- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Why HA Sustainable Infrastructure Capital (HASI) Is Up 5.1% After Record Q3 Earnings and Dividend Announcement

Reviewed by Sasha Jovanovic

- HA Sustainable Infrastructure Capital, Inc. reported third-quarter 2025 results, with revenue rising to US$103.06 million and a turnaround from a prior-year net loss to net income of US$83.26 million; the company also affirmed a quarterly cash dividend of US$0.42 per share to be paid in January 2026.

- Management highlighted a pipeline expansion above US$6 billion after closing US$649 million in new transactions and committing US$1.2 billion to a renewable energy project during the period.

- We'll explore how record earnings and a growing renewable energy pipeline contribute to HA Sustainable Infrastructure Capital's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

To get behind HA Sustainable Infrastructure Capital right now, you've got to believe the company can leverage its robust renewable energy pipeline and recent earnings swing to keep momentum moving forward, even as broader market profit growth expectations outpace its own. The third-quarter results marked a sharp jump in profitability, with the prior year’s net loss turning into strong net income. That said, this upbeat news could change what drives the stock in the near term, investors may shift focus from past concerns about weak cash flow coverage for the dividend and subpar debt coverage, to monitoring whether new pipeline commitments and record transactions actually flow through to sustainable earnings and cash generation. The risk of overextending on project commitments, especially given the size of recent deals, makes execution and future funding sources more relevant than ever for those assessing the stock post-earnings.

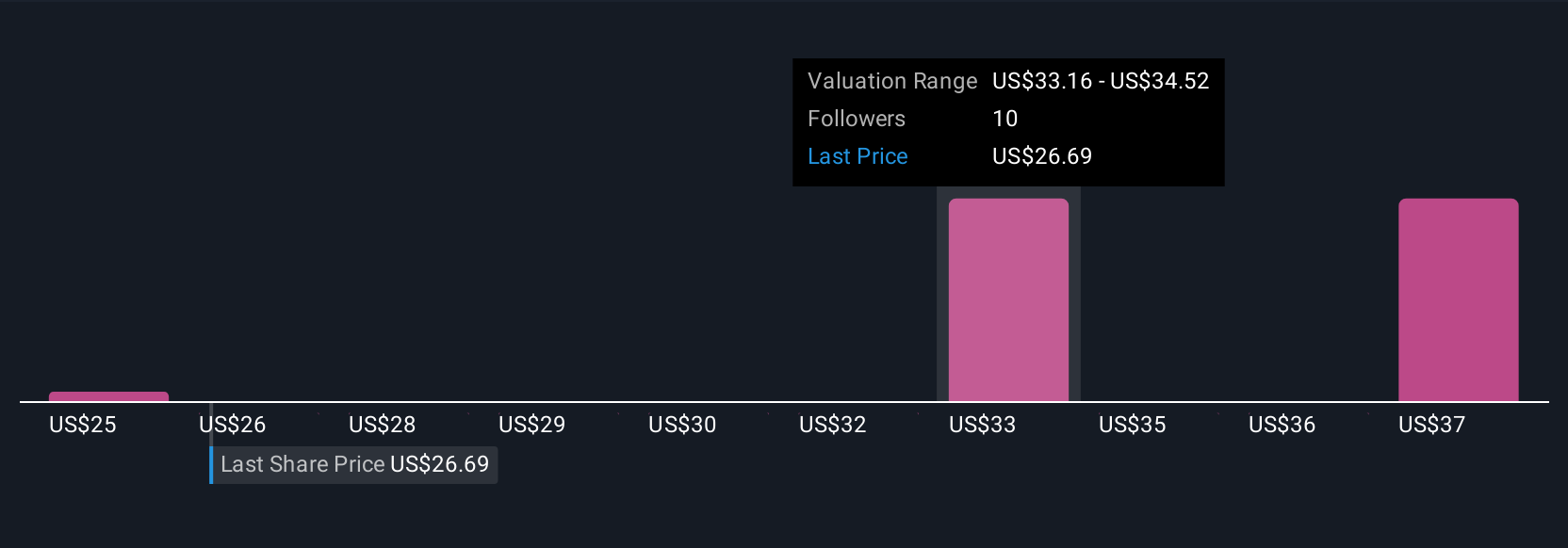

But with large-scale project commitments, execution risks stand out and shouldn't be ignored. HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 9%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth as much as 15% more than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives