- United States

- /

- Diversified Financial

- /

- NYSE:GPN

Will the Uber Eats Partnership Redefine Global Payments' (GPN) Role in Restaurant Technology?

Reviewed by Sasha Jovanovic

- Global Payments recently announced it has teamed up with Uber Eats to integrate the food delivery platform into its Genius point-of-sale (POS) system for restaurants across the U.S. and Canada, making Uber Eats its preferred delivery partner and streamlining onboarding and order management.

- This partnership, including additional advancements like a modular countertop POS and innovative camera vision system, highlights Global Payments’ push to simplify operations and accelerate digital transformation within the restaurant industry.

- We'll explore how the Uber Eats collaboration and new restaurant technology offerings could impact Global Payments' investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Global Payments Investment Narrative Recap

To own shares of Global Payments, investors must believe that the company can successfully expand its integrated payments ecosystem and maintain its relevance as merchants and consumers shift to digital-first commerce. The new Uber Eats collaboration supports Global Payments’ push for scale and software-driven growth but does not fundamentally shift the most immediate catalyst, broadening Genius POS adoption, nor does it directly reduce ongoing risks tied to execution following major acquisitions and divestitures.

Among recent company announcements, the launch of the modular countertop POS device stands out as most relevant, as it directly complements the Uber Eats integration by enhancing operational flexibility and speed for restaurant clients. Both moves support the broader strategy of making Genius the go-to platform for omnichannel transactions, feeding into Global Payments’ core catalyst of driving deeper penetration and recurring software revenues.

By contrast, investors should be aware of the persistent risk that integration challenges from large-scale acquisitions and divestitures could disrupt operations or...

Read the full narrative on Global Payments (it's free!)

Global Payments' outlook anticipates $12.3 billion in revenue and $1.7 billion in earnings by 2028. This projection assumes a 7.0% annual revenue growth rate and a $0.2 billion increase in earnings from the current level of $1.5 billion.

Uncover how Global Payments' forecasts yield a $104.36 fair value, a 38% upside to its current price.

Exploring Other Perspectives

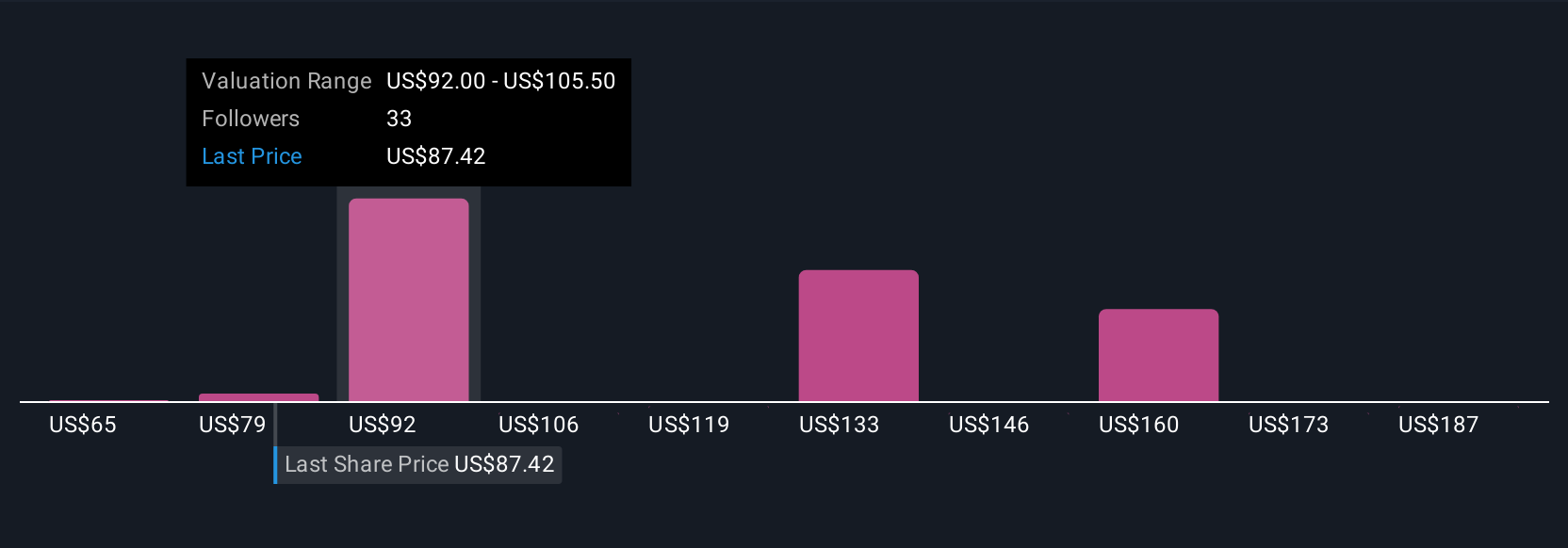

Simply Wall St Community members across 12 perspectives forecast fair values from US$65 to US$200 per share. Many cite Genius POS expansion as a key driver, but a wide range of opinions suggests investors should compare different scenarios for future growth and risks.

Explore 12 other fair value estimates on Global Payments - why the stock might be worth 14% less than the current price!

Build Your Own Global Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Global Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Payments' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPN

Global Payments

Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026