- United States

- /

- Capital Markets

- /

- NYSE:ICE

Is Intercontinental Exchange Still Worth the Premium After Recent 10% Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Intercontinental Exchange stock is truly living up to its potential or if there's hidden value you might be missing? Let's take a closer look and see what the numbers reveal beneath the surface.

- Intercontinental Exchange's share price has seen some swings recently, dropping 7.2% over the past week and 10.0% over the past month. The one-year return stands at -4.3%, and the stock remains up 57.5% over three years.

- These moves have been set against a backdrop of shifting sentiment around exchange operators. Discussions are heating up about regulatory changes and ongoing innovation in digital asset trading. Headlines continue to spotlight how sector-wide developments could impact Intercontinental Exchange's long-term growth and risk profile.

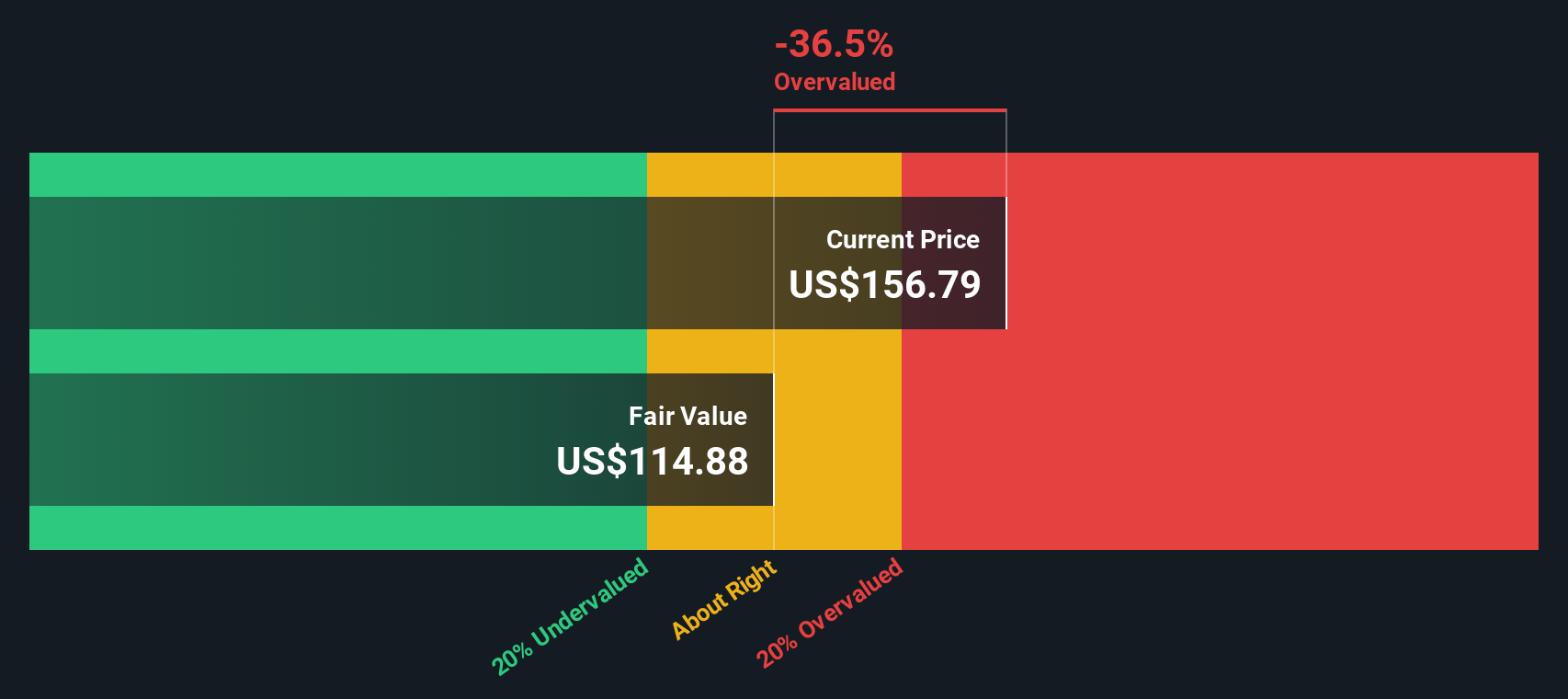

- According to our checklist, Intercontinental Exchange currently scores 2 out of 6 for undervaluation. While that tells part of the story, there is a more insightful approach to valuation waiting in the wings later in this article.

Intercontinental Exchange scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intercontinental Exchange Excess Returns Analysis

The Excess Returns model estimates a company's value by focusing on how much profit it generates above its cost of equity. This approach highlights whether Intercontinental Exchange is producing returns that exceed what investors require for taking on extra risk. The quality and consistency of these profits can be more telling than simple earnings or sales multiples.

For Intercontinental Exchange, the core figures in this model are:

- Book Value: $50.25 per share

- Stable EPS: $8.03 per share (Source: Weighted future Return on Equity estimates from 5 analysts.)

- Cost of Equity: $4.32 per share

- Excess Return: $3.71 per share

- Average Return on Equity: 16.02%

- Stable Book Value: $50.14 per share (Source: Weighted future Book Value estimates from 4 analysts.)

Based on this method, the estimated intrinsic value for Intercontinental Exchange is $117.05 per share. With the stock trading at a 25.0% premium to this value, the model indicates the share price is overvalued compared to the company's sustainable returns.

Result: OVERVALUED

Our Excess Returns analysis suggests Intercontinental Exchange may be overvalued by 25.0%. Discover 838 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intercontinental Exchange Price vs Earnings

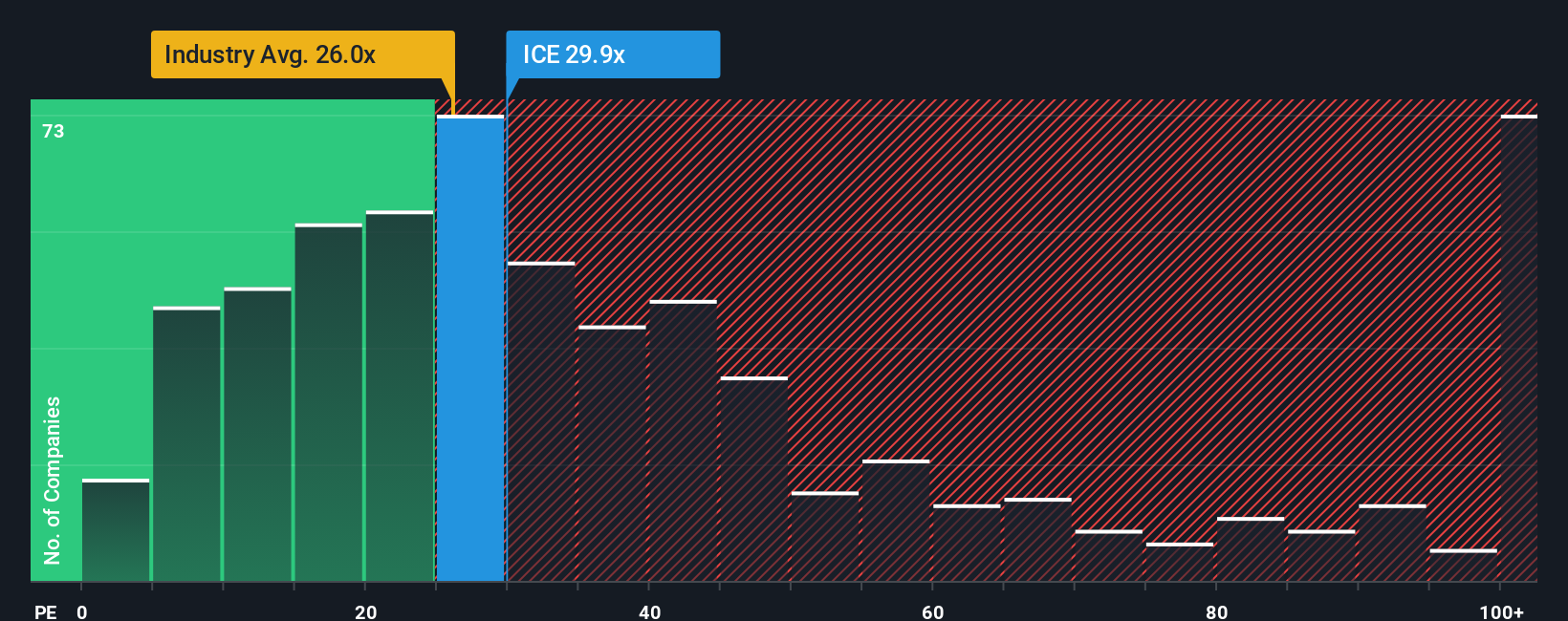

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Intercontinental Exchange because it connects a stock’s value with its actual earnings power. Investors look to the PE ratio to assess how much they are paying for each dollar of profit, making it especially relevant for established businesses in the capital markets sector.

Not all PE ratios are created equal. Companies with higher expected earnings growth or lower risks tend to command higher PE ratios, while those facing greater uncertainties might trade at lower multiples. So, it's important to consider comparative benchmarks when assessing value.

Currently, Intercontinental Exchange is trading at a PE ratio of 26.4x. This is above the industry average of 24.0x, but below the peer group’s average of 30.4x. These benchmarks provide a quick snapshot, but they do not account for company-specific traits like growth prospects or risk.

That is where Simply Wall St’s “Fair Ratio” comes in. This is a more tailored benchmark that considers not just growth, but also profit margins, company size, industry, and unique risk factors. For Intercontinental Exchange, the Fair Ratio stands at 16.3x, significantly below its current valuation.

When comparing the Fair Ratio to the actual PE multiple, it suggests that Intercontinental Exchange is currently overvalued on an earnings basis when taking all these extra factors into account.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intercontinental Exchange Narrative

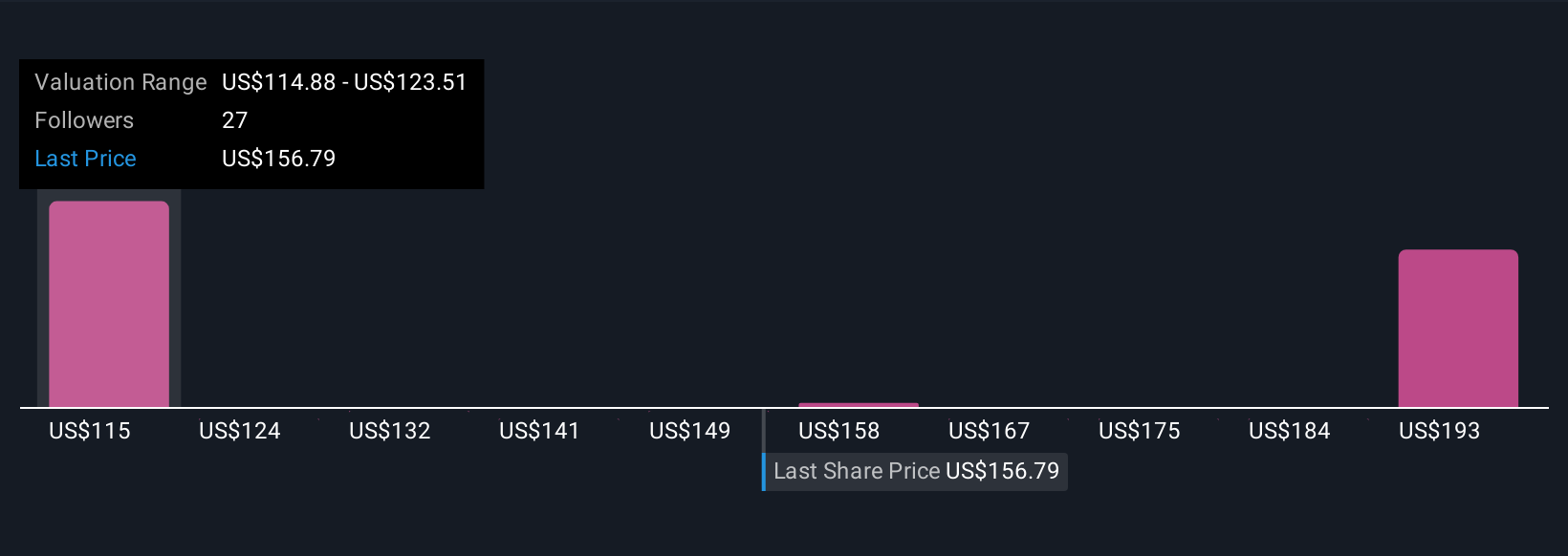

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple way for investors to connect their personal story or perspective about a company with their financial forecasts, including what they believe is a fair value and where they think future revenue, earnings, and margins are headed.

Instead of relying only on traditional ratios or analyst summaries, Narratives let you link a company's story, including its growth drivers, challenges, and future opportunities, directly to a dynamic financial forecast and a clear estimate of value. Narratives are easy to create and explore on Simply Wall St’s Community page, used by millions of investors worldwide.

This tool helps you decide when to buy or sell by comparing your own fair value against the current market price, empowering more confident decisions. As new information arrives, such as quarterly earnings, regulatory changes, or fresh news, your Narrative updates automatically, ensuring your assumptions always reflect the latest reality.

For example, within the Intercontinental Exchange Community, some investors are optimistic and see a fair value as high as $227.00 per share, while others are more cautious and assign a value as low as $170.00. This shows how Narratives turn the numbers into actionable stories tailored to every investor’s outlook.

Do you think there's more to the story for Intercontinental Exchange? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives