- United States

- /

- Capital Markets

- /

- NYSE:FDS

Is Now the Moment to Reevaluate FactSet After Its 44% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering whether FactSet Research Systems is a smart buy at current levels? You are not alone in asking if now is the time to take a closer look at its value.

- The stock has seen some notable movement lately, dropping 8.3% over the past week and down 44.5% year-to-date, suggesting shifting market sentiment that could spell opportunity or signal new risks.

- Recent news in the data and analytics sector, including growing competition and evolving client needs, has prompted investors to reassess FactSet's long-term strategy. Updates around large client partnerships and industry innovation have further fueled conversations about where the stock might be headed next.

- On the valuation front, FactSet Research Systems scores a 4 out of 6 based on our key value checks. This indicates attractive potential, but not the full picture. We will explore traditional valuation approaches, and also hint at a more holistic way to gauge true value, later in the article.

Approach 1: FactSet Research Systems Excess Returns Analysis

The Excess Returns valuation model measures how effectively a company deploys its capital to generate returns above its cost of equity. This approach emphasizes both profitability and efficient use of shareholders’ funds, focusing on long-term shareholder value beyond simple earnings multiples.

For FactSet Research Systems, the key figures are:

- Book Value: $58.08 per share

- Stable EPS: $19.72 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $5.89 per share

- Excess Return: $13.82 per share

- Average Return on Equity: 28.17%

- Stable Book Value: $70.00 per share (Source: Weighted future Book Value estimates from 5 analysts.)

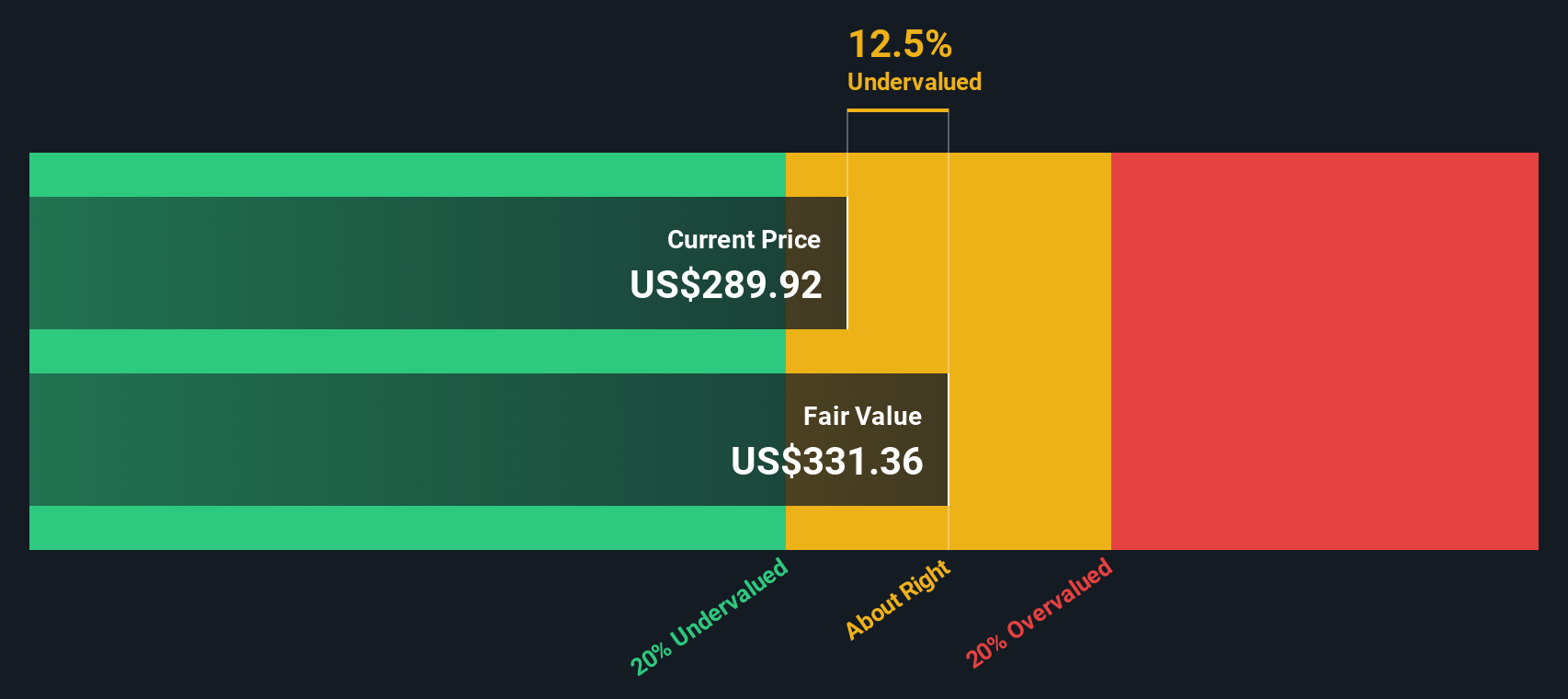

This strong return on equity, well above the cost of equity, signals that FactSet is adding meaningful value with the capital it invests. Using these inputs, the Excess Returns model estimates an intrinsic value of $328.84 per share. This figure is nearly 20% above current levels, suggesting the stock is undervalued by 19.5%.

Result: UNDERVALUED

Our Excess Returns analysis suggests FactSet Research Systems is undervalued by 19.5%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: FactSet Research Systems Price vs Earnings

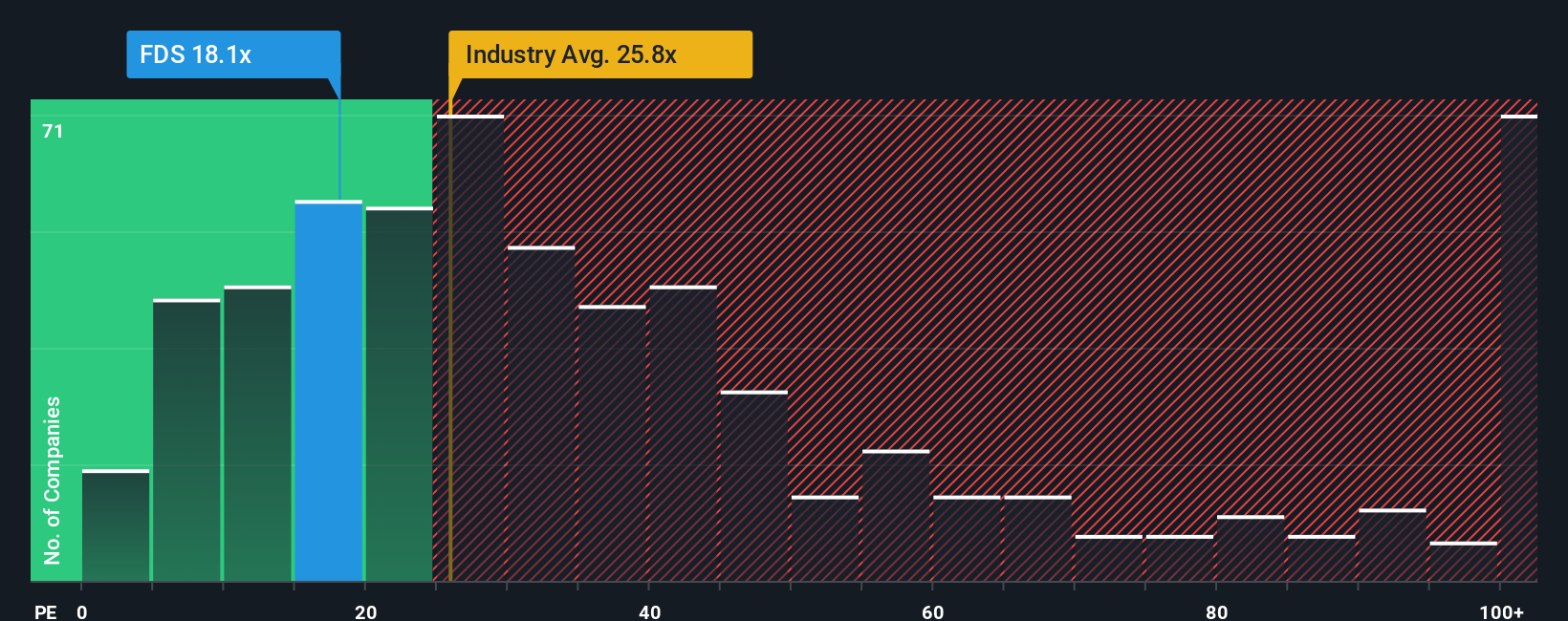

The Price-to-Earnings (PE) ratio is a widely recognized tool for valuing profitable companies like FactSet Research Systems. It provides a snapshot of how much investors are willing to pay for each dollar of earnings and is particularly helpful for established businesses with steady profits.

Generally, companies with higher growth expectations or lower perceived risks tend to justify higher PE ratios, while more mature or riskier businesses warrant lower values. This means the “right” PE ratio depends not only on the company’s current performance but also on how the market views its future prospects and risks.

At present, FactSet Research Systems trades at a PE of 16.60x, noticeably below the Capital Markets industry average of 24.25x and the peer average of 28.12x. Simply Wall St’s proprietary “Fair Ratio” for FactSet, calculated using a blend of factors such as earnings growth, profit margins, risk profile, industry, and market capitalization, is 13.56x. This Fair Ratio provides deeper insight by factoring in the company’s unique fundamentals and risk context, offering a more nuanced view compared to simply looking at industry or peer averages.

Comparing FactSet’s current PE of 16.60x with its Fair Ratio of 13.56x suggests the stock is trading slightly above what would be considered fair value based on its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FactSet Research Systems Narrative

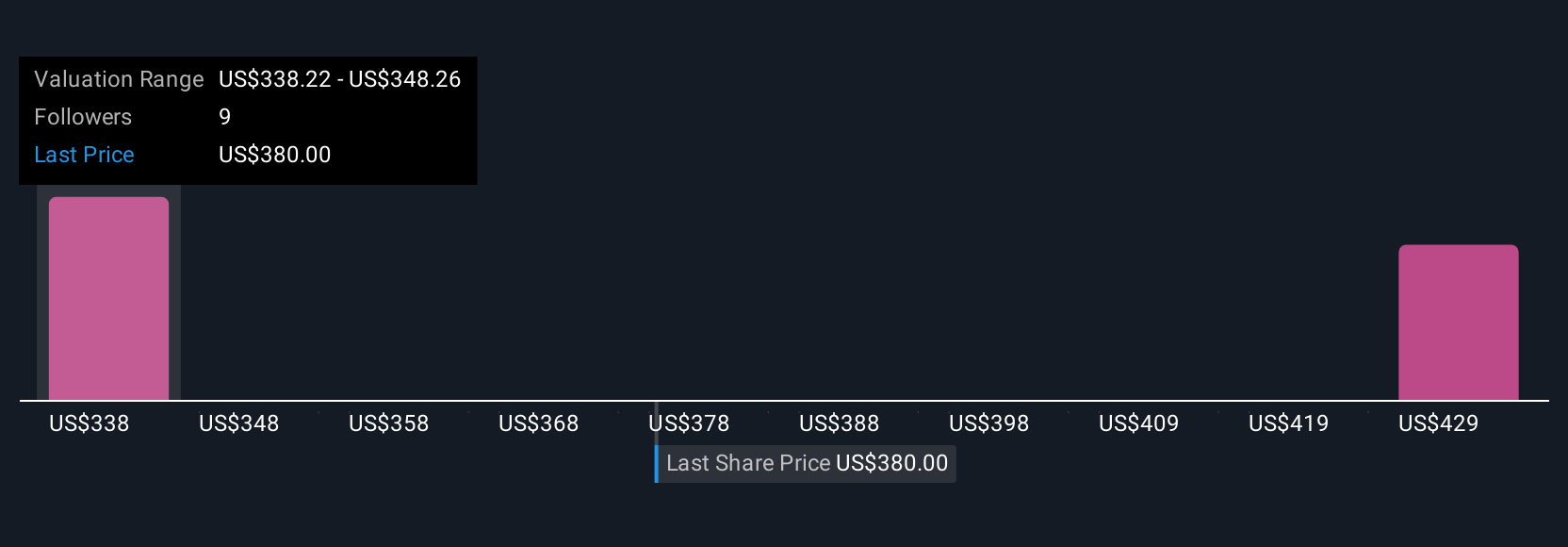

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story and expectations about a company, brought to life with a forecast. This means you decide what you believe FactSet Research Systems will earn, how its margins might evolve, and what fair value that implies. Unlike static multiples or formulas, Narratives connect your personal perspective (the “why” behind your numbers) to a real financial projection, and then to a clear fair value for shares.

Narratives are easy to create and explore on Simply Wall St’s Community page, where millions of investors share their own views. This tool allows you to adjust your assumptions, compare Fair Value to today’s Price, and decide whether to buy or sell, all without needing to master complex financial models.

The best part? Narratives update automatically when new earnings, news, or partnerships arrive, giving you a dynamic foundation for every decision. For example, one investor focused on FactSet’s AI innovation and growth potential may set a bullish price target close to $500, while another worried about rising costs and competition may see fair value as low as $355. Narratives help everyone anchor their view, whatever the story, directly to actionable data and the current market context.

Do you think there's more to the story for FactSet Research Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives