- United States

- /

- Diversified Financial

- /

- NYSE:FOA

Finance of America Companies (FOA): One-Off Gain Drives Profit, Raising Questions on Earnings Quality

Reviewed by Simply Wall St

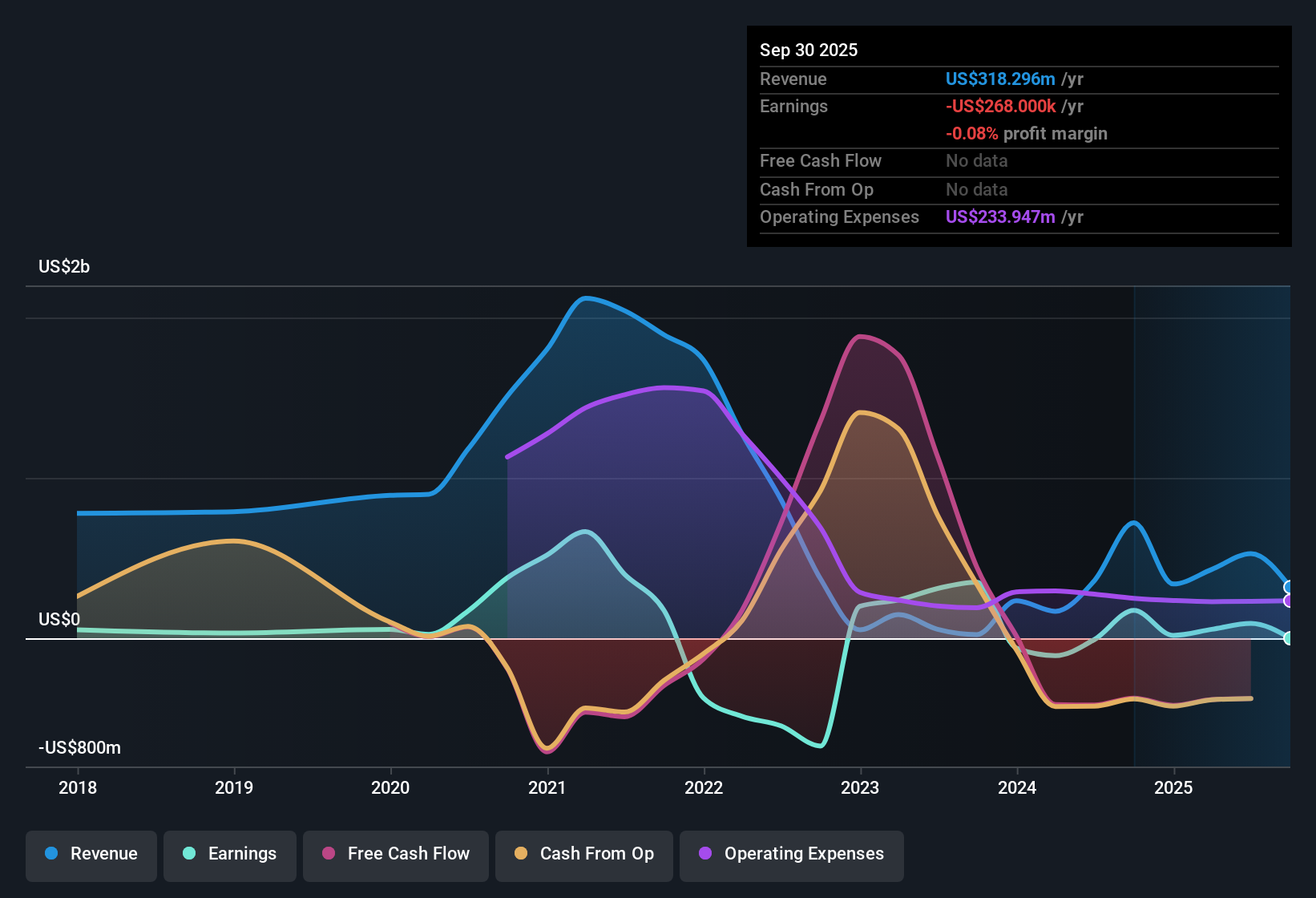

Finance of America Companies (FOA) recently returned to profitability, with net profit margins improving over the past year. However, earnings for the last twelve months were notably impacted by a one-off gain of $54.9 million that does not represent regular operational income. Over the past five years, FOA’s earnings have declined by an average of 15.6% per year. Revenue is forecast to grow at 8.6% annually, which trails the broader US market’s projected 10.5% pace.

See our full analysis for Finance of America Companies.Now, let’s see how these fresh results measure up against the most prominent market narratives and perspectives driving investor debate.

See what the community is saying about Finance of America Companies

One-Off Gains Inflate Recent Profits

- While Finance of America Companies reported a return to profitability, a one-off gain of $54.9 million that does not reflect regular business operations made up a significant portion of the latest annual profit.

- This complicates the analysts' consensus view that operational improvements will drive sustainable net margins, as consistent profit growth would depend on actual recurring income rather than unpredictable, non-recurring events.

- Analysts anticipate that profit margins will shrink from the current 5.2% to 3.0% in three years, which suggests they recognize the limited impact of such one-off items on the long-term outlook.

- The consensus narrative notes that even with revenue projected to grow by 10.6% annually, actual earnings may decline in the future as one-time gains drop out of the numbers.

- Curious how this tension between operational performance and headline profit shapes the bigger picture? 📊 Read the full Finance of America Companies Consensus Narrative.

Growth Trends Lag Behind the Industry

- Revenue is forecast to grow by 8.6% per year for FOA, underperforming the broader US market’s 10.5% pace and falling short of consensus expectations for top-line expansion.

- According to the analysts' consensus, integration of platforms and moves into the senior home equity market are expected to help, but rising competition and low current market penetration present real hurdles.

- Bears highlight that even with anticipated loan origination growth of 26% to 42% by 2025, penetration in the core market remains very limited, which could restrict FOA's ability to close the growth gap with its peers.

- Consensus also points out that the company’s reliance on demographic trends and market conditions, such as interest rate volatility, could stall the revenue momentum that management is targeting through these strategic initiatives.

Valuation Screens as Deep Value

- FOA trades at a price-to-earnings (P/E) ratio of 2x, notably below both its peer group (9.4x) and the US diversified financial industry average (15x), and well beneath the industry’s forward-looking P/E ratios.

- Analysts' consensus view sees this discount as a key reward for patient investors, but warns that the low valuation likely reflects market skepticism about the sustainability of recent profitability and whether long-term growth can outpace persistent sector headwinds.

- While the consensus analyst price target is 32.00, nearly 39% above the current share price of 23.01, reaching this level would require profits to stabilize and growth to reaccelerate. Neither of these is assured given the backdrop of shrinking forecasted profit margins.

- Consensus commentary highlights the tension between the apparent bargain valuation and doubts around execution on operational and revenue-driving initiatives in a challenging industry landscape.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Finance of America Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have your own take on these results? In just a few minutes, you can build your own perspective and add your voice. Do it your way

A great starting point for your Finance of America Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Finance of America Companies faces shrinking profit margins and inconsistent earnings, with forecasts projecting only modest growth and little assurance of sustained improvement.

If you want steadier performers, use stable growth stocks screener (2073 results) to discover companies consistently growing revenue and earnings. This allows you to filter for more reliable results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOA

Finance of America Companies

A financial service holding company, through its subsidiaries, provides home equity-based financing solutions for a modern retirement in the United States.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives