- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

Enova International (ENVA): Gauging Valuation After Analyst Upgrades and Four Straight Earnings Beats

Reviewed by Simply Wall St

Enova International (ENVA) is drawing attention after topping earnings expectations for four straight quarters. In addition, there is an upward trend in analyst estimates and a solid Zacks rank. This positive momentum has fueled fresh investor interest.

See our latest analysis for Enova International.

Enova International’s shares have surged to fresh highs this year, with investor sentiment getting a boost from upbeat quarterly results and news of an upcoming $261 million asset-backed note offering. Its 22.2% one-month share price return and an impressive 505% total shareholder return over five years suggest momentum is clearly building, both in the short term and the long term.

If this kind of sustained outperformance has you curious about other compelling opportunities, now's a great time to broaden your investing search and discover fast growing stocks with high insider ownership

With the share price at record highs and analyst targets still implying further upside, the big question for investors is whether Enova International remains undervalued or if the market has already priced in the company’s strong growth prospects.

Most Popular Narrative: 9.6% Undervalued

Enova International’s last close of $127.06 trails the most popular fair value estimate of $140.63, suggesting a valuation gap that the narrative proposes could close as key drivers materialize.

The scaling efficiencies of Enova's digital customer base, disciplined cost controls, and continued optimization of marketing effectiveness are driving operating leverage. This is leading to declining operating expenses as a percent of revenue and contributing to accelerating adjusted EPS growth and improving operating margins.

Want to see the formula powering this optimistic valuation? The most watched narrative points to potential leaps in earnings, margin trends, and future multiples. See what projections set this price target apart.

Result: Fair Value of $140.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory scrutiny or a shift in consumer lending preferences could quickly dampen Enova International’s growth trajectory. This could put current bullish expectations at risk.

Find out about the key risks to this Enova International narrative.

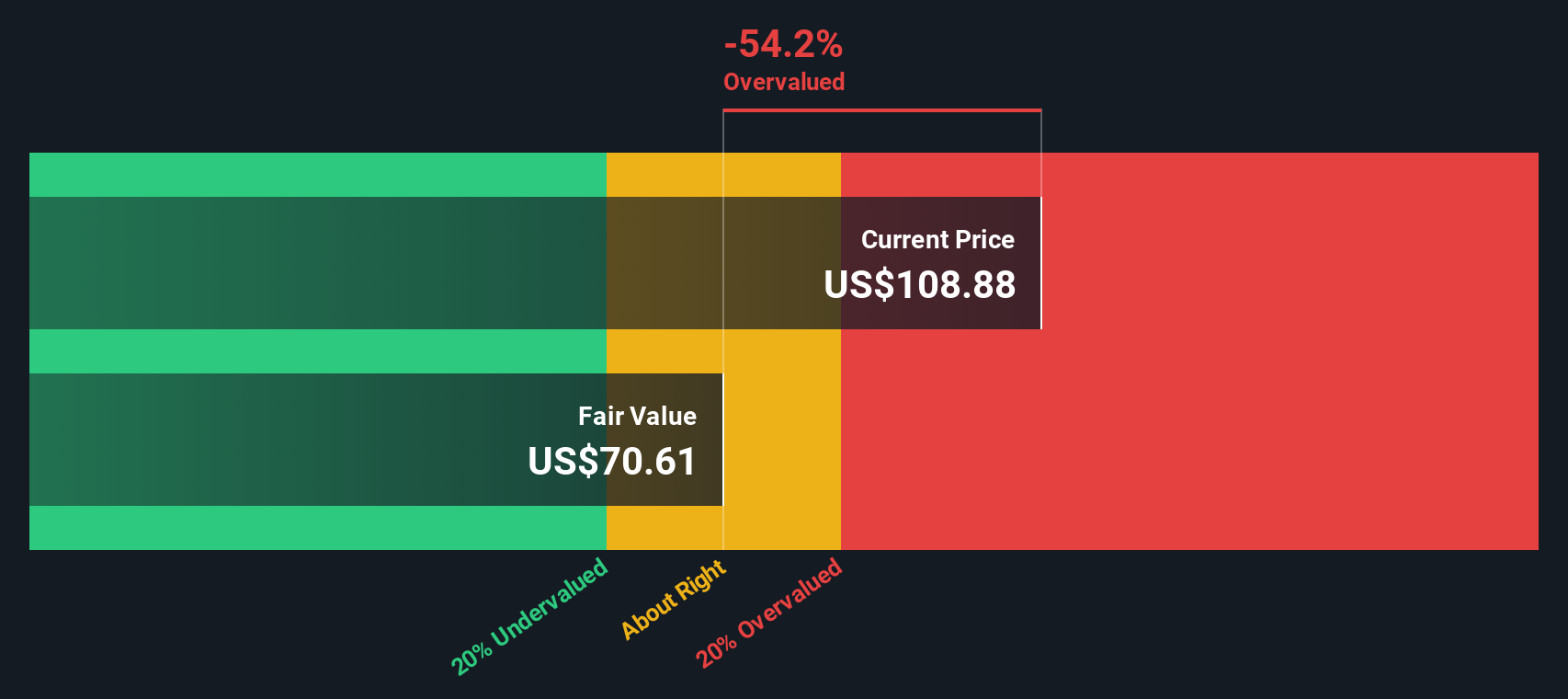

Another View: DCF Model Raises Questions

While the popular view sees Enova International as undervalued based on fair value estimates and growth momentum, our SWS DCF model tells a different story. It suggests the current share price is actually above its calculated fair value, which implies there may be less upside than expected. Does this model expose risks that other approaches are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enova International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enova International Narrative

If the analysis above does not quite fit your view or you want a hands-on look at Enova International’s data, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to get ahead of the curve and capture the next big market move, don’t wait for opportunities to pass you by. Use these powerful tools to uncover your next smart investment.

- Boost your portfolio’s income potential by scanning for reliable companies offering attractive yields via these 16 dividend stocks with yields > 3%.

- Tap into the future of finance as you hunt for strong contenders among these 82 cryptocurrency and blockchain stocks powering innovations in blockchain, digital currency, and decentralized systems.

- Spot unique opportunities with artificial intelligence breakthroughs, and invest in businesses at the forefront through these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives