- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evercore (EVR) Earnings Jump 64.8%, Reinforcing Bullish Profitability Narratives Despite Long-Term Decline

Reviewed by Simply Wall St

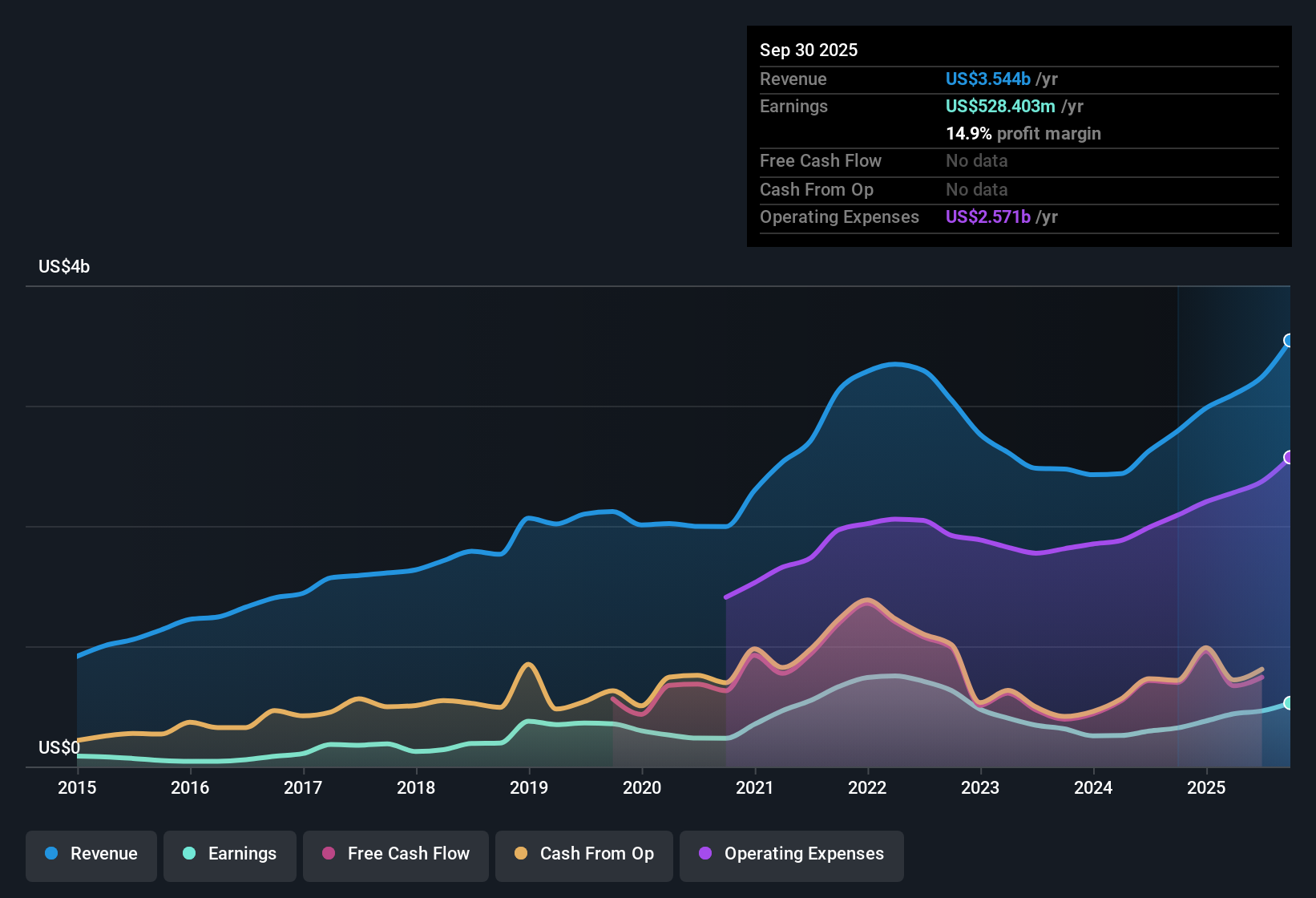

Evercore (EVR) reported a robust set of headline figures, with earnings surging 64.8% over the past year and net profit margins climbing to 14.9%, up from 11.5% a year ago. Though the share price sits at $291.66, well above a discounted cash flow fair value of $228.54 and exceeding the peer average price-to-earnings ratio, investors will have to weigh these strong short-term results against the fact that earnings have declined by an average rate of 6.7% per year over the past five years. With forecasts pointing toward further profit and revenue growth, expectations remain on the optimistic side as risks stay modest and recent margin expansion stands out.

See our full analysis for Evercore.Next, we will see how Evercore’s latest numbers match up with the market’s broader narratives. Let us dive into where expectations are met and where the conversation might shift.

See what the community is saying about Evercore

Margins Poised for Continued Climb

- Analysts expect profit margins to rise from 14.3% today to 17.6% in three years, an ambitious gain that would mark a substantial improvement over the current level of 14.9% and last year's 11.5%.

- According to the analysts' consensus view, this forecast is supported by Evercore's ongoing investments in technology and hiring of sector specialists. These key strategies are already evident in improved net margins but carry execution risk if cost controls or deal volumes do not keep pace.

- Expansion into non-M&A services such as private capital advisory and activism defense, now about 50% of total revenues, is expected to reduce exposure to deal cycle swings and underpin margin durability.

- At the same time, persistently high compensation ratios (65.4% of revenue this quarter) could pressure net margins, especially if competitive hiring and integration of acquisitions bring further fixed costs without immediate revenue uplift.

- To see how analysts weigh margin expansion against rising costs, dig into the full consensus narrative for Evercore. 📊 Read the full Evercore Consensus Narrative.

Growth Targets Exceed Recent Trends

- Despite five-year average earnings contraction of 6.7% per year, the company is now targeting robust growth. Revenue is forecast to rise at 16.4% per year and earnings are expected to increase 10.2% per year, with a consensus analyst view of $953.1 million profit by 2028.

- The analysts' consensus view argues these projections rely on successful integration of international acquisitions, expansion in cross-border M&A, and resilience in new business lines, yet highlight the risks if M&A volumes remain below prior peaks.

- Bulls point to Robey Warshaw’s acquisition and expansion in markets like France, Spain and Dubai as major profit drivers, leveraging deep relationships among large multinational clients for fee growth.

- Critics highlight that a high level of exposure to cyclical M&A activity could quickly erode these growth assumptions if the external deal environment weakens or integration of new teams falters.

Premium Valuation Despite Fair Value Gap

- Evercore’s current share price of $291.66 stands well above its DCF fair value of $228.54, and its price-to-earnings ratio of 21.3x remains above the peer average of 20.2x but below the broader capital markets industry at 25.2x.

- The analysts' consensus view suggests investors are betting on future revenue and margin improvement to justify the premium, but emphasize the tension between Evercore's current price, higher-than-peer valuation, and its mixed long-term earnings record.

- Shares trade below the latest analyst target price of $357.50, a gap that implies optimism around strategy execution. Yet the premium PE ratio means there is less room for error if margin or growth projections fall short.

- The absence of significant insider selling lends some confidence to bulls, but sustained upward pressure on compensation and competition could quickly alter the value story if operating leverage fails to materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Evercore on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s another way to interpret the figures? Add your perspective and shape the story in just a few minutes by creating your own narrative: Do it your way.

A great starting point for your Evercore research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Evercore’s strong recent quarter, its premium valuation and inconsistent long-term earnings highlight the risk if future growth or margins do not meet expectations.

If you want lower entry points and more value for your money, now is an ideal time to discover opportunities among these 831 undervalued stocks based on cash flows that may offer more upside potential and less price risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives