- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Assessing Shift4 Payments (FOUR) Valuation After a Steep Year-to-Date Share Price Decline

Reviewed by Simply Wall St

Shift4 Payments (FOUR) has quietly slipped about 7% over the past week and roughly 26% in the past 3 months, prompting investors to recheck whether the recent pullback matches the company’s fundamentals.

See our latest analysis for Shift4 Payments.

Zooming out, that recent slide sits on top of a much steeper year to date share price return of about negative 41 percent. However, the three year total shareholder return is still positive, suggesting long term holders are ahead even as shorter term momentum fades and risk perceptions reset.

If you are rethinking your exposure to payments and fintech, it could be a good moment to explore other high growth tech names through high growth tech and AI stocks.

With earnings still growing solidly and Wall Street targets implying nearly 50 percent upside, is Shift4 now trading at an unjustified discount, or simply reflecting a more cautious view of its future growth potential?

Most Popular Narrative: 33% Undervalued

With Shift4 Payments last closing at $64.40 versus a narrative fair value near $95.86, the spread implies the market is heavily discounting its long term plan.

The accelerating global shift to cashless and digital payments continues to expand transaction volumes in key Shift4 verticals (hospitality, sports and entertainment, luxury retail) and underpins long term double digit revenue growth projections.

Ongoing consolidation in the payments industry increases Shift4's acquisition driven growth potential and competitive positioning, underpinning further operating leverage and possible net margin expansion through scale and integration synergies.

Curious how this story justifies a much higher price tag, even with richer margins and faster growth baked in, and still leans on a premium future earnings multiple, all discounted by a punchy required return, to bridge today’s gap with that fair value.

Result: Fair Value of $95.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still face integration risk from recent acquisitions and rising leverage, both of which could pressure margins and derail Shift4’s long term growth story.

Find out about the key risks to this Shift4 Payments narrative.

Another Angle on Valuation

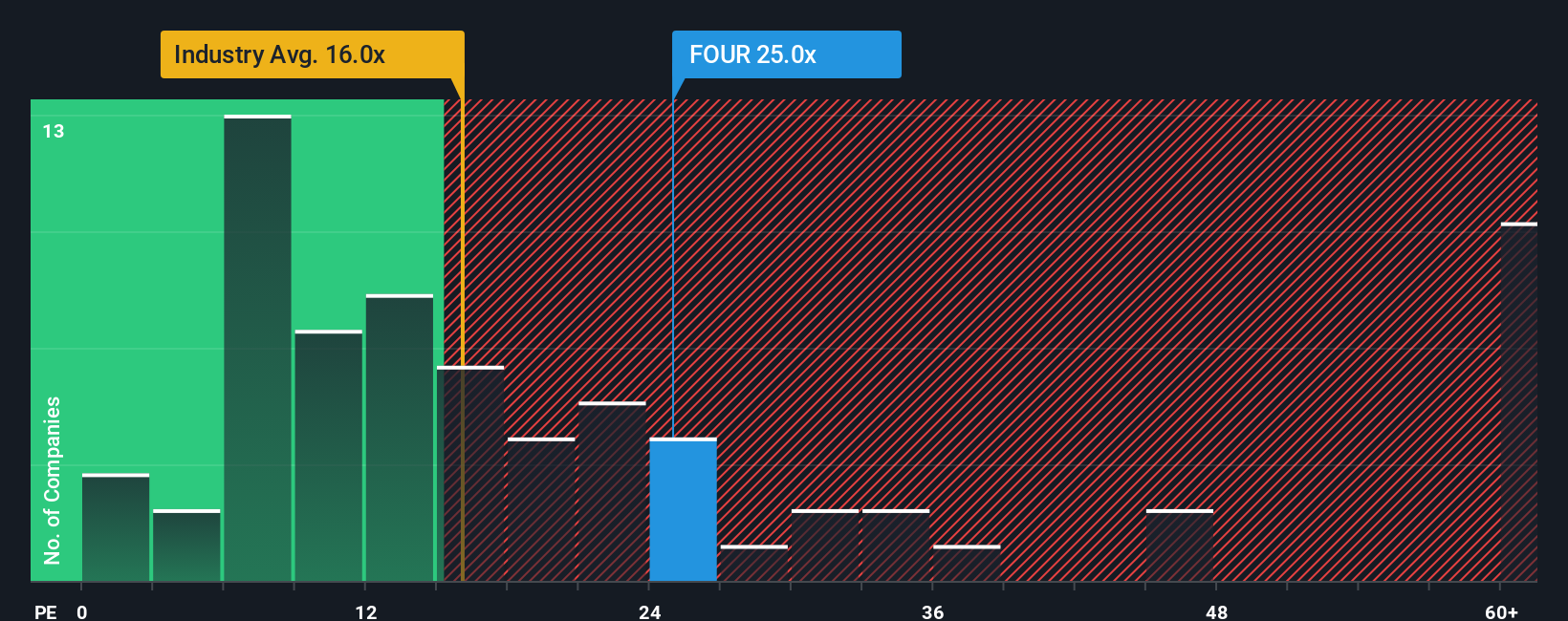

While the narrative fair value paints Shift4 as meaningfully undervalued, our earnings based lens looks more cautious. At around 26.4 times earnings versus 13.6 times for the US Diversified Financial industry and a 25.7 times fair ratio, the stock screens as slightly expensive. This raises the question of how much execution risk investors are really being paid for.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shift4 Payments Narrative

If you see things differently or want to dig into the numbers yourself, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to explore new opportunities by using the Simply Wall Street Screener to uncover compelling stocks that match your strategy and risk appetite.

- Look for potential multi baggers early by screening for these 3629 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Explore the next growth wave with these 24 AI penny stocks at the intersection of artificial intelligence and scalable business models.

- Seek to strengthen your portfolio’s cash flow with these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion