- United States

- /

- Capital Markets

- /

- NYSE:KKR

Should Investors Reassess KKR Amid 20% Price Drop and Shifting Market Sentiment?

Reviewed by Bailey Pemberton

- Ever wondered if KKR stock is actually a bargain or just riding the waves? You are not alone. Now might be a great time to sharpen your perspective.

- Despite a powerful 222.8% return over the last five years, KKR has recently slipped, down 1.9% for the past week, 7.3% this month, and 20.7% year-to-date. The spotlight is back on its value proposition.

- What is behind these latest moves? Headlines have focused on deal-making activity, shifting macroeconomic sentiment, and ongoing debates about the outlook for alternative asset managers. All of these factors are keeping investors guessing.

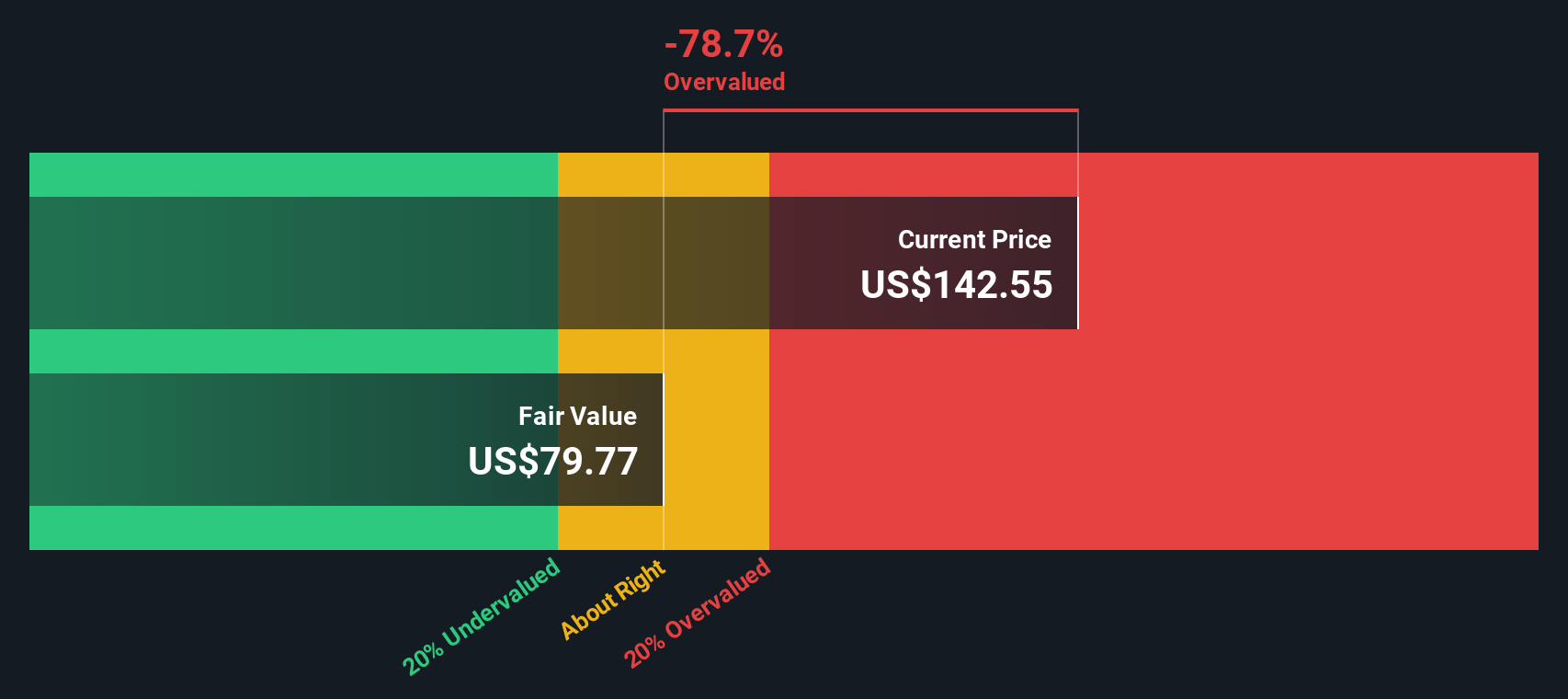

- Right now, KKR's valuation score clocks in at 1 out of 6. Classic valuation checks are just the start. We will dig into the numbers and, at the end of this article, explore a smarter way to think about what KKR is really worth.

KKR scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KKR Excess Returns Analysis

The Excess Returns Model evaluates a company by measuring how much profit it generates above its cost of equity. It uses both the book value and expected return on equity to assess value creation over time. This model is especially useful for companies like KKR, where the ability to generate steady returns from invested capital is central to the business.

For KKR, the details reveal the following:

- Book Value: $28.82 per share

- Stable EPS: $6.83 per share

(Source: Weighted future Return on Equity estimates from 7 analysts.) - Cost of Equity: $5.31 per share

- Excess Return: $1.52 per share

- Average Return on Equity: 12.07%

- Stable Book Value: $56.58 per share

(Source: Weighted future Book Value estimates from 3 analysts.)

Based on these projections, the Excess Returns valuation suggests KKR is currently 46.7% overvalued compared to its intrinsic worth. This finding implies that the stock price may be running ahead of the company's true economic profitability, at least under these assumptions.

Result: OVERVALUED

Our Excess Returns analysis suggests KKR may be overvalued by 46.7%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KKR Price vs Earnings

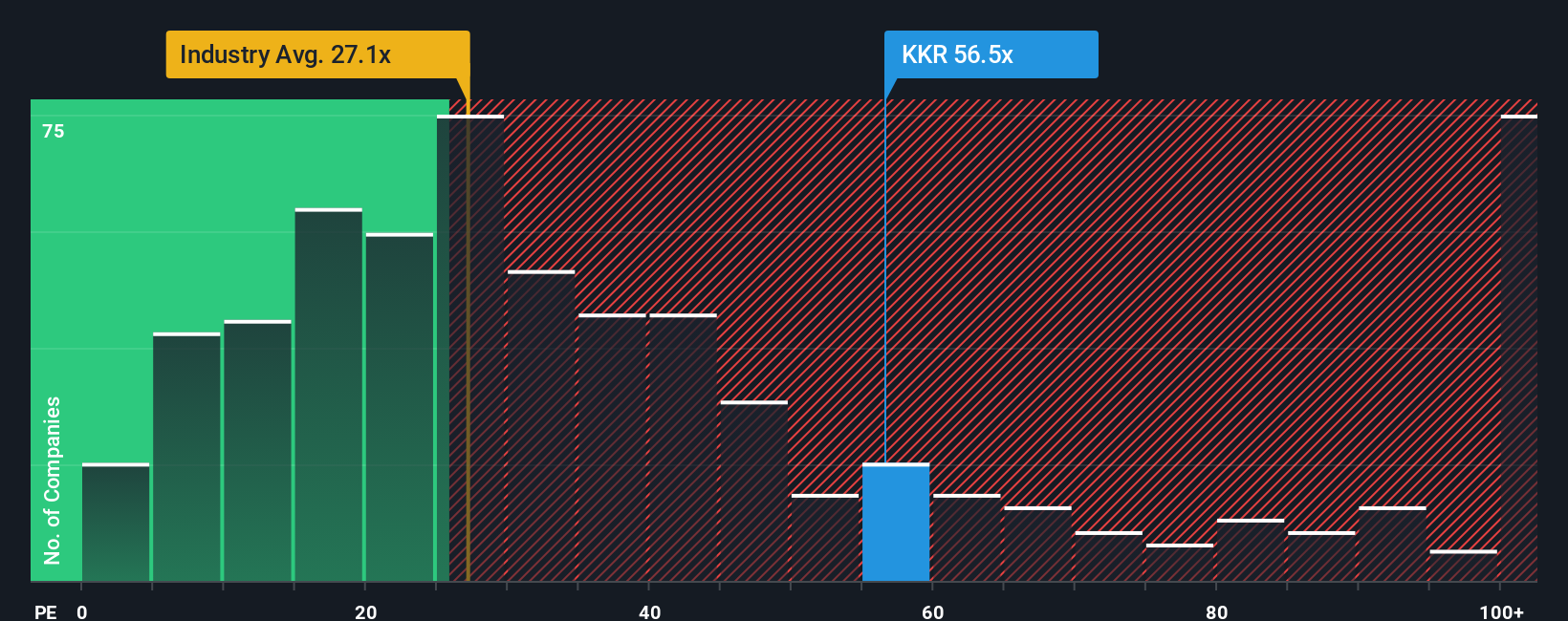

The price-to-earnings (PE) ratio is one of the most widely used valuation tools for profitable companies. By comparing a company's share price with its earnings per share, investors can get a sense of how much they are paying for each dollar of profit. This makes the PE ratio particularly relevant for established businesses generating consistent profits like KKR.

Interpreting what is a "normal" or "fair" PE ratio depends heavily on factors such as growth prospects and perceived risk. Companies expected to deliver faster earnings growth or with lower perceived risk tend to command higher PE multiples, while slower-growing or riskier firms usually trade on lower multiples.

At present, KKR is trading on a PE ratio of 52.7x, which is notably higher than the Capital Markets industry average of 23.7x and the peer average of 34.2x. However, to truly get a sense of fair value, Simply Wall St's "Fair Ratio" provides a more tailored yardstick. It estimates a fair PE for KKR at 31.7x by factoring in the company's growth outlook, profit margins, risks, market cap, and industry dynamics.

Unlike basic industry or peer comparisons, the Fair Ratio is designed to account for the unique combination of attributes that make up KKR's investment case. This more holistic metric helps investors avoid the blind spots that come with using generic averages and offers a clearer target for what a balanced valuation should look like.

Comparing KKR's current PE (52.7x) with its Fair Ratio (31.7x) suggests the shares are trading well above what would be considered reasonable given its fundamentals. By this metric, KKR appears overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your KKR Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter tool that connects a company's story to future forecasts and fair value in a way that's accessible for all investors.

A Narrative is your unique perspective. It combines your view of KKR's business drivers, industry changes, risks, and opportunities, alongside your assumptions for future revenue, margins, and earnings, into a personal story that leads to a calculated fair value for the stock.

This approach goes beyond numbers alone. It links each company's evolving story, such as KKR's push into private markets or risk management strategies, to a tailored financial forecast and, crucially, to a fair value you can use as your own investing reference point.

With Narratives, deciding when to buy or sell becomes easier. You can quickly compare your fair value to the current price, with your numbers and thesis brought together in one clear dashboard. These Narratives update dynamically as new news and earnings emerge, keeping your investment view relevant.

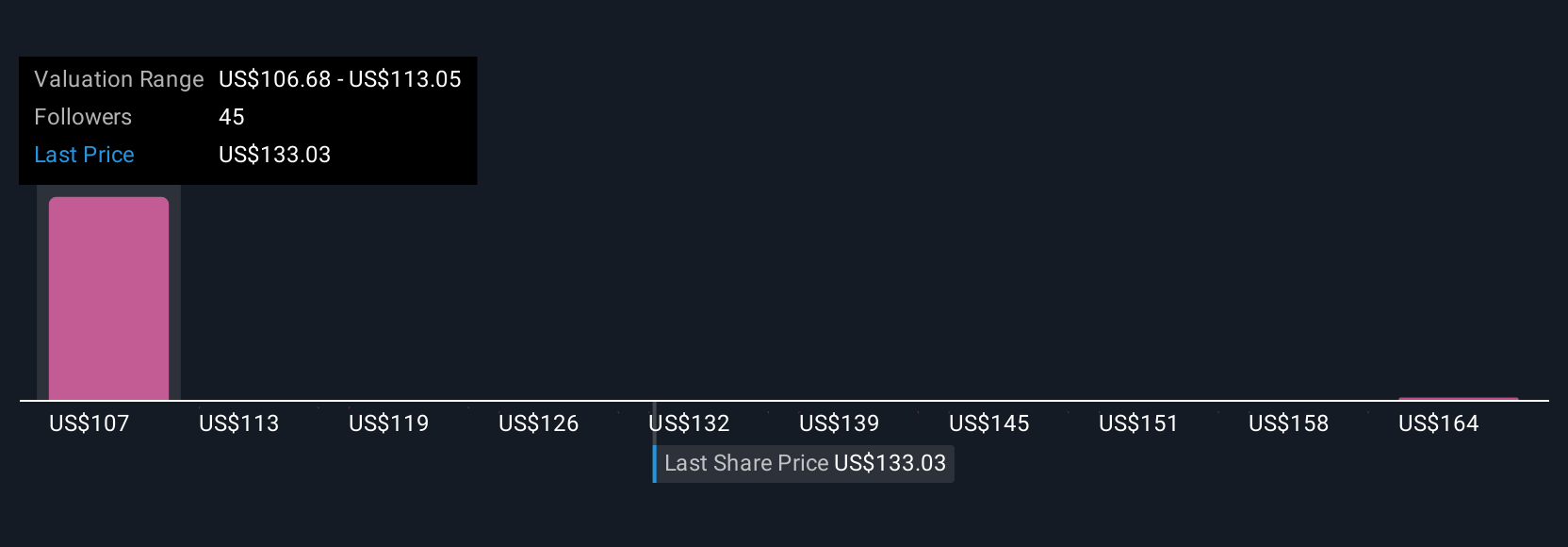

On Simply Wall St's Community page, used by millions of investors, you will see that for KKR, some investors' Narratives are bullish, highlighting targets as high as $187.00, while others take a far more cautious stance at $135.00. This proves there is no single story and that the best decision is always personal.

Do you think there's more to the story for KKR? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives