- United States

- /

- Capital Markets

- /

- NYSE:HTGC

Assessing Hercules Capital After Recent Price Drop and Venture Lending Volatility in 2025

Reviewed by Bailey Pemberton

If you have been watching Hercules Capital lately and wondering, “Should I buy, hold, or sell?” you are definitely not alone. Whether you are a seasoned investor or just starting to explore dividend stocks, Hercules is one name that has a knack for drawing attention, sometimes for its spectacular growth, other times for its rollercoaster swings. In the past five years, this stock has returned an eye-popping 156.2%, and over the last three years, it has shot up 104.6%. But the ride has not always gone up: Hercules is down -8.9% across the last month and has lost -13.1% year-to-date. Even the short-term looks a bit choppy, with a -4.8% move in just the past seven days.

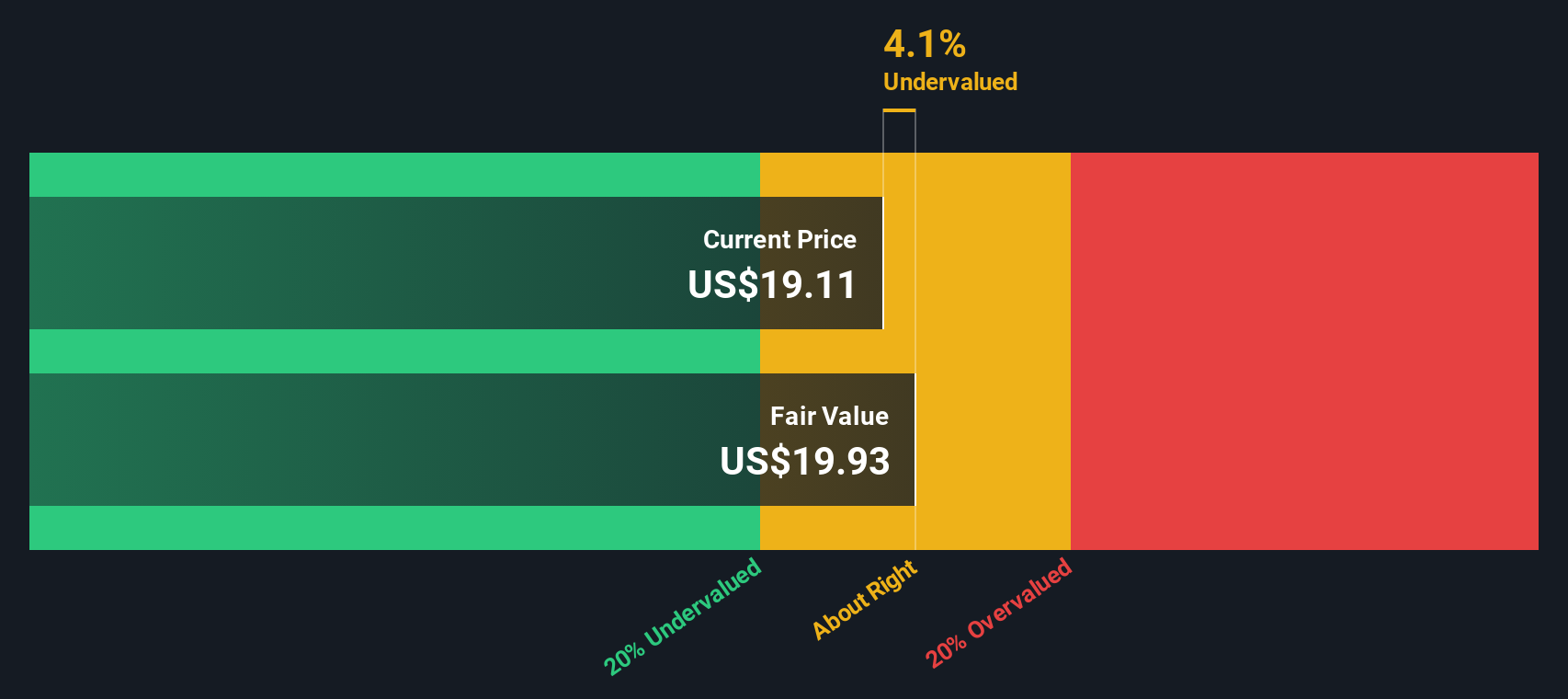

Recent price dips have prompted debates about whether investors are reassessing the risks around venture lending, or simply taking profits after a multi-year run. The broader market’s shifting appetite for risk, including concerns about rising rates and the startup funding landscape, seem to have played a big role in these swings. Still, these price changes open up questions about value. If you are thinking about future returns, the real story may be whether Hercules is undervalued or if there is still room to grow from here.

To get some clarity, I have run Hercules Capital through six key valuation checks, and it looks undervalued on four of them. That is a value score of 4 out of 6, a strong indication that something interesting is happening beneath the surface. Next, let’s break down what these valuation methods are actually telling us, and stick around for a better way to judge where Hercules Capital stands in the market.

Why Hercules Capital is lagging behind its peers

Approach 1: Hercules Capital Excess Returns Analysis

The Excess Returns valuation model is designed to assess how effectively a company generates returns above its cost of equity. By comparing the actual return on invested capital to the minimum required by shareholders, this approach provides insight into whether a company is creating or eroding value for investors.

For Hercules Capital, the data shows a solid foundation. The book value per share stands at $11.99, while stable earnings per share over recent years reach $1.69 according to median Return on Equity statistics. With a calculated cost of equity at $1.13 per share, Hercules generates an excess return of $0.55 for each share, supported by an average Return on Equity of 14.59%. The stable book value of $11.56 further confirms the company's consistent equity performance.

According to the Excess Returns model, Hercules Capital is currently trading at a 10.3% discount to its estimated intrinsic value. This suggests the shares are undervalued compared to their true worth. Investors may note that Hercules is creating value above its cost of capital based on recent metrics.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hercules Capital is undervalued by 10.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hercules Capital Price vs Earnings

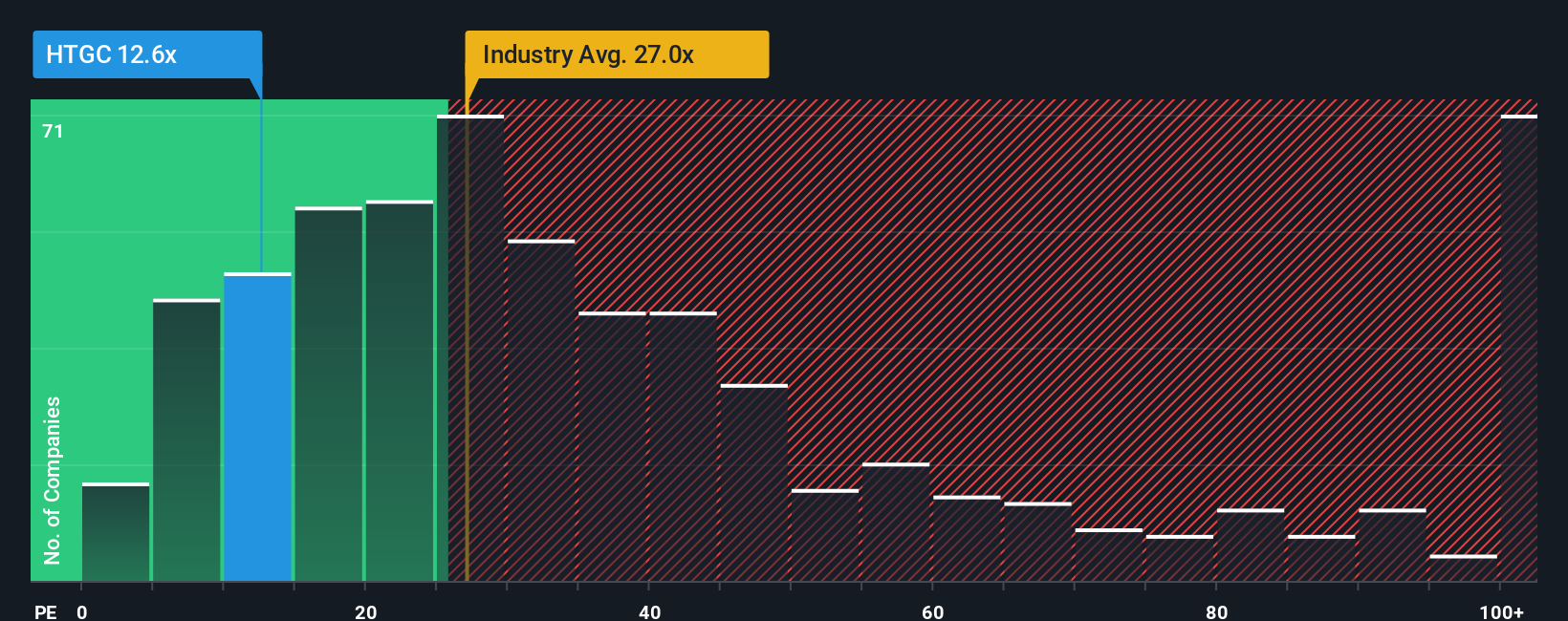

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for evaluating profitable companies like Hercules Capital, as it tells investors how much they are paying for each dollar of earnings. For reliable dividend payers and established profit generators, the PE ratio offers a clear picture of how the market values current and future profitability.

It is important to remember that growth expectations and perceived risks play a huge role in what investors see as a “normal” or “fair” PE ratio. If a company is expected to grow faster or has more stable earnings, investors are usually willing to pay a higher multiple. Conversely, companies facing uncertainty or slower growth tend to be valued at lower PEs.

Currently, Hercules Capital trades at 12.4x earnings, which is noticeably lower than both the industry average for the Capital Markets sector at 25.7x and its closest peers, averaging 15.4x. While this may suggest a discount, Simply Wall St’s proprietary Fair Ratio for Hercules Capital is 15.3x. This Fair Ratio stands out because it does not just compare companies, but also factors in specifics like Hercules’s earnings growth outlook, profit margins, size, and risk profile, offering a more tailored yardstick for value.

Comparing the Fair Ratio of 15.3x to the current PE of 12.4x reveals that the stock is trading below what would be expected for its fundamentals and risk, pointing to undervaluation in the market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hercules Capital Narrative

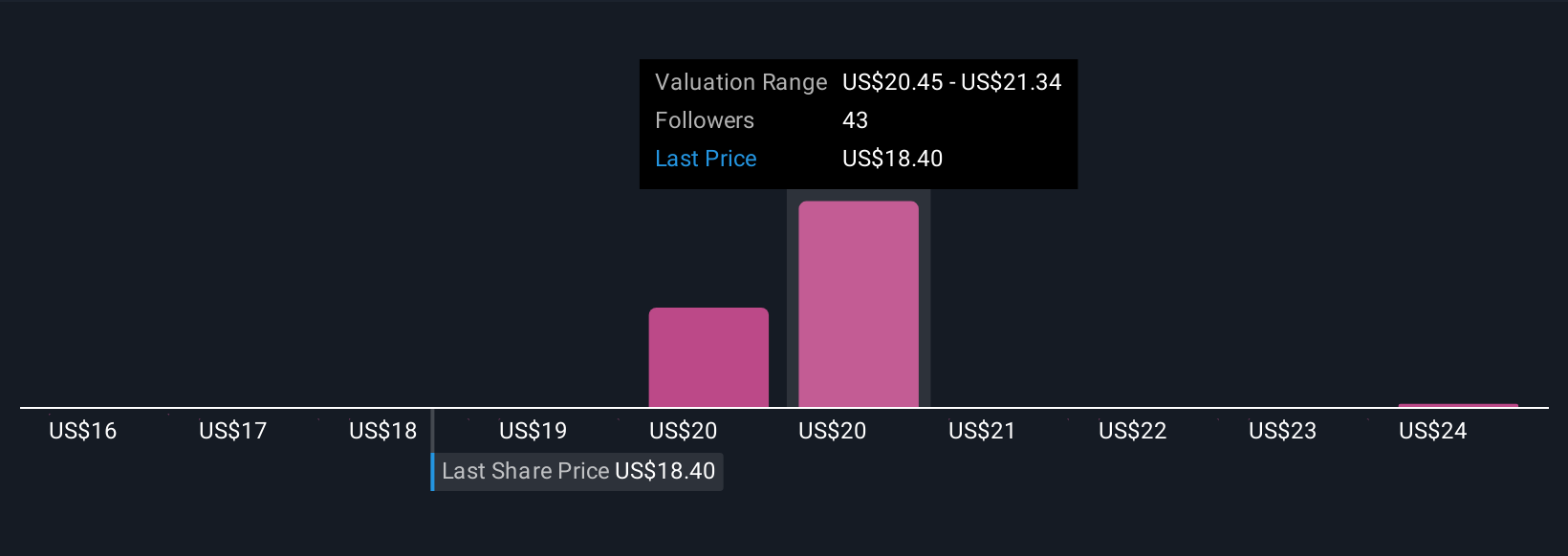

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is essentially your own story or perspective on a company like Hercules Capital, based on your assumptions around its future revenue, earnings, margins, and what you believe is a fair value. Instead of only focusing on financial ratios, Narratives help you connect the dots between how you see Hercules’s business evolving, what those numbers look like in the future, and what the shares should be worth today.

Narratives are available on Simply Wall St’s Community page and offer an easy way, used by millions of investors, to test your convictions against market reality. When you create a Narrative, you combine your view of the company’s prospects with a financial forecast; the platform then works out a fair value based on your estimates and automatically compares it to today’s share price to suggest whether Hercules is a buy or a sell at this moment. The real power is that Narratives update dynamically as new information, news, or earnings come in. This ensures your investment case is always relevant.

For example, right now some investors believe Hercules could be worth as high as $25.00 if technology and life sciences drive strong growth. Others set their fair value closer to $19.00 based on concerns over competition and rising expenses.

Do you think there's more to the story for Hercules Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hercules Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HTGC

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives