Book Value of $6.32 per share and is forecast to deliver a Stable EPS of $0.35 per share, based on the weighted future Return on Equity estimates from 9 analysts. The Cost of Equity, however, sits at $0.49 per share, meaning Klarna is not earning enough to exceed what investors expect as a minimum return. This results in a negative Excess Return of $-0.14 per share and an average Return on Equity of 5.63%. The Stable Book Value, reflecting the company’s consistent net asset position, is $6.15 per share, determined by the median Book Value over the past five years.

Pitting these numbers against the market price, the intrinsic discount implied by the Excess Returns valuation comes in at a striking 1109.1% overvalued. This suggests the current price is far above what these fundamentals can justify, signaling a large disconnect between market optimism and profit reality.

Result: OVERVALUED

Our Excess Returns analysis suggests Klarna Group may be overvalued by 1109.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Klarna Group Price vs Sales

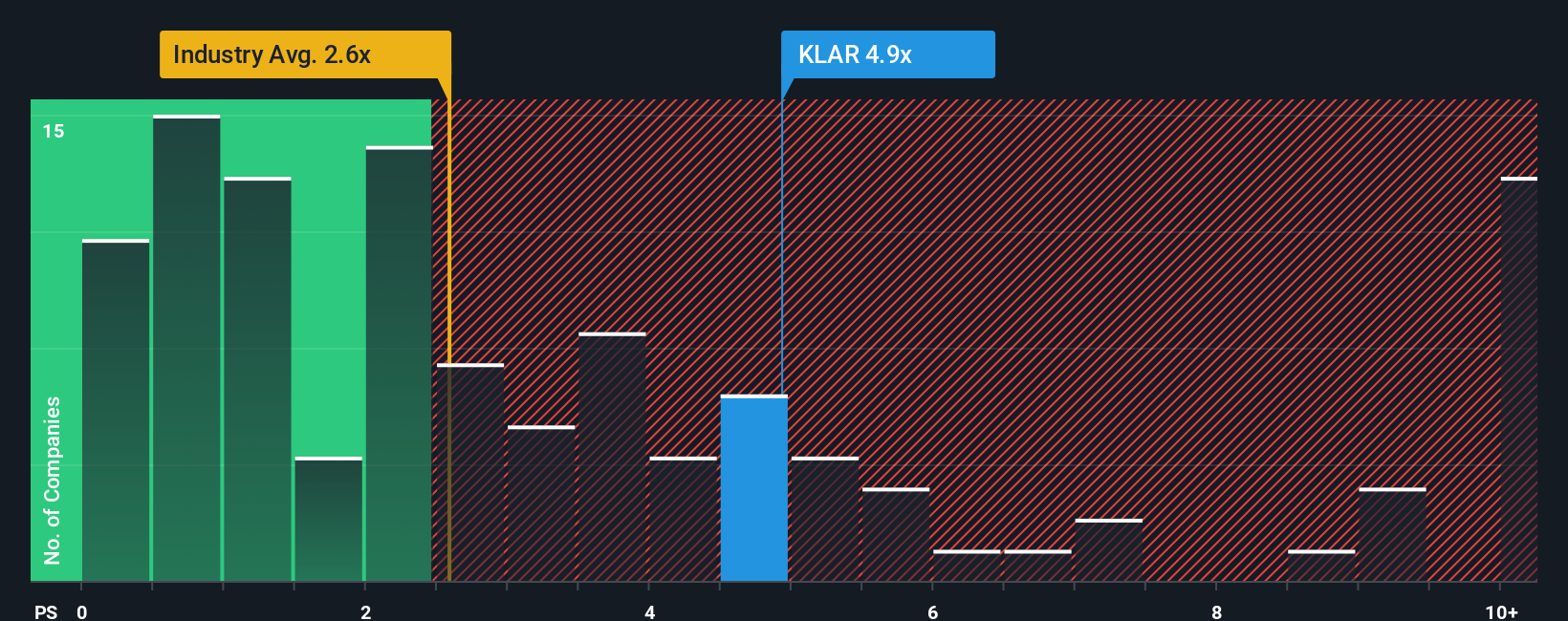

For companies like Klarna Group, which are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the go-to valuation metric. This ratio helps investors see how much they are paying for each dollar of revenue, offering a clearer picture when earnings are volatile or negative. While growth expectations and the risk profile should always inform what a “normal” multiple looks like, a lower P/S ratio generally signals that the company may be undervalued provided growth prospects and competitive pressures hold up.

Currently, Klarna is trading at a P/S multiple of 4.88x. When we put that in context, the industry average for Diversified Financials stands at just 2.52x, while the closest peer group is averaging about 5.29x. At first glance, this positions Klarna between broader industry norms and its direct peers. This suggests the market is pricing in higher growth or stronger market positioning than most, but not quite at the very top end.

To get a sharper reading, Simply Wall St’s proprietary Fair Ratio comes into play. Unlike a simple peer or industry comparison, the Fair Ratio is tailored to capture Klarna’s unique mix of growth, profit margins, risk factors, industry context, and even market cap. This approach gives a more personalized benchmark than what off-the-shelf multiples can offer, making it a more nuanced way to gauge true value.

Comparing Klarna’s P/S of 4.88x to the Fair Ratio (not provided), the difference suggests the valuation is about in line with expectations at this time.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Klarna Group Narrative

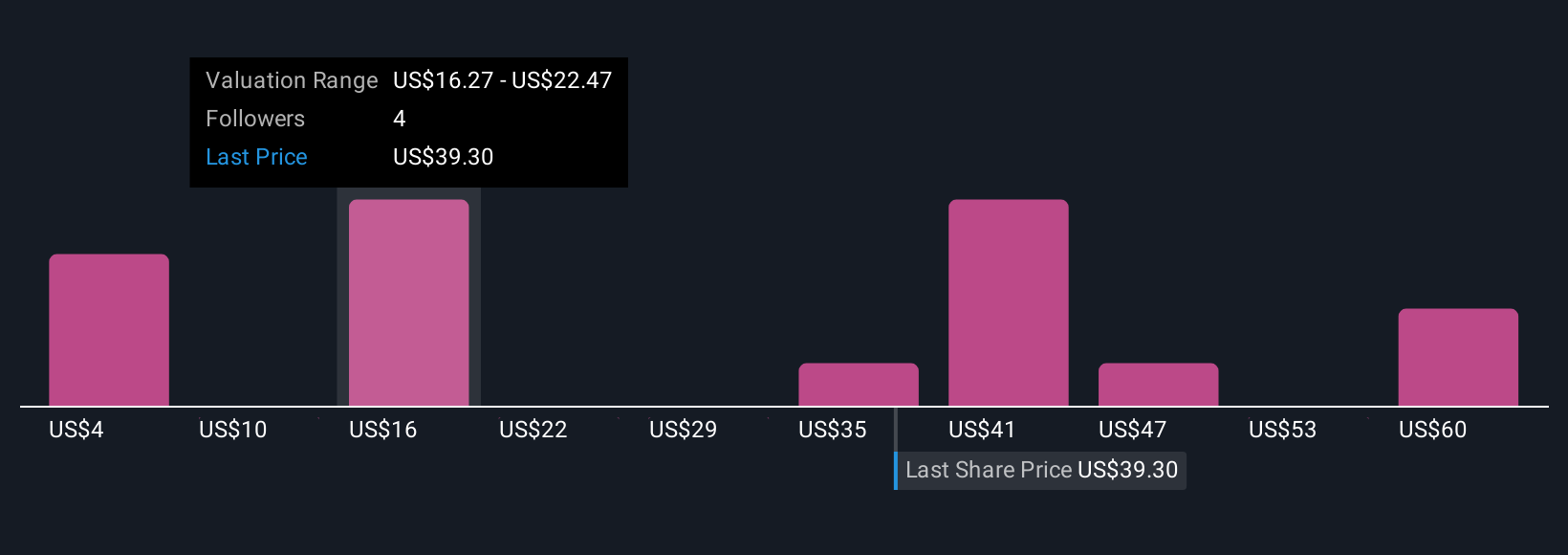

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your own story or perspective on a company like Klarna Group, combining your assumptions about future growth, profits, and risks with a financial forecast to arrive at your personal fair value estimate.

Narratives bridge the gap between what you believe about a company's future and what the numbers show, making your investment thesis both explicit and actionable. On Simply Wall St’s platform, available to millions of investors in the Community page, Narratives give you a structured and accessible tool for making smarter investment decisions.

They help you decide when to buy or sell by letting you compare your own Fair Value against today's market price, and they refresh automatically whenever new data, such as breaking news or financial results, appears.

For Klarna Group, this means you might see one investor’s Narrative forecasting rapid international expansion and a high fair value, while another Narrative might anticipate regulatory challenges, reflecting a much lower fair value. Narratives empower you to see these different perspectives and make choices that align with your own convictions and analysis.

Do you think there's more to the story for Klarna Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klarna Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KLAR

Klarna Group

Operates as a technology-driven payments company in the United Kingdom, the United States, Germany, Sweden, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives