- United States

- /

- Diversified Financial

- /

- NYSE:HASI

A Closer Look at Hannon Armstrong (HASI) Valuation Following Record Profits and SunZia Investment

Reviewed by Simply Wall St

HA Sustainable Infrastructure Capital (HASI) just posted its most profitable quarter ever, with revenue and net income both jumping sharply from last year. The company also highlighted a $1.2 billion investment in the SunZia clean energy project, strengthening its forward-looking growth guidance.

See our latest analysis for HA Sustainable Infrastructure Capital.

Momentum has picked up for HA Sustainable Infrastructure Capital in recent months, partly due to its best-ever quarterly earnings and a new SunZia project investment. The stock’s 17% share price gain over the past week and nearly 25% year-to-date share price return indicate that investors are warming to its growth outlook, even as the long-term total shareholder return over five years remains negative. Overall, short-term optimism is building based on improved fundamentals and forward guidance.

If HASI’s resurgence has you wondering what else might be gaining steam, now is a perfect time to expand your search and discover fast growing stocks with high insider ownership

With all this recent momentum and impressive guidance, should investors see HA Sustainable Infrastructure Capital’s current valuation as an opening to buy in, or is the market already reflecting all this future growth potential?

Price-to-Earnings of 14x: Is it justified?

HA Sustainable Infrastructure Capital is currently trading at a price-to-earnings (P/E) ratio of 14x, slightly above both its estimated fair P/E of 13.4x and the US Diversified Financial industry average of 13.5x. With its last close at $33.93, this means the market is assigning a premium compared to some valuation markers and sector peers.

The price-to-earnings ratio measures how much investors are paying for each dollar of the company’s earnings and is a key metric for financial companies, where steady profits are a central focus. A higher P/E can signal expectations for future growth or strong profitability.

While HASI’s P/E is above the typical industry benchmark, it remains well below the peer average of 40.5x. This could suggest the stock’s premium is not excessive. Against the fair P/E estimate, the current level leaves limited room for upside based on earnings. Strong recent results could potentially justify the modest premium if momentum continues. If market sentiment changes, the P/E could move toward the fair value level.

Explore the SWS fair ratio for HA Sustainable Infrastructure Capital

Result: Price-to-Earnings of 14x (ABOUT RIGHT)

However, persistent negative long-term returns and a limited premium over fair value remain key risks. These factors could quickly temper the recent optimism surrounding HASI.

Find out about the key risks to this HA Sustainable Infrastructure Capital narrative.

Another View: DCF Says HASI Is Undervalued

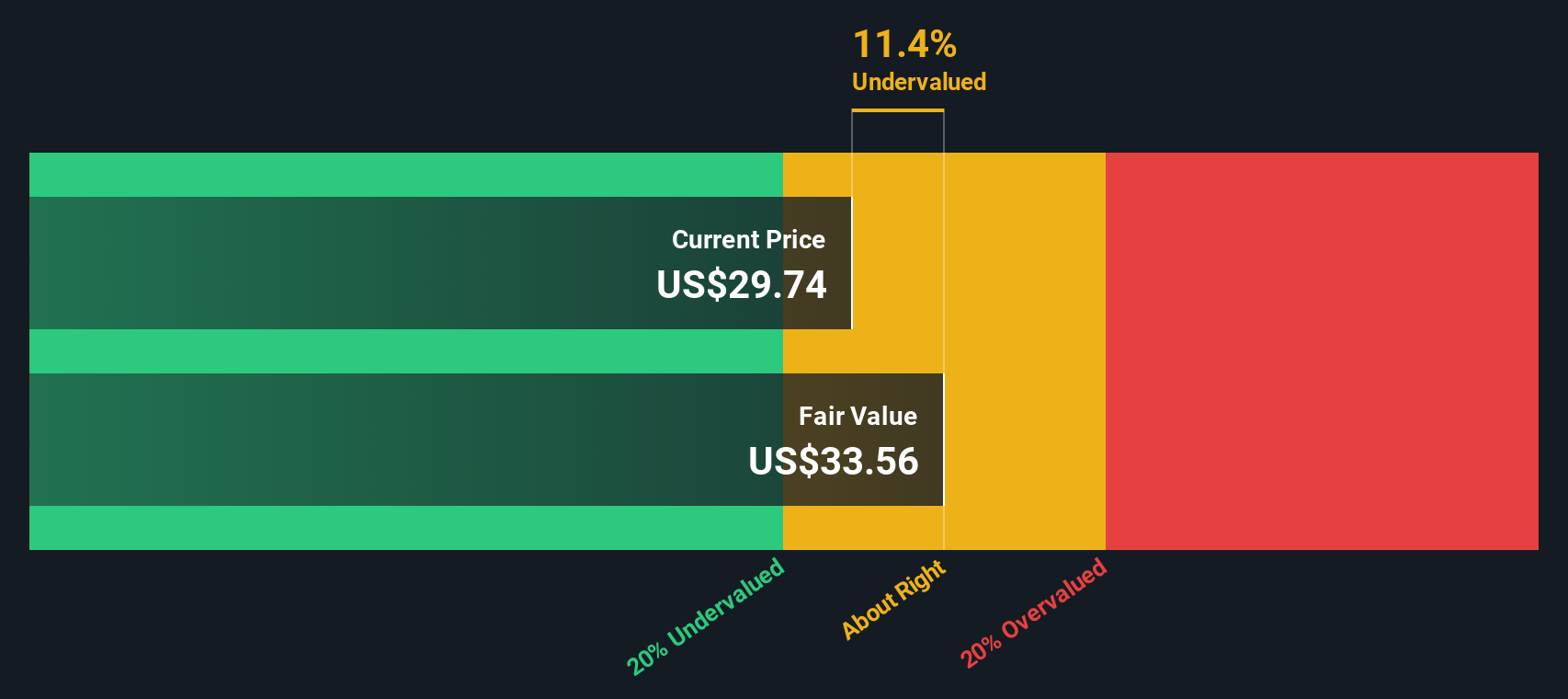

Our DCF model takes all expected future cash flows and discounts them back to the present, offering a bottom-up estimate of value. On this basis, HASI appears to be trading about 9% below its fair value at $33.93 per share compared to an estimate of $37.27. That points to an undervalued stock according to the SWS DCF model. However, does this difference suggest real opportunity or is it a reflection of different assumptions beneath the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HA Sustainable Infrastructure Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HA Sustainable Infrastructure Capital Narrative

If you have your own perspective or want to dig deeper into the numbers, you can easily build your own take on HASI in just a few minutes. Do it your way

A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great investment opportunities slip through your fingers. Power up your portfolio by using Simply Wall Street’s screener to spot what others might be missing.

- Jump on high-yield opportunities by checking out these 14 dividend stocks with yields > 3% with yields above 3% for steady income growth.

- Tap into the AI boom with these 27 AI penny stocks that are transforming industries and creating tomorrow’s market leaders right now.

- Get ahead of the curve with these 27 quantum computing stocks pushing boundaries in computing and setting the stage for groundbreaking innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives