- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Can Shift4 (FOUR)’s Bengals Deal Reveal Its Next Move in the Sports Payments Arena?

Reviewed by Sasha Jovanovic

- The Cincinnati Bengals announced a partnership with Shift4 Payments to upgrade and streamline all payment transactions throughout Paycor Stadium, leveraging Shift4’s commerce platform for food and beverage concessions.

- This move highlights Shift4’s expanding presence in the sports and entertainment sector, aiming to deliver faster and more secure payment experiences for fans.

- We’ll explore how the Bengals partnership may influence Shift4’s broader investment narrative and potential sector expansion.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Shift4 Payments Investment Narrative Recap

To be a shareholder in Shift4 Payments, you need to believe in the company's ability to accelerate digital commerce adoption in high-traffic sectors like sports and entertainment, while executing on its broad international expansion strategy. The Bengals partnership strengthens its brand in stadiums but does not immediately change the biggest near-term catalyst, rapid integration of recent acquisitions, or lessen the largest risk, which is the complexity of integrating multiple businesses and sustaining momentum post-acquisition.

Of the recent announcements, the most relevant is Shift4’s third-quarter earnings report, as the Bengals partnership may contribute to growth but has yet to materially impact revenue and margins. The latest results showed rising sales, but net income declined year-over-year, reinforcing that profitability is sensitive to both new business integration and sector headwinds, which remain key catalysts for ongoing shareholder value.

On the other hand, investors should keep in mind the ongoing integration and execution risks as the company...

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments' narrative projects $7.0 billion in revenue and $613.9 million in earnings by 2028. This requires 24.8% yearly revenue growth and a $406.2 million earnings increase from $207.7 million currently.

Uncover how Shift4 Payments' forecasts yield a $96.67 fair value, a 38% upside to its current price.

Exploring Other Perspectives

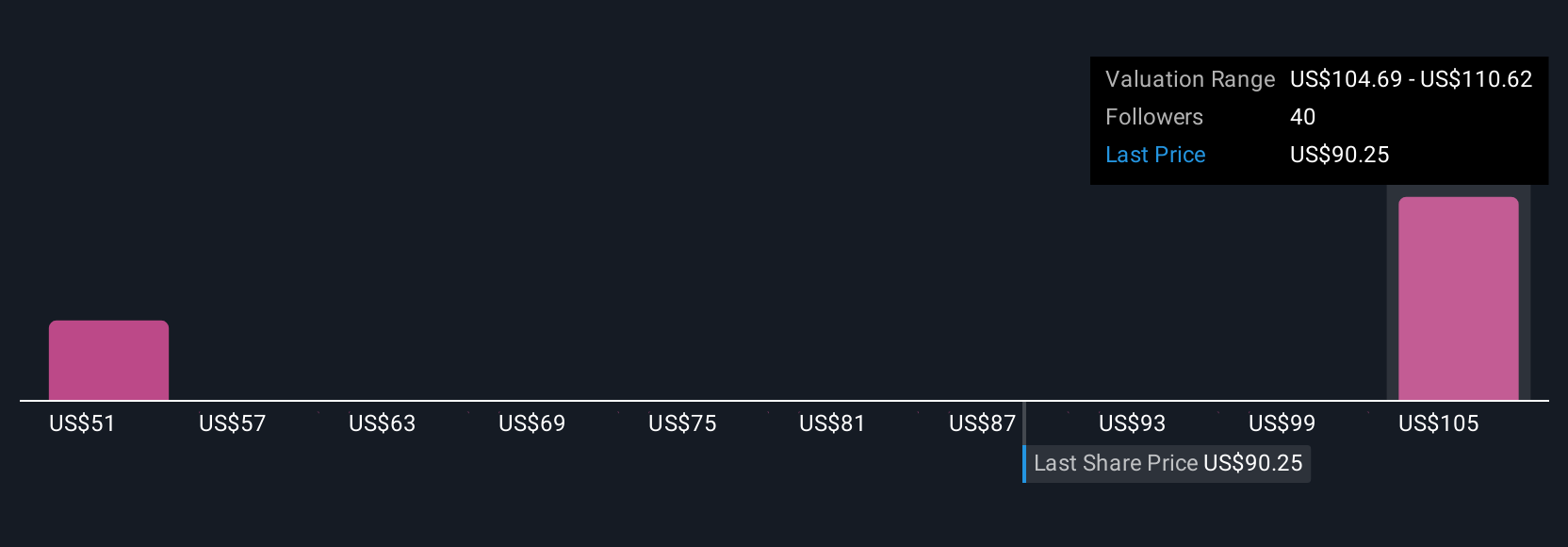

Five members of the Simply Wall St Community see fair value for Shift4 Payments ranging from US$48.94 to US$105.99 per share. As opinions vary, the challenge of successfully uniting recent acquisitions could influence future results and is important for you to consider as you weigh different viewpoints.

Explore 5 other fair value estimates on Shift4 Payments - why the stock might be worth 30% less than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives