- United States

- /

- Diversified Financial

- /

- NYSE:FIS

Assessing Fidelity National Information Services (FIS) Valuation Following Upbeat Analyst Forecast Revisions and Revenue Growth Signals

Reviewed by Simply Wall St

Fidelity National Information Services (FIS) has caught investors’ attention after recent updates signaled stronger third-quarter earnings and renewed optimism around its Banking Solutions and Capital Market Solutions operations. Consensus forecasts for both earnings and revenue have edged higher, which reflects a more upbeat outlook.

See our latest analysis for Fidelity National Information Services.

After a tough year for Fidelity National Information Services, recent momentum in analyst sentiment and continued growth in its main segments have set the stage for renewed optimism. While the stock’s latest price closed at $62.2, share price returns remain under pressure with a 30-day share price return of -6.8% and a year-to-date decline of -22.3%. Over the longer term, total shareholder return for the past year has fallen 29.2%, reflecting ongoing challenges. The three-year total return sits modestly positive at 8.7%, while five-year returns remain deeply negative. Investors are watching closely for a turnaround as confidence builds around the company’s next results.

If you’re looking beyond FIS for stocks with fresh growth potential, now’s the perfect time to see what stands out among fast growing stocks with high insider ownership.

Given FIS’s discounted share price compared to analyst targets and recent signs of earnings momentum, could this be a value opportunity for patient investors, or is the market already factoring in the company’s renewed growth prospects?

Most Popular Narrative: 25.3% Undervalued

The consensus narrative calls for a fair value of $83.25, which is significantly above the last close of $62.20. Additionally, analysts and investors are recalibrating expectations quickly as future margin gains and recurring revenues come into focus.

"Operational streamlining and international expansion are supporting lower costs, sustained revenue momentum, and an enhanced future earnings outlook. Rapidly evolving fintech competition, integration risks, and shifts toward decentralized finance threaten FIS's revenue stability, profitability, and ability to maintain industry leadership."

What drives such an optimistic outlook? The narrative’s calculation relies on bold assumptions for future profits, faster revenue streams, and structurally higher margins. Wondering which forecasts power this premium? Unlock the story behind these eye-catching projections.

Result: Fair Value of $83.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competition from fintech disruptors and ongoing integration challenges could affect FIS’s growth prospects and pose risks to future margin improvement.

Find out about the key risks to this Fidelity National Information Services narrative.

Another View: Is the Market Right on FIS?

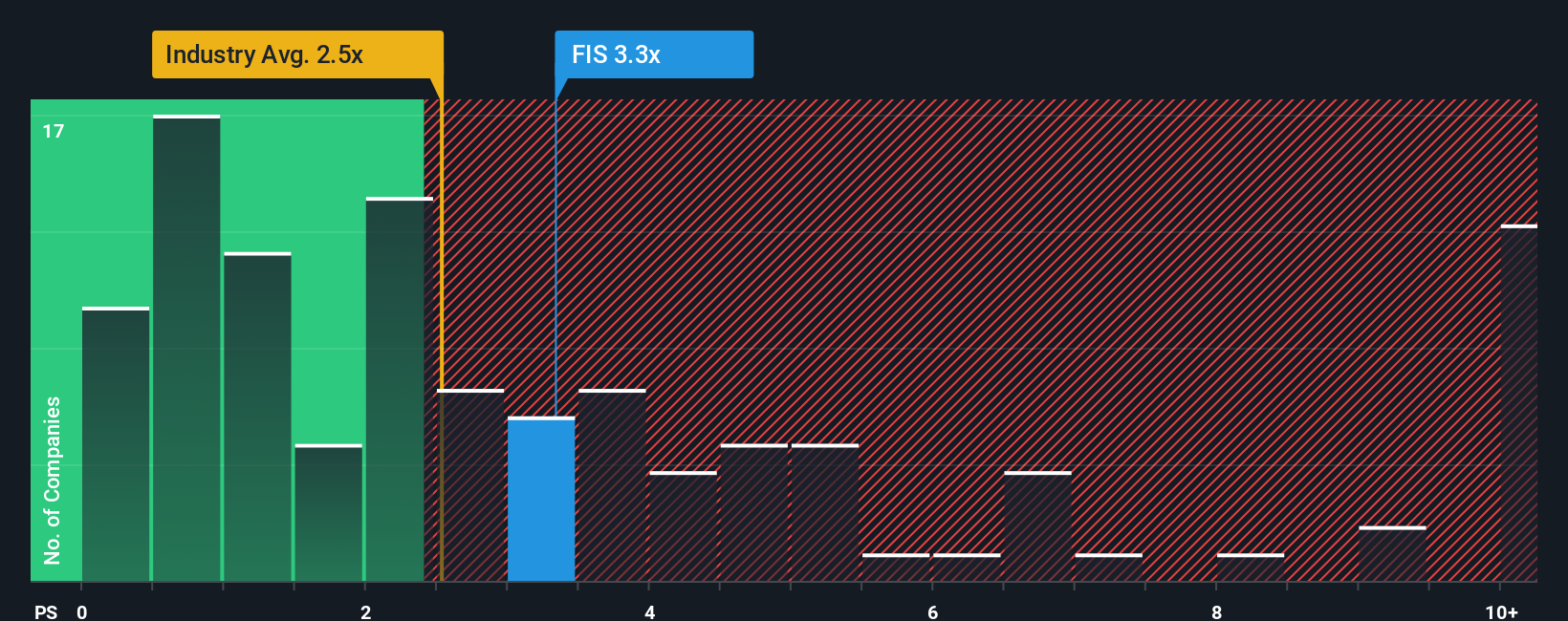

Looking beyond analyst forecasts, the market’s preferred pricing method tells a different story. FIS trades at a price-to-sales ratio of 3.1x, which is higher than both the US Diversified Financial industry average of 2.4x and its own peer average of 2.5x. Compared to its fair ratio of 2.9x, this premium valuation suggests that investors are paying more than what fundamental regression analysis would recommend. This could indicate the stock is riskier than it appears, or it may suggest current multiples point to untapped upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Information Services Narrative

If you see things differently or want to uncover your own insights, it takes just a few minutes to build your own perspective. Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Market-Winning Ideas?

Don’t miss your chance to pursue smarter investment moves. Easily pinpoint fresh opportunities and give yourself the edge by checking out these leading stock ideas on Simply Wall Street:

- Tap into the explosive growth of artificial intelligence and see which companies are making headlines with breakthroughs using these 26 AI penny stocks.

- Secure reliable cash flow by targeting top picks with robust yields over 3 percent when you access these 18 dividend stocks with yields > 3%.

- Stay ahead of the curve by following these 843 undervalued stocks based on cash flows that the market has not fully appreciated based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives