- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Invesco (IVZ): Exploring Valuation After Recent 2% Share Price Rise and 32% Year-to-Date Gain

Reviewed by Simply Wall St

Invesco (IVZ) shares have delivered a 2% bump over the past day, pushing the stock’s year-to-date gain to 32%. Over the past month, the stock is up nearly 1%, reflecting steady momentum despite mixed signals from the financial sector.

See our latest analysis for Invesco.

Invesco's 31.6% share price return since the start of the year stands out in a sector where sentiment has been varied. Its impressive 36.7% total shareholder return over the past twelve months highlights the benefits of its steady capital returns and improving outlook. Momentum has clearly been building, with the stock benefiting from renewed optimism despite occasional reversals.

If you're considering where to look next as the financial sector shifts, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with shares trading about 13% below analyst price targets and robust total returns, the key question remains: is Invesco still undervalued, or is the market already factoring in future growth prospects?

Most Popular Narrative: 11.9% Undervalued

With Invesco’s fair value estimate set at $26.35, which is more than 11% above the last closing price of $23.22, analysts see meaningful upside potential if their long-range expectations prove accurate. This sets the stage for a narrative centered around margin expansion and business evolution.

"Invesco's aggressive expansion in private markets and alternative asset offerings, including strategic partnerships (e.g., with Barings and MassMutual) and increased distribution through wealth management channels, aligns with the growing demand for alternatives and could drive higher-fee revenue streams and improved earnings resilience."

What’s behind this valuation? The narrative hinges on a financial transformation, with margin growth, lower share count, and a profit surge that could flip the script for Invesco’s future. Intrigued by which projections push this stock well above current trading levels? Don’t miss the full explanation behind these bold numbers.

Result: Fair Value of $26.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in QQQ ETF reclassification and persistent competitive pressures could complicate Invesco’s margin story and challenge the bullish outlook.

Find out about the key risks to this Invesco narrative.

Another View: Multiples Signal Relative Value

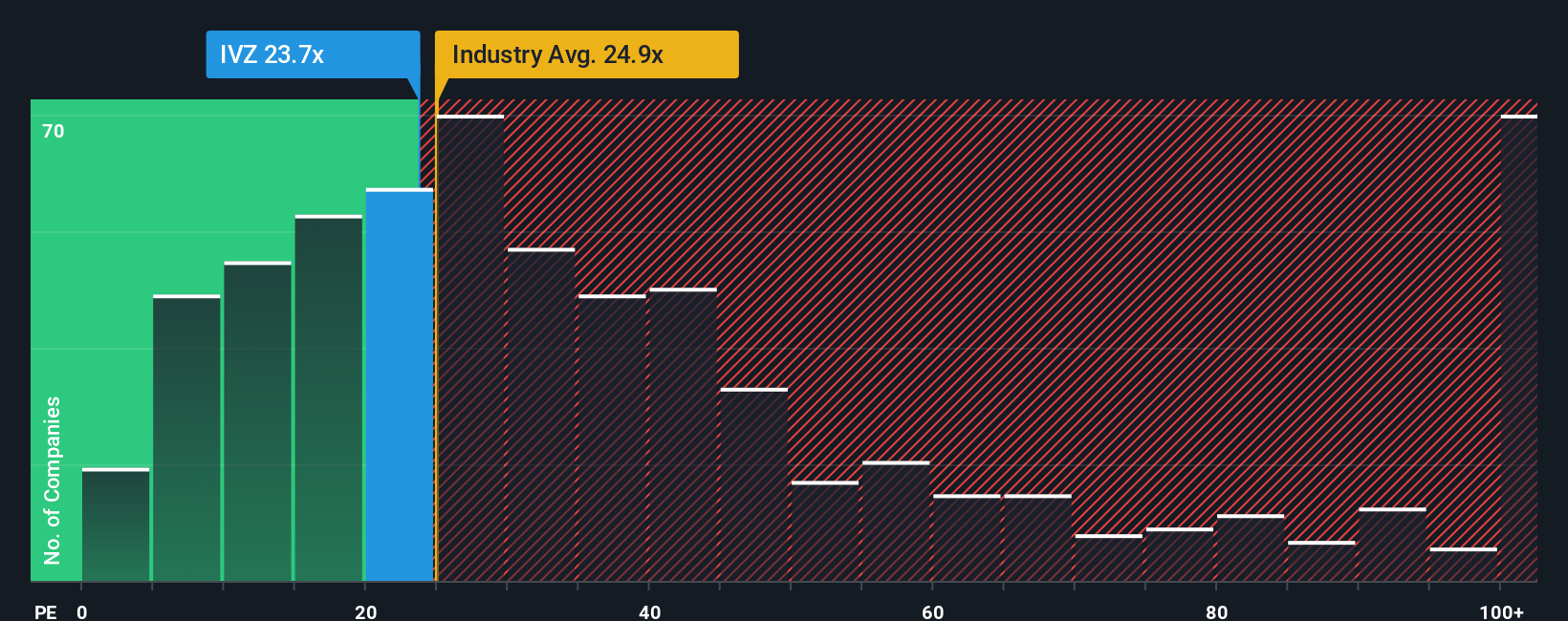

While analysts estimate fair value using future earnings and margin expansion, the current price-to-earnings ratio of 15.4x stands out. This is not only below the US market average of 18.2x, but also well under the industry’s average of 23.6x and even below the calculated fair ratio of 19x. This suggests the market sees added risk, or potentially a bargain if sentiment improves. Could this discount narrow as confidence climbs, or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Invesco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Invesco Narrative

If you’d rather follow your own path or dig into the numbers personally, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Invesco research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your opportunities and give yourself an edge by searching beyond a single stock. Let Simply Wall Street’s screener point you toward bold, high-impact investment themes that are shaping tomorrow's markets.

- Start building a portfolio of untapped potential by checking out these 3598 penny stocks with strong financials with strong financials and real momentum behind them.

- Maximize your growth prospects when you target innovation through these 26 AI penny stocks focused on artificial intelligence breakthroughs across multiple industries.

- Secure your income stream and potentially improve returns over low-yield accounts by reviewing these 16 dividend stocks with yields > 3% offering yields over 3% from stable, reliable companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives