- United States

- /

- Diversified Financial

- /

- NYSE:EVTC

EVERTEC (EVTC) Is Up 6.4% After Raising Full-Year Guidance on Strong Q3 Results – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- EVERTEC, Inc. recently reported third quarter 2025 earnings, posting sales of US$228.59 million and net income of US$32.86 million, both higher than the same period a year ago, and raised its full-year 2025 revenue and profit guidance.

- Stronger sales and raised expectations suggest EVERTEC is benefiting from rising digital payments demand and positive business momentum in Latin America and the Caribbean.

- We'll examine how EVERTEC's upgraded guidance, reflecting higher forecasted revenue and earnings, may influence its long-term investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

EVERTEC Investment Narrative Recap

To be a shareholder in EVERTEC, you need to believe in the ongoing shift toward digital payments in Latin America and the Caribbean, and the company's ability to grow alongside those trends while managing its risks. The recent quarterly results and raised revenue guidance point to continued business momentum, although the biggest short-term catalyst remains robust transaction growth, while reliance on large customers like Popular, Inc. still poses concentration risk. This news affirms strength, but those core dynamics remain essentially unchanged for now.

EVERTEC's updated full-year 2025 revenue guidance is the most relevant recent announcement, projecting US$921 million to US$927 million in revenue and higher earnings per share. This outlook supports optimism about digital payments adoption, yet also frames the importance of sustaining growth amid ongoing exposure to large single-client contracts, especially as Popular, Inc. contract pricing is set to shift in Q4. But even with the upgraded forecasts, investors should not overlook...

Read the full narrative on EVERTEC (it's free!)

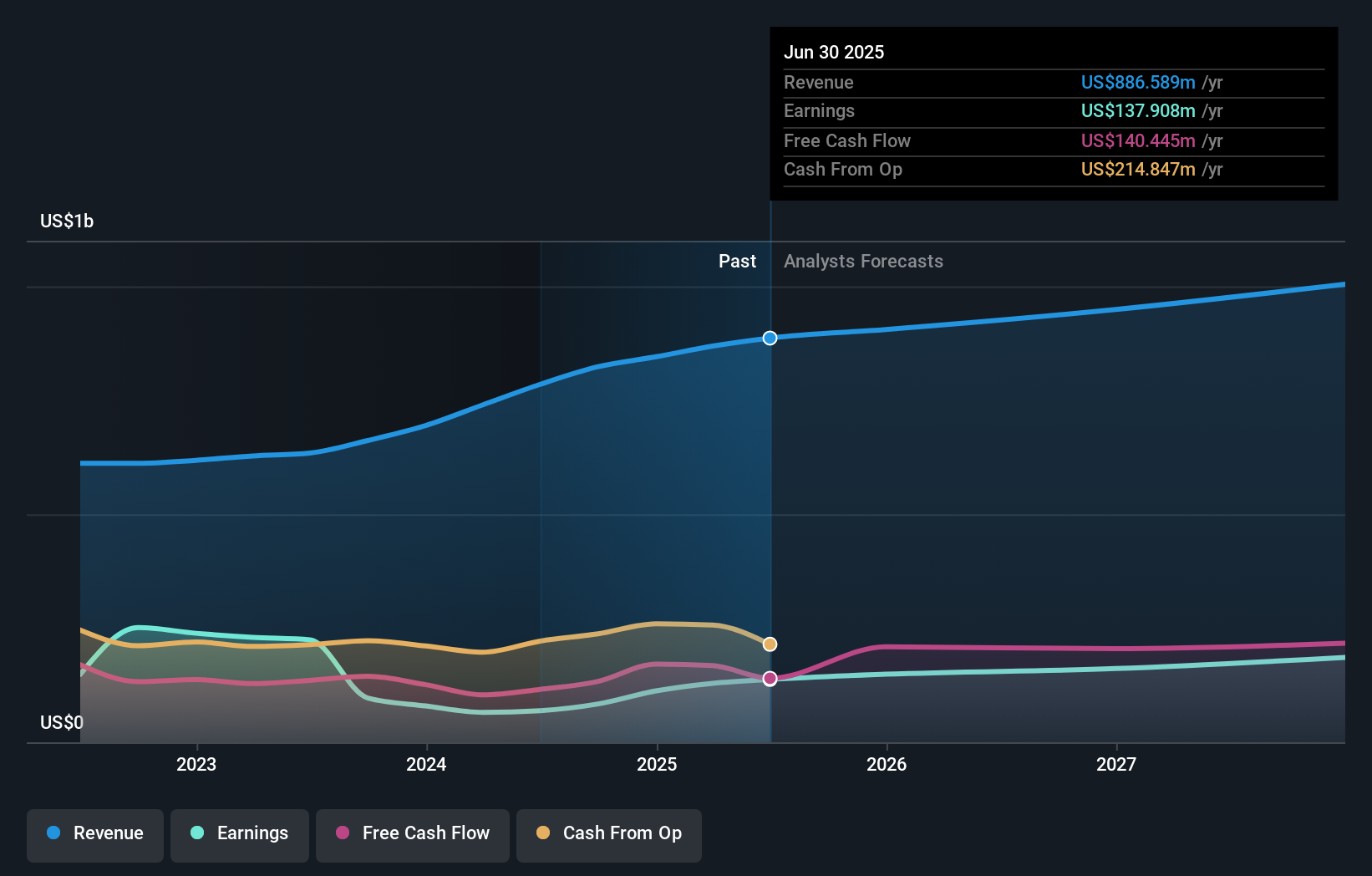

EVERTEC's outlook forecasts $1.0 billion in revenue and $193.8 million in earnings by 2028. Achieving these targets assumes a 5.0% annual revenue growth rate and an earnings increase of about $56 million from current earnings of $137.9 million.

Uncover how EVERTEC's forecasts yield a $33.80 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 3 distinct fair value estimates, ranging from US$30.64 up to US$56.35. As you consider these opinions, keep in mind that customer concentration could rapidly shift the outlook for EVERTEC’s earnings and stability.

Explore 3 other fair value estimates on EVERTEC - why the stock might be worth as much as 94% more than the current price!

Build Your Own EVERTEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EVERTEC research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EVERTEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EVERTEC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVERTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVTC

EVERTEC

Provides transaction processing and financial technology services in Latin America, Puerto Rico, and the Caribbean.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives