- United States

- /

- Capital Markets

- /

- NYSE:ICE

Should ICE’s (ICE) Launch of IRM 2 Transform Portfolio Risk Management for Energy Market Participants?

Reviewed by Sasha Jovanovic

- Intercontinental Exchange announced on November 17, 2025 that it has launched IRM 2, its enhanced Value-at-Risk-based portfolio margining methodology, for energy clearing, now covering over 1,000 energy futures and options contracts.

- This marks a significant expansion of ICE’s comprehensive risk management tools for energy markets, offering greater transparency and resilience for participants managing complex, multi-asset portfolios.

- We'll explore how the rollout of IRM 2, with its advanced portfolio risk capabilities, could influence ICE's longer-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Intercontinental Exchange Investment Narrative Recap

Being a shareholder in Intercontinental Exchange means believing in the ongoing expansion of its global trading and risk management platforms, as well as its ability to drive growth through technology and recurring data revenue. The launch of IRM 2 for energy clearing strengthens ICE’s reputation for robust risk controls, yet it does not materially shift the primary short-term catalyst (continued transaction and data revenue growth) nor does it reduce the biggest risk: ICE’s exposure to cyclical downturns in energy and regulatory uncertainty.

Among recent announcements, ICE’s August 2025 expansion of climate data coverage is especially relevant alongside IRM 2, as both reflect the company’s commitment to providing participants with tools for navigating increasingly complex environmental markets. These offerings align with catalysts such as higher demand for transparency and advanced analytics, reinforcing the company’s push into areas with recurring, higher-margin opportunities.

Yet, in contrast, investors should be aware that even these advanced risk models cannot fully insulate ICE from...

Read the full narrative on Intercontinental Exchange (it's free!)

Intercontinental Exchange's outlook anticipates $11.4 billion in revenue and $4.1 billion in earnings by 2028. This is based on a 5.7% annual revenue growth rate and reflects a $1.1 billion increase in earnings from the current $3.0 billion.

Uncover how Intercontinental Exchange's forecasts yield a $192.38 fair value, a 26% upside to its current price.

Exploring Other Perspectives

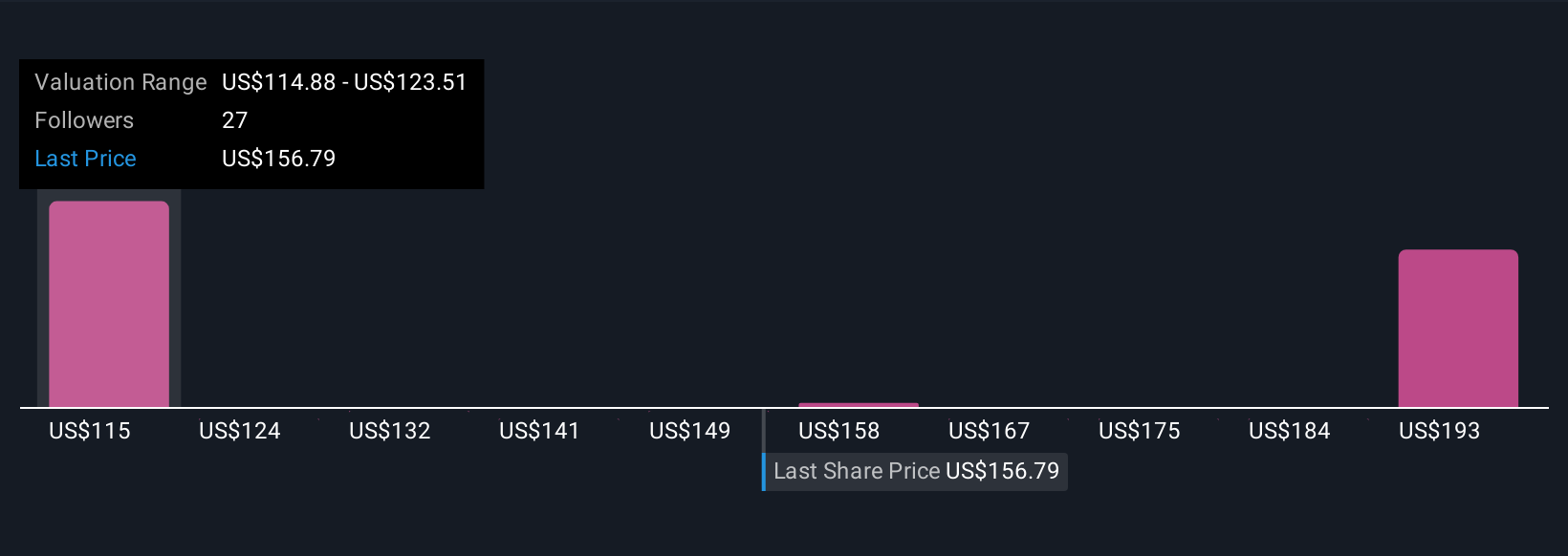

Fair value opinions from seven Simply Wall St Community members span from US$104.75 to as high as US$192.38 per share. With such a wide spread, keep in mind that the company’s growth in data services and risk technology remains tied to broader volume trends across energy and regulatory shifts, both of which can weigh on future results.

Explore 7 other fair value estimates on Intercontinental Exchange - why the stock might be worth as much as 26% more than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intercontinental Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercontinental Exchange's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives