- United States

- /

- Capital Markets

- /

- NYSE:KKR

PayPal’s €65 Billion BNPL Deal With KKR Might Change the Case for Investing in KKR (KKR)

Reviewed by Sasha Jovanovic

- PayPal Holdings, Inc. recently announced a new agreement allowing KKR-managed credit funds and accounts to acquire up to €65 billion in European buy now, pay later loan receivables, supported by a replenishing loan commitment of up to €6 billion across five countries.

- This deal further cements KKR's footprint in private credit markets while highlighting ongoing institutional confidence in the BNPL segment within Europe.

- We'll examine how this expanded private credit partnership deepens KKR's earnings base and shapes its broader investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

KKR Investment Narrative Recap

For investors considering KKR, the core belief centers on the firm's ability to harness private market growth, diversify earnings across credit and alternative assets, and scale new platforms efficiently. The recent PayPal agreement increases KKR's exposure to private credit and accelerates its asset-based finance ambitions, reinforcing the main near-term catalyst, expansion of fee-paying assets, but also mildly heightens asset quality and liquidity risk if credit markets destabilize, making the impact material for both earnings durability and risk profile.

Among KKR’s recent updates, the Q3 earnings report stands out: quarterly revenue rose to US$5.53 billion with net income hitting US$900.36 million. This underscores how bolstering private credit deal flow, exemplified by the PayPal BNPL partnership, supports the firm's ability to grow management fees and capitalize on secular trends, reinforcing the importance of scaling platforms while managing risks tied to rapid credit expansion.

However, if credit markets lose momentum or asset quality deteriorates, investors should be aware that...

Read the full narrative on KKR (it's free!)

KKR's outlook forecasts $13.7 billion in revenue and $5.4 billion in earnings by 2028. This scenario assumes revenue will decline by 13.9% per year, while earnings are expected to rise by $3.4 billion from the current $2.0 billion level.

Uncover how KKR's forecasts yield a $157.14 fair value, a 32% upside to its current price.

Exploring Other Perspectives

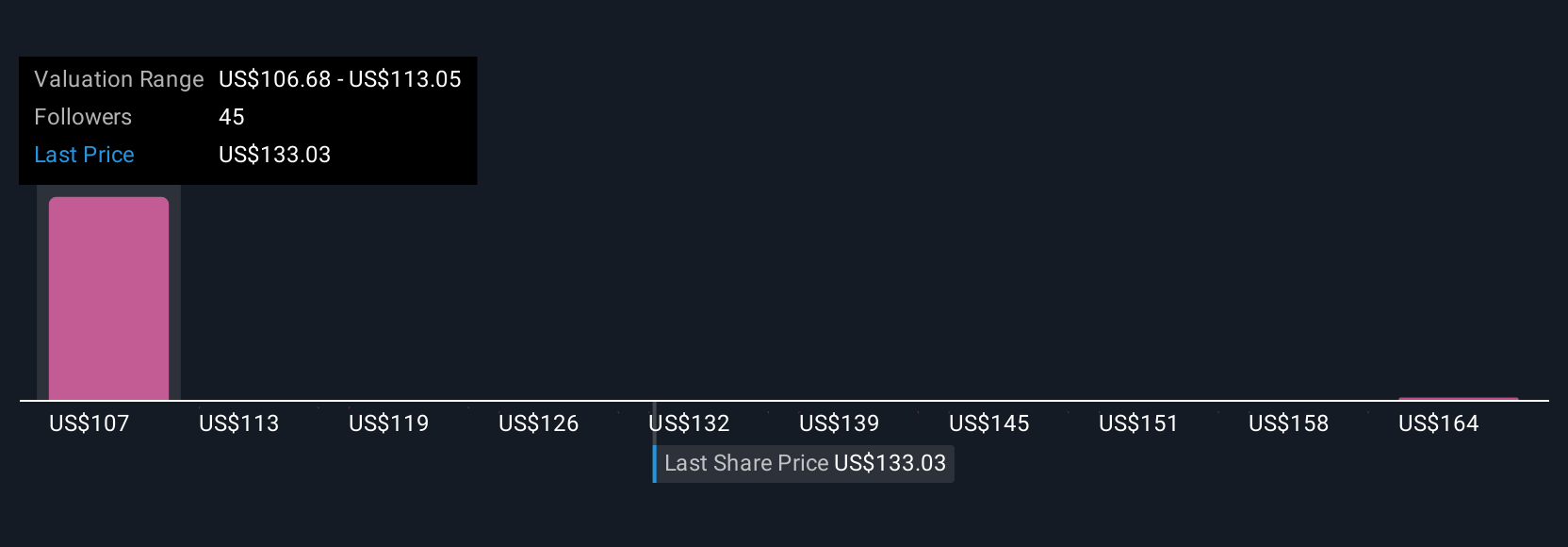

Fair value estimates from the Simply Wall St Community span from US$58.15 to US$170.36 based on five individual analyses. As the private credit segment grows, competition and fee pressure could challenge KKR’s operating margins, so it pays to examine various outlooks on risk and reward.

Explore 5 other fair value estimates on KKR - why the stock might be worth as much as 44% more than the current price!

Build Your Own KKR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KKR research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KKR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KKR's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives