- United States

- /

- Diversified Financial

- /

- NYSE:EVTC

Why EVERTEC (EVTC) Is Up 9.2% After Strong Q2 Results and Expanded Buyback Program

Reviewed by Simply Wall St

- EVERTEC, Inc. recently reported strong second quarter 2025 results, with revenue growing to US$229.61 million and net income rising to US$40.47 million, alongside an expanded share buyback authorization and program extension through December 2026.

- These developments highlight the company's focus on both operational performance and returning capital to shareholders, signaling increased management confidence in the company’s financial position.

- Next, we'll examine how EVERTEC's earnings strength and expanded buyback program potentially reshape the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

EVERTEC Investment Narrative Recap

To be an EVERTEC shareholder, you'd need to believe the company can sustain earnings growth through disciplined execution across Puerto Rico and Latin America, while managing exposure to economic trends and key customer relationships. The recent strong Q2 2025 results and expanded buyback authorization add to investor confidence, but do not fundamentally change the short-term focus on integrating the Sinqia acquisition and monitoring foreign currency pressures, nor do they diminish the risk of softening local or regional economic activity. Among recent announcements, the increased buyback plan to US$150 million and extension through December 2026 stands out, reinforcing attention on efficient capital allocation alongside core revenue growth efforts. While this supports the near-term investment story, ongoing success depends on how execution evolves around integration efforts, organic pipeline wins, and managing client concentration. On the other hand, investors should be aware that sustained outperformance will hinge on managing the risk of revenue declines tied to...

Read the full narrative on EVERTEC (it's free!)

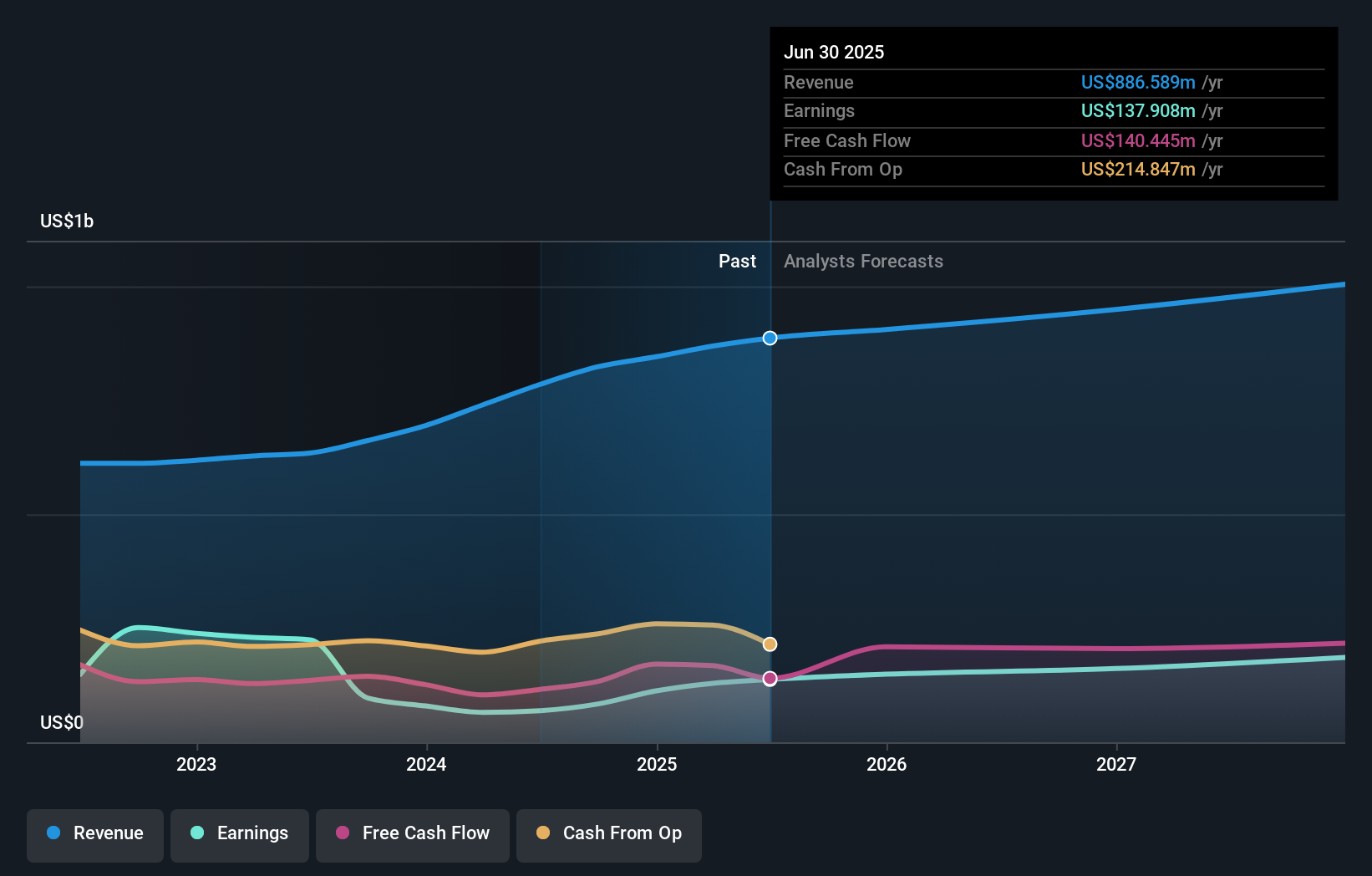

EVERTEC's outlook anticipates $999.0 million in revenue and $182.9 million in earnings by 2028. This implies a 4.8% annual revenue growth rate and an earnings increase of $53.6 million from the current $129.3 million level.

Uncover how EVERTEC's forecasts yield a $39.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value estimates for EVERTEC ranging from US$33.04 to US$58.84, with just two perspectives captured. While profit growth has recently accelerated, foreign currency headwinds remain a crucial consideration for future returns and overall business resilience.

Explore 2 other fair value estimates on EVERTEC - why the stock might be worth as much as 63% more than the current price!

Build Your Own EVERTEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EVERTEC research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free EVERTEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EVERTEC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVERTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVTC

EVERTEC

Provides transaction processing and financial technology services in Latin America, Puerto Rico, and the Caribbean.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives