- United States

- /

- Diversified Financial

- /

- NYSE:FI

Not Many Are Piling Into Fiserv, Inc. (NYSE:FI) Stock Yet As It Plummets 47%

Fiserv, Inc. (NYSE:FI) shareholders that were waiting for something to happen have been dealt a blow with a 47% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

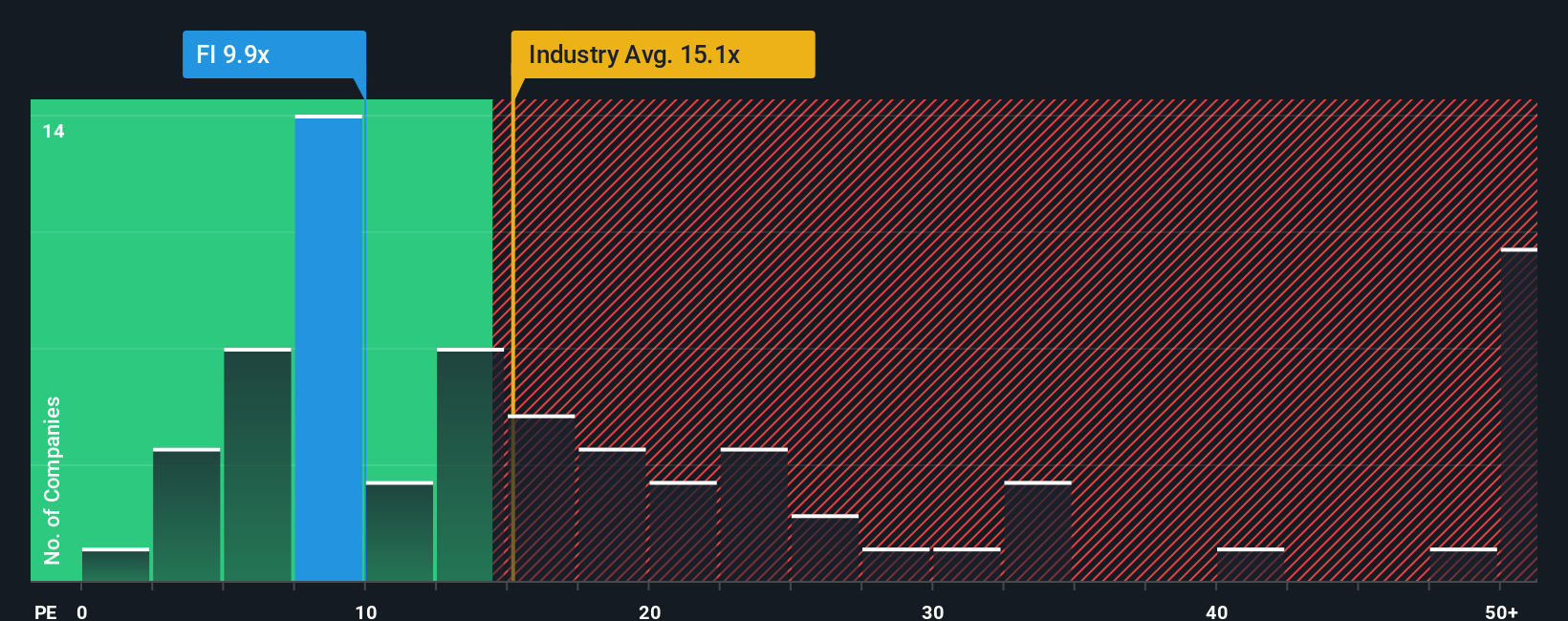

Following the heavy fall in price, Fiserv's price-to-earnings (or "P/E") ratio of 9.9x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Fiserv certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Fiserv

How Is Fiserv's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Fiserv's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 25%. The strong recent performance means it was also able to grow EPS by 109% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we find it odd that Fiserv is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The softening of Fiserv's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Fiserv currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Fiserv you should be aware of.

If you're unsure about the strength of Fiserv's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives