- United States

- /

- Capital Markets

- /

- NYSE:ICE

A Look at Intercontinental Exchange (ICE) Valuation Following Senior Notes Offering and New Risk Margining Rollout

Reviewed by Simply Wall St

Intercontinental Exchange (ICE) has been in the spotlight following its $1.25 billion public offering of senior notes. This move is aimed at optimizing capital structure as the company manages upcoming debt maturities.

See our latest analysis for Intercontinental Exchange.

ICE’s recent senior notes offering follows a busy period for the company, including the rollout of its next-generation risk margining model covering over 1,000 energy derivatives, and an upcoming investor appearance at a major tech conference. While the 1-year total shareholder return has slipped into negative territory at -3.15%, the 3- and 5-year total returns remain strong at 47.5% and 55.6%, respectively, reflecting solid long-term performance even as recent share price momentum has faded.

If ICE’s bold moves got you thinking more broadly, this could be the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With the share price trading around $151.66, well below analyst targets and supported by robust fundamentals, investors are left to consider if ICE is undervalued or if the market has already priced in its future growth prospects.

Most Popular Narrative: 21.2% Undervalued

Intercontinental Exchange’s most widely followed narrative sets a fair value much higher than the current share price, creating a sharp gap between investor expectations and market reality. The stage is set for a closer look at what’s fueling this bullish perspective.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification. These trends are likely to drive sustained double-digit growth in transaction revenues and operating leverage.

Want to know what’s powering this bold valuation? There is a set of powerful growth projections beneath the surface, such as surging revenues, rising profits, and high future multiples. Uncover the quantifiable forces behind this narrative and see what justifies such a lofty target.

Result: Fair Value of $192.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges and possible downturns in energy markets could reduce ICE's strong earnings outlook and put pressure on future growth projections.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: Big Numbers, Bigger Questions

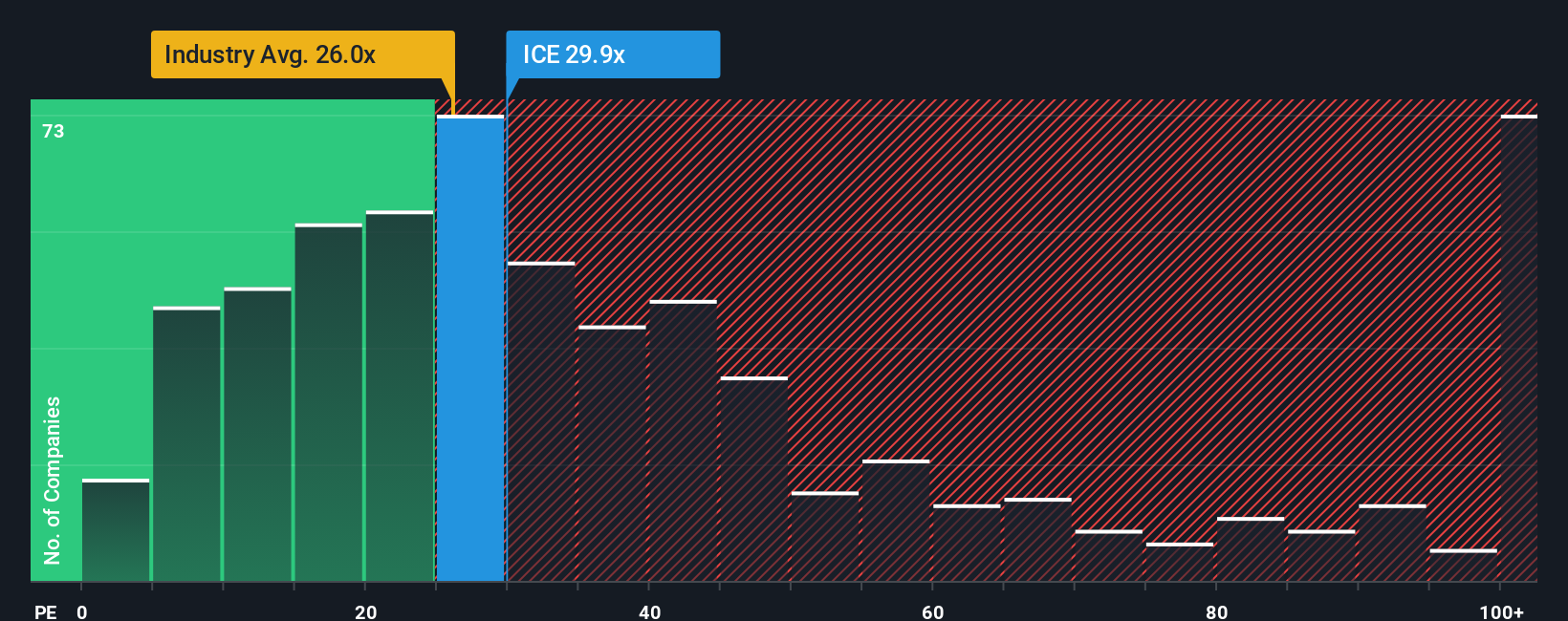

Looking through the lens of valuation ratios, ICE is trading at 27.3x earnings, which is more expensive than the US Capital Markets industry average of 23.9x and higher than the fair ratio of 16.4x. However, it is below the peer average of 32.6x. This gap means investors are paying a notable premium for ICE compared to its industry and what the market could eventually consider “fair value.” Will this premium hold in a shifting market, or is there room for prices to move down toward the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intercontinental Exchange Narrative

If these perspectives don’t fully align with your view, or if you’d rather dive into the details yourself, you can craft your own Intercontinental Exchange story in just minutes. Let the facts guide your conclusion. Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put yourself ahead of the curve by acting now. There are fresh opportunities waiting if you know where to look, and you won’t want to miss them.

- Tap into long-term income by reviewing high-yield picks through these 16 dividend stocks with yields > 3% and give your portfolio a reliable boost.

- Uncover the strongest market up-and-comers by checking out these 3608 penny stocks with strong financials and spot early-stage winners before the crowd catches on.

- Target growth at the intersection of health and tech by evaluating breakout opportunities with these 30 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives