- United States

- /

- Capital Markets

- /

- NYSE:KKR

Is Adam Selipsky’s Appointment Signaling a New AI-Focused Investment Strategy Shift for KKR (KKR)?

Reviewed by Simply Wall St

- KKR recently announced the appointment of former AWS CEO Adam Selipsky as its leading technology advisor, focusing on guiding the firm's AI infrastructure and real assets investment strategy.

- This move signals KKR's intent to significantly advance its expertise and presence in the global AI and data center sector with experienced leadership at the helm.

- We'll now explore how Adam Selipsky's arrival and KKR's AI ambitions may shift its investment narrative and future growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

KKR Investment Narrative Recap

To own KKR, you need to believe in the company's ability to drive consistent growth through expanding its alternative asset platform, strong fundraising, and scaling technology investments, while managing the risks of earnings volatility and asset quality, especially as competition heats up. Adam Selipsky's arrival does not materially alter the biggest near-term catalyst, which remains sustained fundraising momentum across private markets and wealth channels, nor does it mitigate the key risk of potential fee compression from increased competition.

The recently announced USD 50 billion AI infrastructure push, including the 190 MW data center partnership in Texas, is directly relevant to Selipsky’s appointment and highlights the business's continued move into real assets and technology-driven growth areas. This aligns with the existing catalyst around expanding differentiated origination platforms and technology, but does not diminish ongoing concerns around margin pressures or the unpredictability of carried interest income from monetizations.

However, investors should be aware that despite these growth ambitions, fee compression and intense competition for capital could still ...

Read the full narrative on KKR (it's free!)

KKR's narrative projects $13.7 billion revenue and $5.4 billion earnings by 2028. This requires a 13.9% yearly revenue decline and a $3.4 billion earnings increase from $2.0 billion today.

Uncover how KKR's forecasts yield a $164.47 fair value, a 21% upside to its current price.

Exploring Other Perspectives

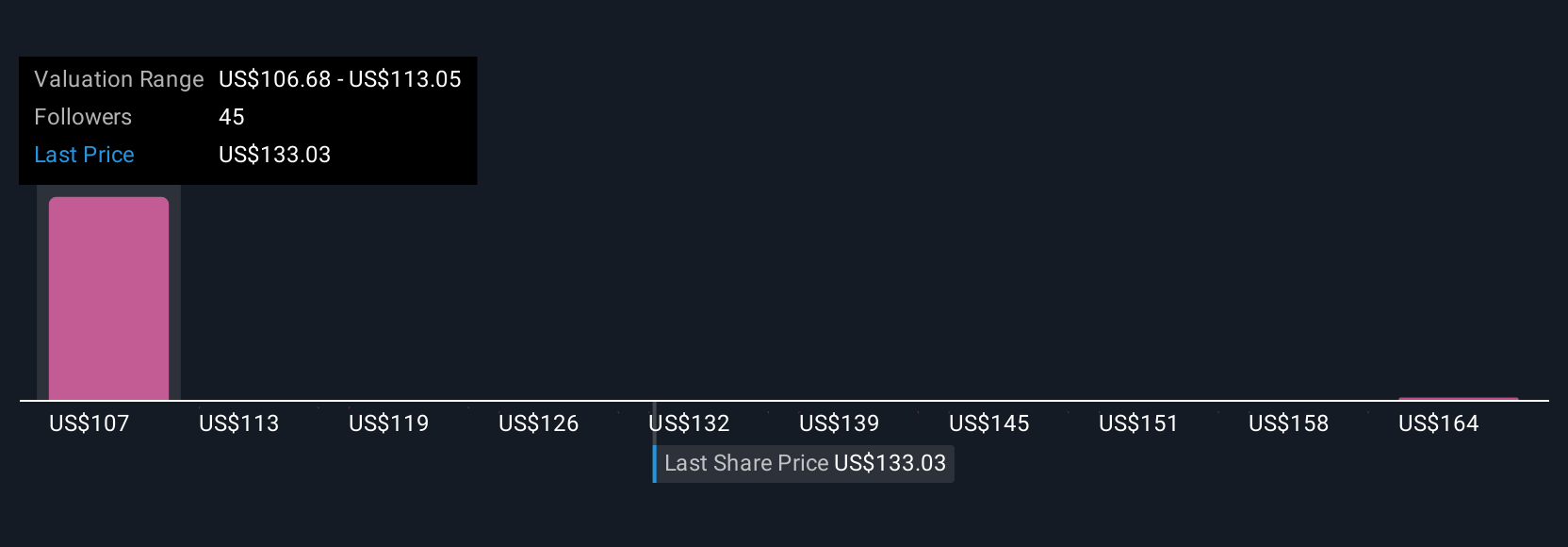

Seven members of the Simply Wall St Community estimate KKR’s fair value ranging from US$69 to US$170 per share. While some see significant upside, others price in risks such as increased margin pressures from competition, suggesting you should check a range of viewpoints before deciding for yourself.

Explore 7 other fair value estimates on KKR - why the stock might be worth as much as 26% more than the current price!

Build Your Own KKR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KKR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KKR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KKR's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives