- United States

- /

- Capital Markets

- /

- NYSE:GS

How Investors Are Reacting To Goldman Sachs Group (GS) Share Buyback and Multi-Year Note Offerings

Reviewed by Sasha Jovanovic

- In recent weeks, The Goldman Sachs Group, Inc. announced a series of fixed-income offerings, including both fixed and variable rate senior notes with maturities ranging from 2026 to 2045, alongside completing a share buyback tranche involving the repurchase of over 8.09 million shares for nearly US$5 billion.

- This wave of capital initiatives and financing activity reflects strong confidence in the firm's liquidity position and ongoing investor interest in its debt and equity securities.

- We'll explore how Goldman Sachs' active capital raising, highlighted by multiple note issuances, informs and potentially enhances its current investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Goldman Sachs Group Investment Narrative Recap

To be a Goldman Sachs shareholder, an investor must be confident in the firm's ability to generate earnings through market cycles, driven by growth in advisory, asset management, and capital-light businesses. The recent surge in fixed-income issuances and completion of a large-scale US$5 billion share buyback sends a signal of strong liquidity and management’s ongoing ability to return capital, though these moves are unlikely to materially change the most immediate catalysts, such as a resurgence in M&A, or the chief risks related to regulatory uncertainty and global market volatility.

Among the latest announcements, the recent share buyback, repurchasing more than 8 million shares, stands out for its relevance. While not altering the near-term catalysts of M&A momentum and expanding asset management inflows, this sizeable buyback highlights Goldman's focus on shareholder returns, even as uncertainties linger around policy changes and regulatory impacts on required capital levels.

However, what may surprise many investors is how quickly heightened regulatory uncertainty could alter Goldman's capital return plans such as dividends and buybacks...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's outlook anticipates $61.4 billion in revenue and $17.0 billion in earnings by 2028. This scenario assumes annual revenue growth of 3.9% and an increase in earnings of $2.3 billion from the current earnings of $14.7 billion.

Uncover how Goldman Sachs Group's forecasts yield a $801.58 fair value, in line with its current price.

Exploring Other Perspectives

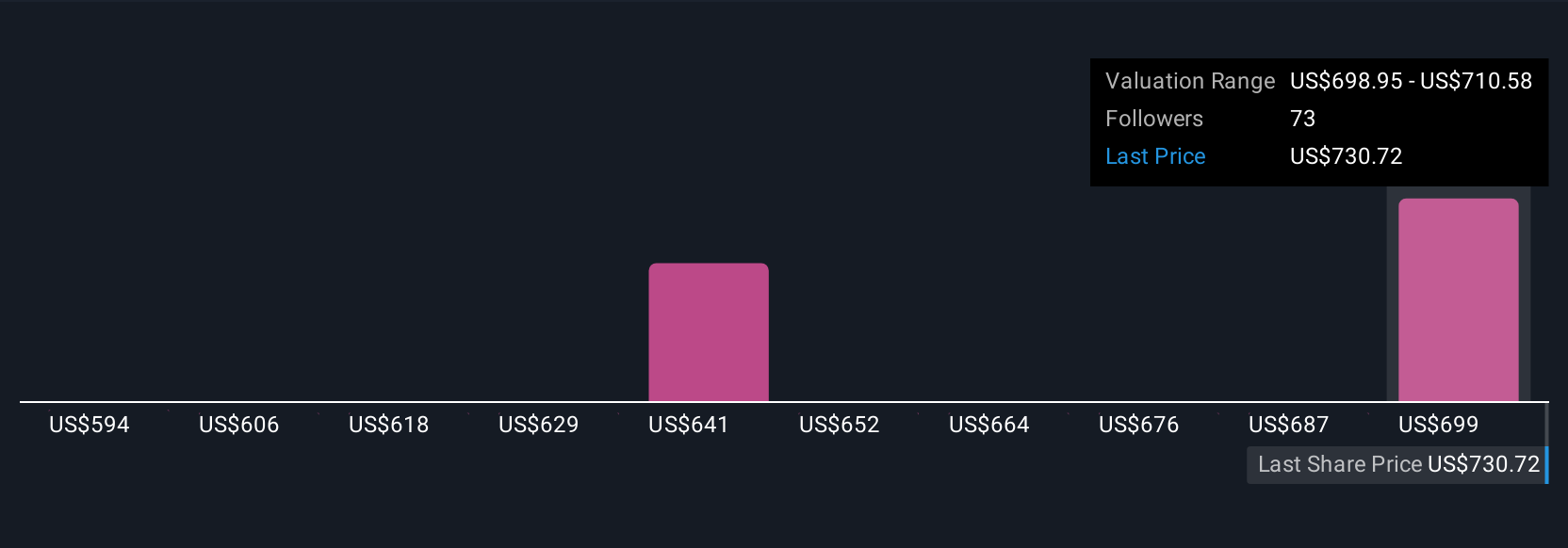

Fair value estimates from nine members of the Simply Wall St Community range from US$498.93 to US$815 per share, reflecting a wide spread of investor expectations. With regulatory and policy headwinds remaining a risk, you may want to explore how different views could signal diverging confidence in Goldman Sachs’ future performance.

Explore 9 other fair value estimates on Goldman Sachs Group - why the stock might be worth as much as $815.00!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives