- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Fidelity National Information Services (FIS): Assessing Valuation as Revenue Grows but Long-Term Returns Stay Mixed

Reviewed by Simply Wall St

Fidelity National Information Services (FIS) stock has been under the spotlight recently as investors weigh its year-to-date slide of 20%. The company has posted positive annual revenue growth. However, longer-term returns remain mixed compared to peers.

See our latest analysis for Fidelity National Information Services.

Fidelity National Information Services has faced some pressure this year, with a 20% year-to-date share price decline reflecting investor concerns around the pace of transformation in its core business. Despite a recent one-day bounce of 2.71%, momentum remains subdued as total shareholder return over the past year sits at -24%. Over the longer term, the stock is still working to recover from a sharp five-year total shareholder return of -52%, even as annual revenue trends upward.

If Fidelity’s shifting momentum has you rethinking your strategy, this could be the perfect time to expand your outlook and discover fast growing stocks with high insider ownership

With FIS shares trading at a notable discount to analyst price targets and annual revenue on the rise, the key question is whether the current weakness signals a bargain or if the market has already factored in future growth prospects.

Most Popular Narrative: 21.0% Undervalued

Compared to its last close of $64.07, the most widely followed narrative sets Fidelity National Information Services' fair value much higher. The valuation builds its case on financial catalysts and big-picture business momentum.

Operational streamlining and international expansion are supporting lower costs, sustained revenue momentum, and an enhanced future earnings outlook. Execution of operational simplification (for example, Worldpay divestiture, focused acquisitions like Everlink and Global Payments Issuer), strong cost reduction programs, and improved working capital management are expected to lower operating expenses and drive EBITDA margin expansion, supporting higher future earnings.

Want to know what’s powering this optimistic valuation? The secret sauce behind the narrative is a combination of ambitious margin expansion targets and bold earnings acceleration. Intrigued by which financial drivers make the model so compelling? The most important numbers are hiding just beneath the surface. See what could send this stock surging.

Result: Fair Value of $81.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fintech competition and ongoing integration challenges could erode FIS’s revenue momentum and profitability. This could potentially derail the optimistic outlook highlighted above.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Multiples Suggest Caution

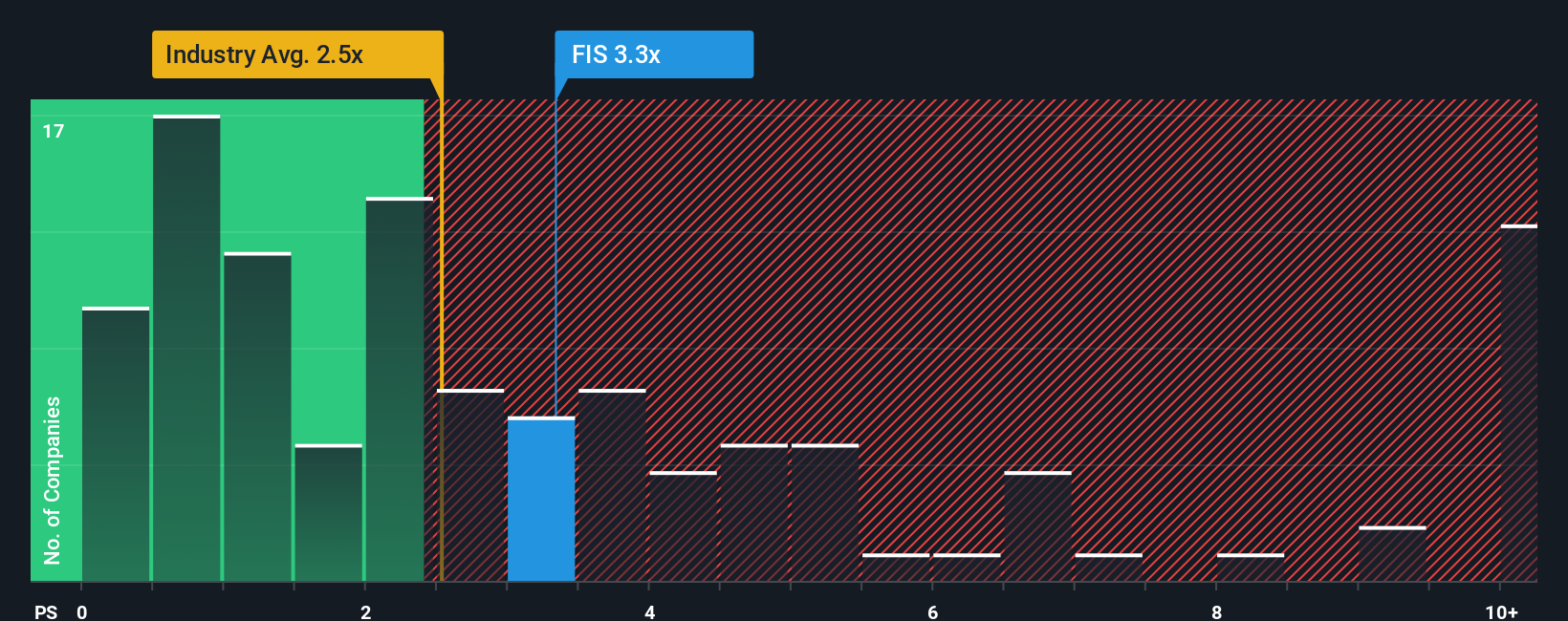

While the narrative shows FIS trading well below analyst fair value, a valuation based on its price-to-sales ratio presents a different picture. At 3.2 times sales, FIS is pricier than both the US diversified financial industry average (2.3x) and the peer group (2.4x). The fair ratio estimate for FIS stands at 2.9 times sales, which means today's market is assigning a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If you’d rather draw your own conclusions from the data or want to explore alternative storylines for Fidelity National Information Services, creating your own narrative takes just a couple of minutes. Do it your way

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. With just a click, you can instantly uncover stocks that match your strategy and spark new ideas for your portfolio.

- Capture growth early by searching through these 3603 penny stocks with strong financials with strong financials and breakout potential, before they attract the market’s attention.

- Lock in cash flow with these 17 dividend stocks with yields > 3% offering over 3% yields and reliable income you can count on.

- Position yourself at the frontier of innovation by seeking out these 30 healthcare AI stocks, which harnesses cutting-edge AI breakthroughs to transform the healthcare landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives