- United States

- /

- Capital Markets

- /

- NYSE:JEF

Jefferies Financial Group (JEF): Evaluating Valuation in Light of Securities Probe Linked to First Brands Bankruptcy

Reviewed by Simply Wall St

Jefferies Financial Group (JEF) is facing new scrutiny after Bleichmar Fonti & Auld LLP launched a securities investigation related to its exposure to First Brands Group, an auto parts supplier that recently filed for bankruptcy.

See our latest analysis for Jefferies Financial Group.

Despite this legal cloud, Jefferies Financial Group’s share price has rebounded 4.1% over the past week, signaling a short-term boost in investor confidence following a tough year that saw a -30.85% year-to-date share price return. Looking long term, the 67% total shareholder return over three years and 192% over five years show that, while momentum has faded recently, disciplined investors have still fared well.

If news around Jefferies makes you curious about other companies connected to the auto sector, this is a good moment to check out See the full list for free..

With Jefferies shares bouncing back slightly, the big question is whether recent declines have left the stock undervalued or if the market is already pricing in all future growth. Could there be a buying opportunity here?

Price-to-Earnings of 17.6x: Is it justified?

At a price-to-earnings (P/E) multiple of 17.6x, Jefferies Financial Group trades at a noticeable discount compared to both US Capital Markets peers and the market average. This reflects a more favorable valuation.

The price-to-earnings ratio measures how much investors are willing to pay today for each dollar of the company’s earnings. It is a widely used gauge in financials, giving insight into market expectations for growth and profitability.

Given Jefferies’ recent strong earnings growth and consistently high-quality profits, its subdued P/E might signal that some investors are discounting the potential for future outperformance or remain wary due to sector risks.

Compared to the US Capital Markets industry average P/E of 23.6x and a fair value benchmark of 17.7x, Jefferies' current multiple stands out as attractive. The market could eventually re-rate the stock toward this fair level if improving trends persist.

Explore the SWS fair ratio for Jefferies Financial Group

Result: Price-to-Earnings of 17.6x (UNDERVALUED)

However, continued legal uncertainties and sector-wide volatility could quickly disrupt Jefferies' recovery narrative. This could challenge the case for undervaluation in the near term.

Find out about the key risks to this Jefferies Financial Group narrative.

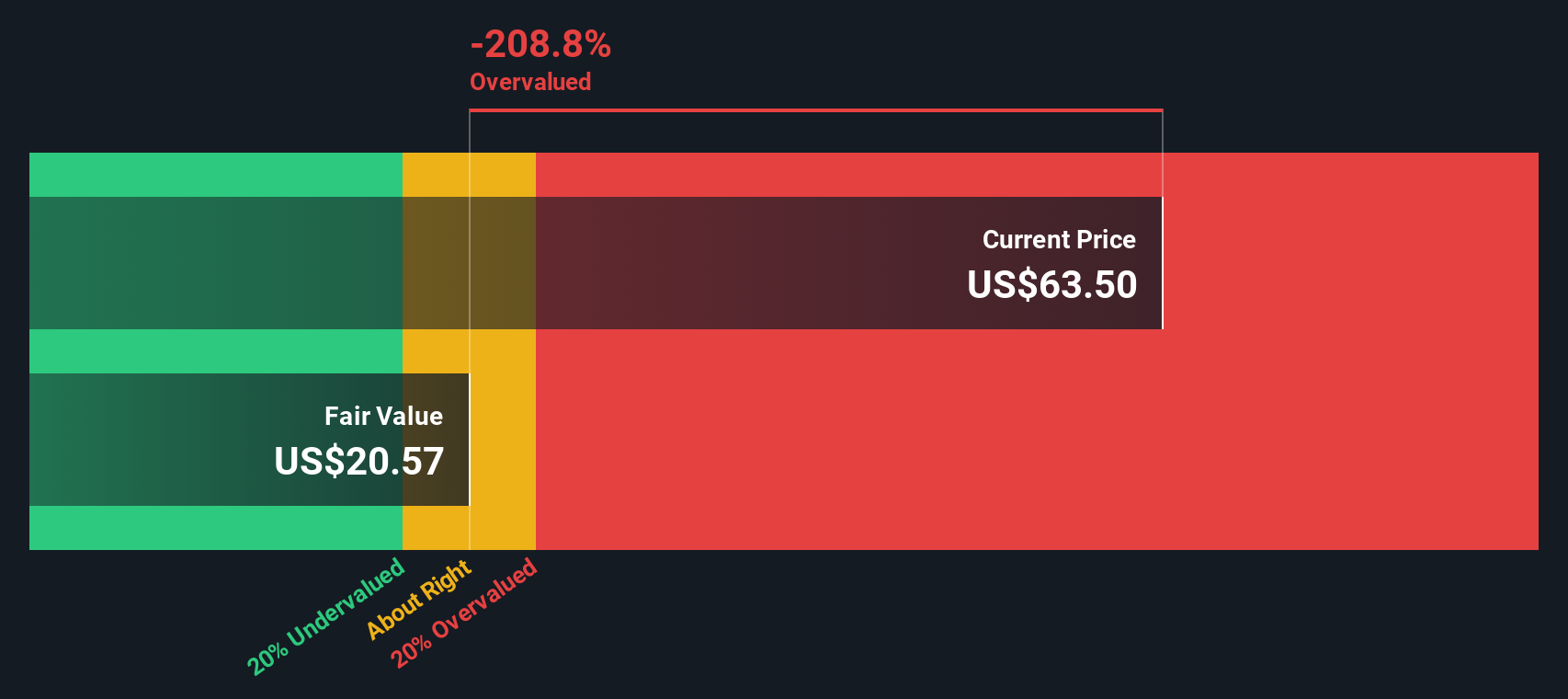

Another View: Discounted Cash Flow Tells a Different Story

While Jefferies appears attractively priced compared to its sector based on earnings multiples, the SWS DCF model provides a more cautious perspective. According to our DCF, the current stock price is well above the estimated fair value. This suggests that market optimism could be concealing underlying valuation risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jefferies Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jefferies Financial Group Narrative

If you have your own perspective on Jefferies or want to dig deeper into the numbers, you can shape your own story in just a few minutes. Do it your way

A great starting point for your Jefferies Financial Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make your next move count. Don’t settle for a single idea when the market is full of potential. Tap into powerful themes and find your next great pick with these hand-selected opportunities:

- Jump on the momentum of tech innovation and uncover the leaders in artificial intelligence by starting with these 26 AI penny stocks.

- Lock in attractive yields and set yourself up for steady returns by checking out these 15 dividend stocks with yields > 3% with a proven history of robust payouts.

- Catalyze your portfolio with the next generation of finance. See which companies are shaping tomorrow’s markets through these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives