- United States

- /

- Capital Markets

- /

- NYSE:JEF

Is Jefferies Financial Group’s Valuation Justified After Recent Expansion and Deal-Making Activity?

Reviewed by Bailey Pemberton

- Curious whether Jefferies Financial Group is a bargain right now? Let’s dive straight into what makes this stock’s value story so compelling.

- The shares have seen some wild rides lately, bouncing up 1.9% over the past week but still sitting down by 11.9% over the past month and off by 31.8% year-to-date.

- Recent headlines have highlighted Jefferies Financial Group’s ongoing expansion initiatives and deal-making activity, including new partnerships and acquisitions that aim to boost its position among financial services peers. This news has fueled both optimism and caution in the market, as investors weigh the potential rewards against increased volatility.

- On Simply Wall St’s valuation checks, Jefferies lands a score of 3 out of 6 for being undervalued, putting it right at the halfway mark. Let’s unpack what drives this score, and stick around for an even smarter way to assess a company’s real worth.

Approach 1: Jefferies Financial Group Excess Returns Analysis

The Excess Returns model evaluates a company’s value by looking at how much profit it generates above the minimum required return for shareholders, known as the cost of equity. This approach helps investors see whether a company is making its invested capital work efficiently, rather than simply focusing on profit growth.

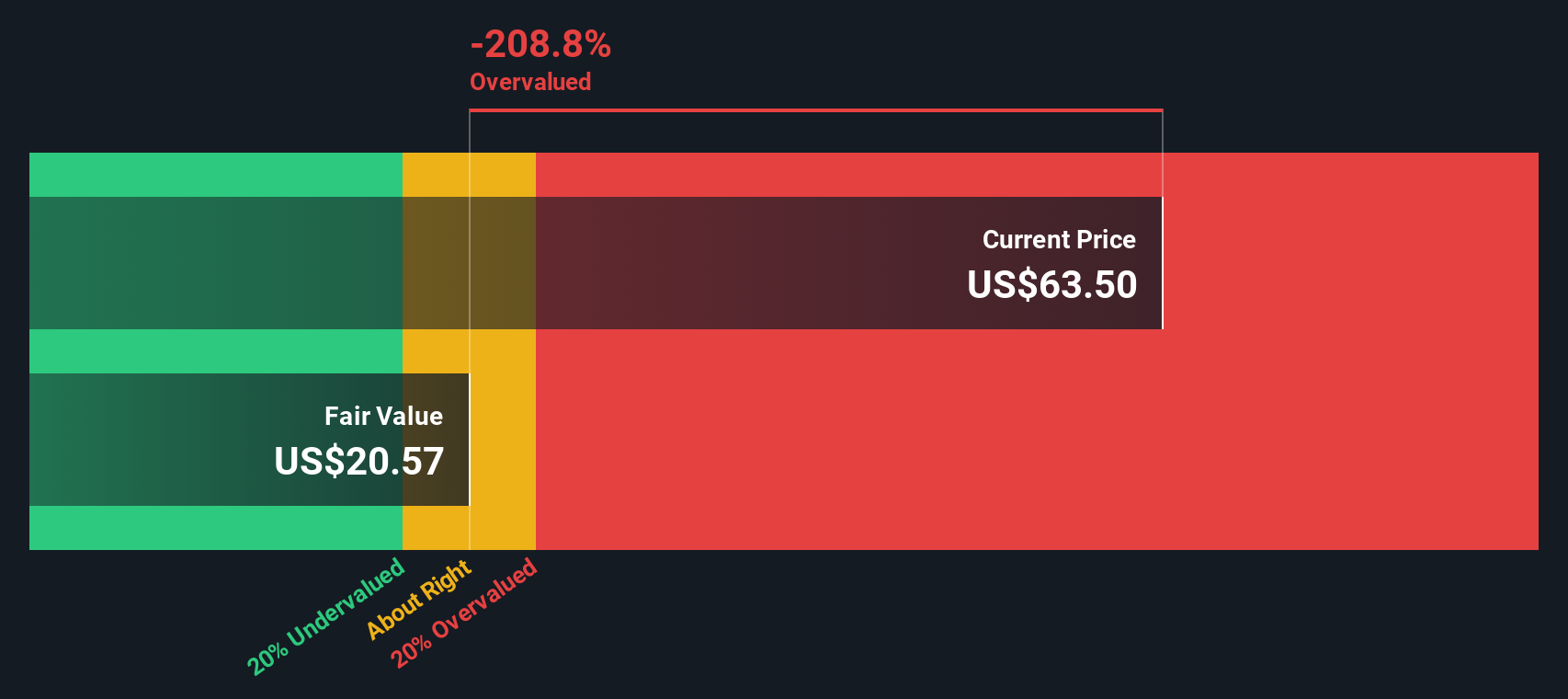

For Jefferies Financial Group, this model highlights a few key numbers. The company’s book value stands at $50.60 per share, and its stable earnings per share (EPS) average $3.07, based on the median return on equity over the past five years. The calculated cost of equity, which is the required rate of return, is $5.15 per share. This results in a negative excess return of $-2.08 per share, indicating the company is not generating sufficient profit above its required hurdle rate. The average return on equity is 5.76%, and forward-looking analyst estimates place the stable book value at $53.28 per share.

When these factors are combined, the Excess Returns model projects that Jefferies Financial Group’s shares are currently 148.7% overvalued compared to their intrinsic value. In summary, this metric suggests the company is not delivering the surplus returns that would justify its current market price.

Result: OVERVALUED

Our Excess Returns analysis suggests Jefferies Financial Group may be overvalued by 148.7%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Jefferies Financial Group Price vs Earnings

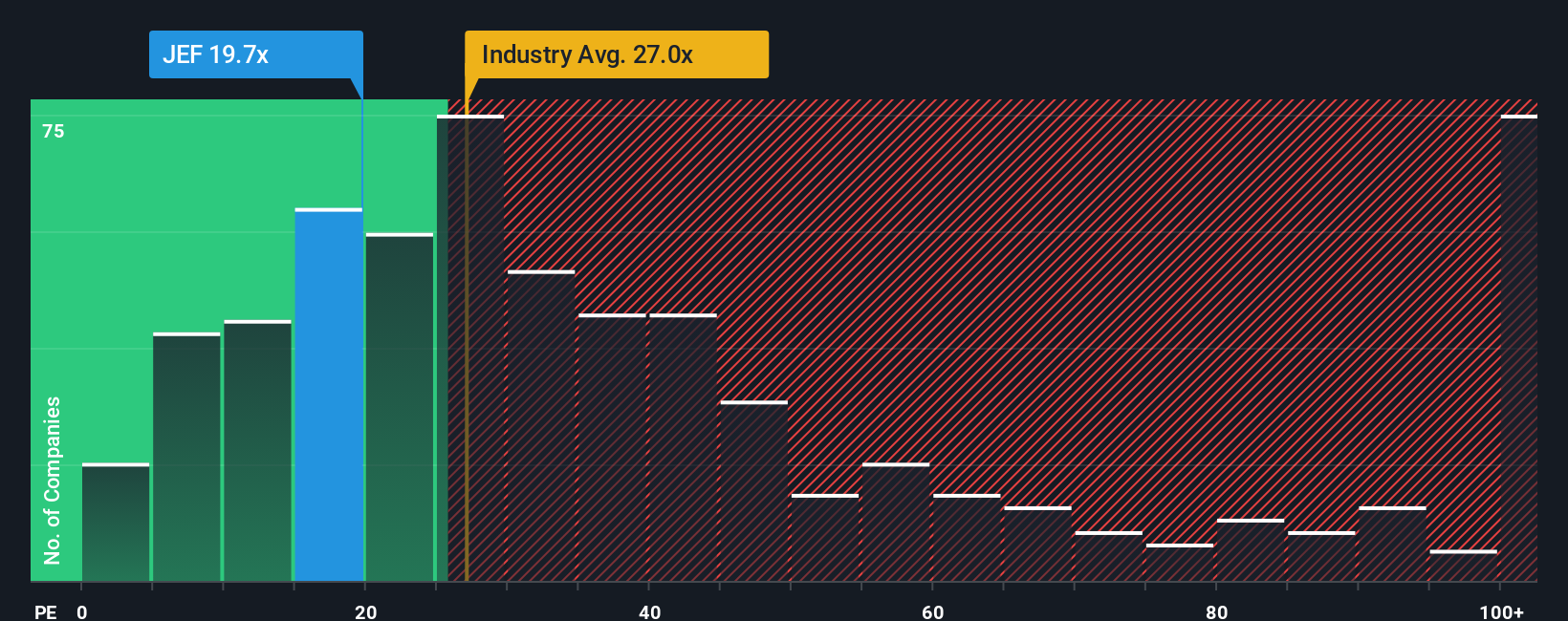

The price-to-earnings (PE) ratio is the go-to valuation measure for profitable companies, because it connects a company’s market price to the earnings it generates. For investors, this helps reveal how much the market is willing to pay for each dollar of profit. This serves as a critical check on whether a stock is overpriced or offers solid value.

Interpreting what a “normal” PE ratio should be is not one-size-fits-all. It depends on how quickly a company is expected to grow and the risks it faces. Stocks with better growth prospects or lower risk usually command higher PE ratios, while those facing slower growth or greater uncertainty often trade at a discount.

Jefferies Financial Group currently trades at a PE ratio of 17.35x, which is noticeably lower than the Capital Markets industry average of 23.79x and the average among its peers at 20.43x. This suggests the market is pricing Jefferies below many of its competitors. However, there is a more nuanced metric: Simply Wall St’s proprietary “Fair Ratio.” The Fair Ratio for Jefferies stands at 17.38x, which factors in not just the company’s growth and risks, but also its profit margins, industry specifics, and market cap. Unlike simple averages, the Fair Ratio gives a more tailored benchmark for a stock’s justified valuation.

With Jefferies trading at 17.35x and the Fair Ratio at 17.38x, the stock appears to be priced about right based on its fundamentals and future prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jefferies Financial Group Narrative

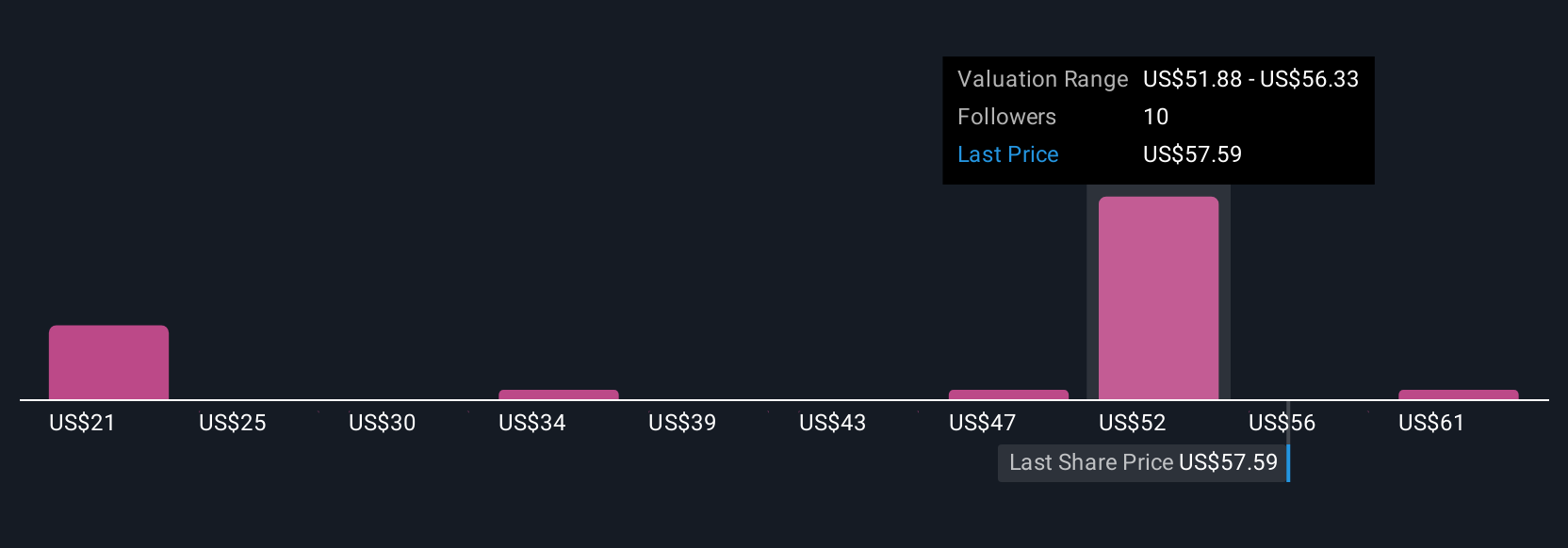

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and powerful tool that allows you to combine your perspective on a company with the numbers, turning your assumptions about its future revenue, earnings, and margins into a story-driven financial forecast and fair value estimate. Narratives do not just explain how you see Jefferies Financial Group’s future; they link that story directly to robust analysis, making your investment thesis actionable.

This approach, available on Simply Wall St’s Community page, makes it easy for millions of investors to craft and share their outlooks. By comparing a Narrative’s Fair Value with the current Price, you can quickly see if it might be time to buy or sell. Narratives are always up to date and instantly reflect new data, such as earnings reports or major news.

For example, while one investor may forecast higher earnings and see Jefferies as considerably undervalued, another might take a cautious view, expecting challenges ahead and valuing the shares more conservatively. Narratives put this kind of active and dynamic decision making in your hands, so you always know where you stand.

Do you think there's more to the story for Jefferies Financial Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives