- United States

- /

- Capital Markets

- /

- NYSE:HTGC

Is There Now an Opportunity in Hercules Capital After the Recent Share Price Rebound?

Reviewed by Bailey Pemberton

If you are eyeing Hercules Capital and wondering whether to buy, hold, or move on, you are not alone. This stock tends to pop up for investors who appreciate strong dividend yields as much as growth potential. However, the real question right now centers on value: is Hercules Capital a bargain or a risk you would rather avoid?

Let’s start with what the numbers tell us. Hercules Capital’s share price recently closed at $17.27. Over the past week, it jumped 3.4%, hinting that investors might be warming up to the stock. This rebound is particularly notable, given that the company lost 10.1% in the last 30 days and remains down 15.3% for the year. So, what’s driving the shift in sentiment? It is not one big headline; rather, there is a renewed focus in the market on financial sector opportunities, especially among business development companies like Hercules, as investors rotate toward income-producing assets given ongoing market volatility.

Looking at the bigger picture, Hercules has delivered strong returns for long-term shareholders: up 81.6% in the past three years and 158.7% over five years. The point to note is its valuation score. By this assessment, Hercules Capital is undervalued in 5 out of 6 key measures, giving it a value score of 5. That score sets the stage for a closer look at how the company stacks up across important valuation approaches. At the end of this analysis, there is a unique perspective that might reshape how you judge “value” entirely.

Why Hercules Capital is lagging behind its peers

Approach 1: Hercules Capital Excess Returns Analysis

The Excess Returns model helps investors understand whether a company is creating value by comparing its return on invested capital to its cost of equity. Specifically, it looks at the profits Hercules Capital is able to generate above what it costs to fund its equity, offering a direct view of value creation over time.

For Hercules Capital, the numbers show several strengths. The company has a book value of $11.99 per share and a stable earnings per share (EPS) of $1.69, based on the median return on equity over the last five years. The average return on equity stands at a robust 14.59%, while the stable book value holds at $11.56 per share. Factoring in a cost of equity of $1.13 per share, Hercules generates an annual excess return of $0.56 per share. This indicates that it consistently earns more than the cost of funding its business.

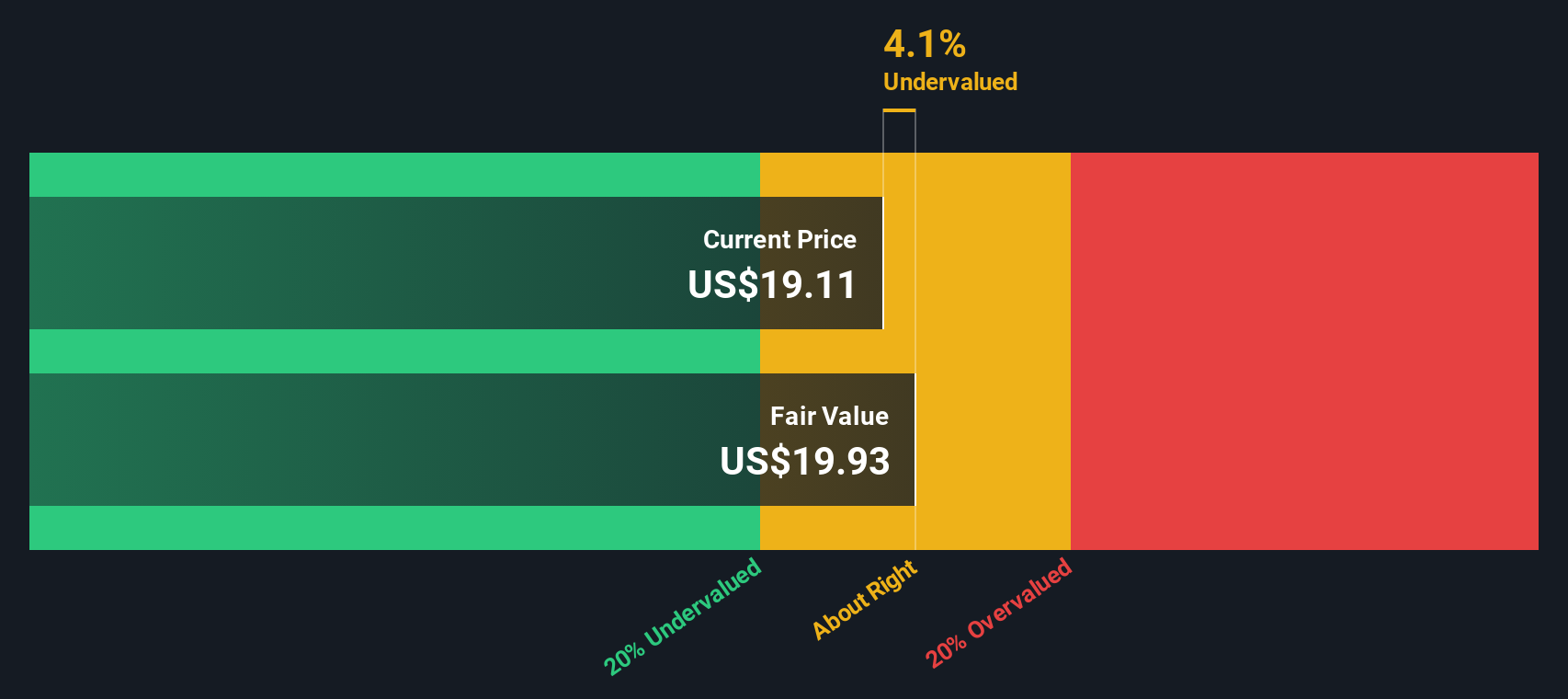

Using this approach, the model calculates that Hercules Capital shares have an intrinsic value that is roughly 13.4% above the current market price. This suggests that, by the Excess Returns method, the stock is undervalued at current levels and may appeal to investors seeking value and consistent capital efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hercules Capital is undervalued by 13.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hercules Capital Price vs Earnings

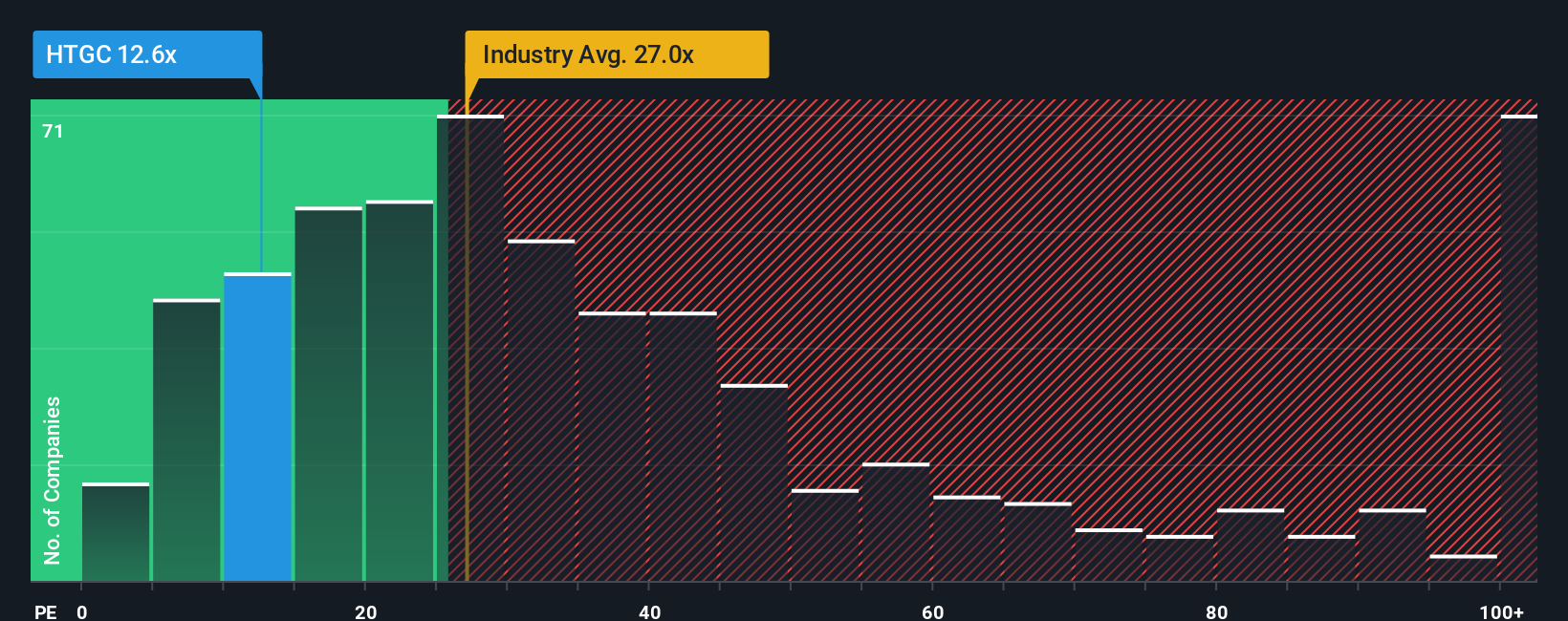

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies because it directly relates a company’s stock price to its earnings power. Since Hercules Capital has delivered consistent profits, using the PE multiple allows investors to assess how much they are paying for each dollar of current earnings.

A company’s "normal" or "fair" PE ratio depends on expected growth and perceived risks. Higher growth and lower risk typically command higher PE ratios, while slower growth or elevated risk levels justify lower ones. Right now, Hercules Capital trades at a PE of 12.1x. That compares favorably to the industry average of 25.4x and its publicly listed peer group’s average of 15.5x. This by itself suggests Hercules looks relatively inexpensive.

However, Simply Wall St's proprietary Fair Ratio, calculated by factoring in the company’s earnings growth, profit margins, industry context, market cap, and overall risk, suggests a fair PE of 15.3x for Hercules Capital. Unlike a straight peer or industry comparison, the Fair Ratio provides a more tailored benchmark, reflecting the real-world considerations specific to Hercules. When looking at the Fair Ratio versus the company’s current 12.1x multiple, Hercules Capital appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

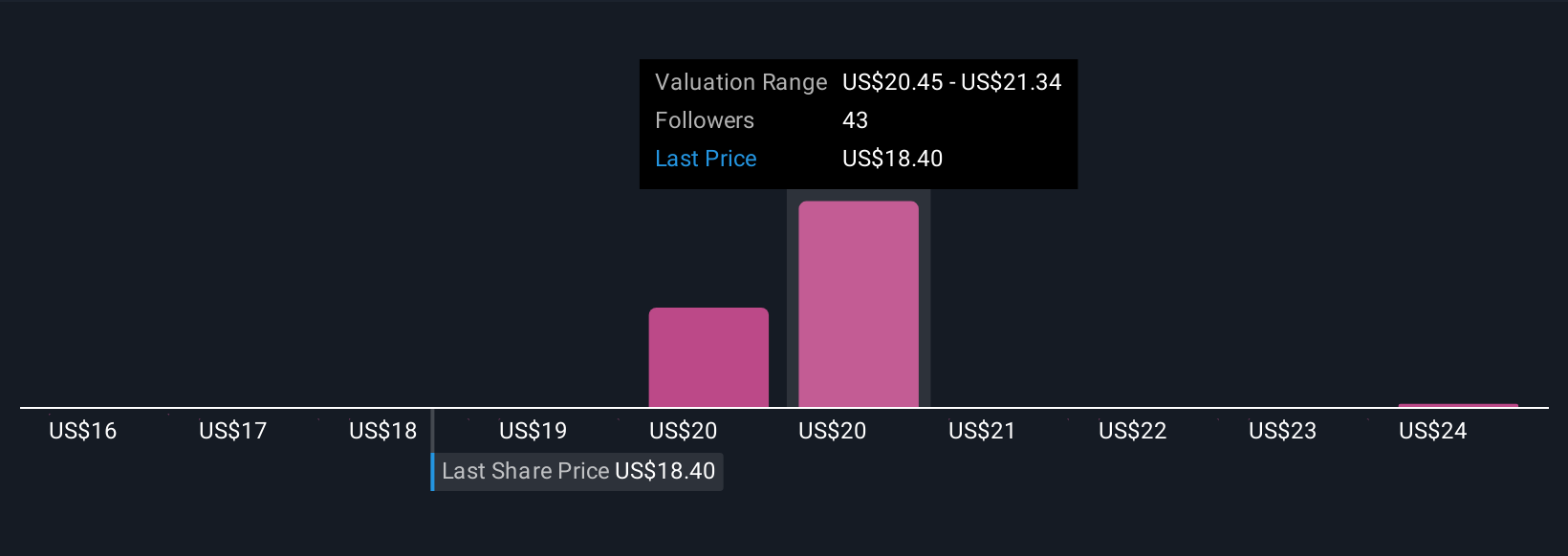

Upgrade Your Decision Making: Choose your Hercules Capital Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story or perspective you have about a company, brought to life with your own fair value estimate and forecasts for future revenue, earnings, and margins. With Narratives, you link the company’s story to a financial forecast and then to a fair value, moving beyond generic numbers to an investment approach with context and meaning. Narratives are designed to be easy and accessible, and you can explore or create them right on Simply Wall St’s Community page, utilized by millions of investors worldwide.

Comparing your Narrative's fair value to the current share price, and seeing how those estimates shift as new information arrives, helps you decide when to buy or sell with greater conviction. Narratives update dynamically with every earnings release or company development, so your view stays relevant as the market evolves.

For Hercules Capital, for example, some investors expect rapid growth in tech and life sciences lending and set a bullish fair value near $25.00. Others, weighing risks like competition and sector concentration, set a more cautious target of $19.00. Both views are clearly tracked through Narratives for you to compare and refine your own perspective.

Do you think there's more to the story for Hercules Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hercules Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTGC

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives