- United States

- /

- Mortgage REITs

- /

- NYSE:DX

Dynex Capital (DX): Assessing Valuation Following Strong Earnings, Equity Raise, and New York Expansion

Reviewed by Simply Wall St

Dynex Capital (DX) has just delivered impressive third quarter earnings, with both revenue and net income climbing past expectations. The company also raised new equity capital and is expanding into New York City.

See our latest analysis for Dynex Capital.

After a year marked by solid execution and new initiatives, Dynex Capital’s 1-year total shareholder return stands at an impressive 23.5%, with momentum building in recent months. The share price has rebounded 9.3% over the past 30 days to $13.23, following upbeat earnings and a sustained dividend. This suggests that the market is responding to both growth prospects and renewed confidence.

If you’re seeking more ideas with strong momentum, now is an excellent time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets after a strong run, investors may wonder if Dynex Capital remains undervalued or if future growth is already reflected in the current price. This presents a crucial buying decision.

Price-to-Earnings of 11x: Is it justified?

Dynex Capital trades at a price-to-earnings (P/E) ratio of 11x, placing it below both its peers and the market average, even after its recent share price rally. This positions the stock as attractively valued on a key metric investors use to measure a company's value against its earnings.

The price-to-earnings ratio is a cornerstone valuation tool that compares a company’s market price to its earnings per share. A lower ratio can signal undervaluation if earnings are stable or set to grow. For a mortgage REIT like Dynex Capital, this measure is especially relevant because these businesses are valued largely by their income streams and payout potential.

Trading at 11x earnings, Dynex Capital stands below the US Mortgage REITs industry average of 13x and its peer average of 12.1x. Notably, the current ratio is also well below the estimated fair price-to-earnings of 21.4x, indicating that further upside could remain if market perceptions shift in Dynex’s favor.

Explore the SWS fair ratio for Dynex Capital

Result: Price-to-Earnings of 11x (UNDERVALUED)

However, slowing annual revenue and sensitivity to market rates could still impact Dynex Capital’s growth trajectory and investor sentiment in the coming quarters.

Find out about the key risks to this Dynex Capital narrative.

Another View: What Does Our DCF Model Show?

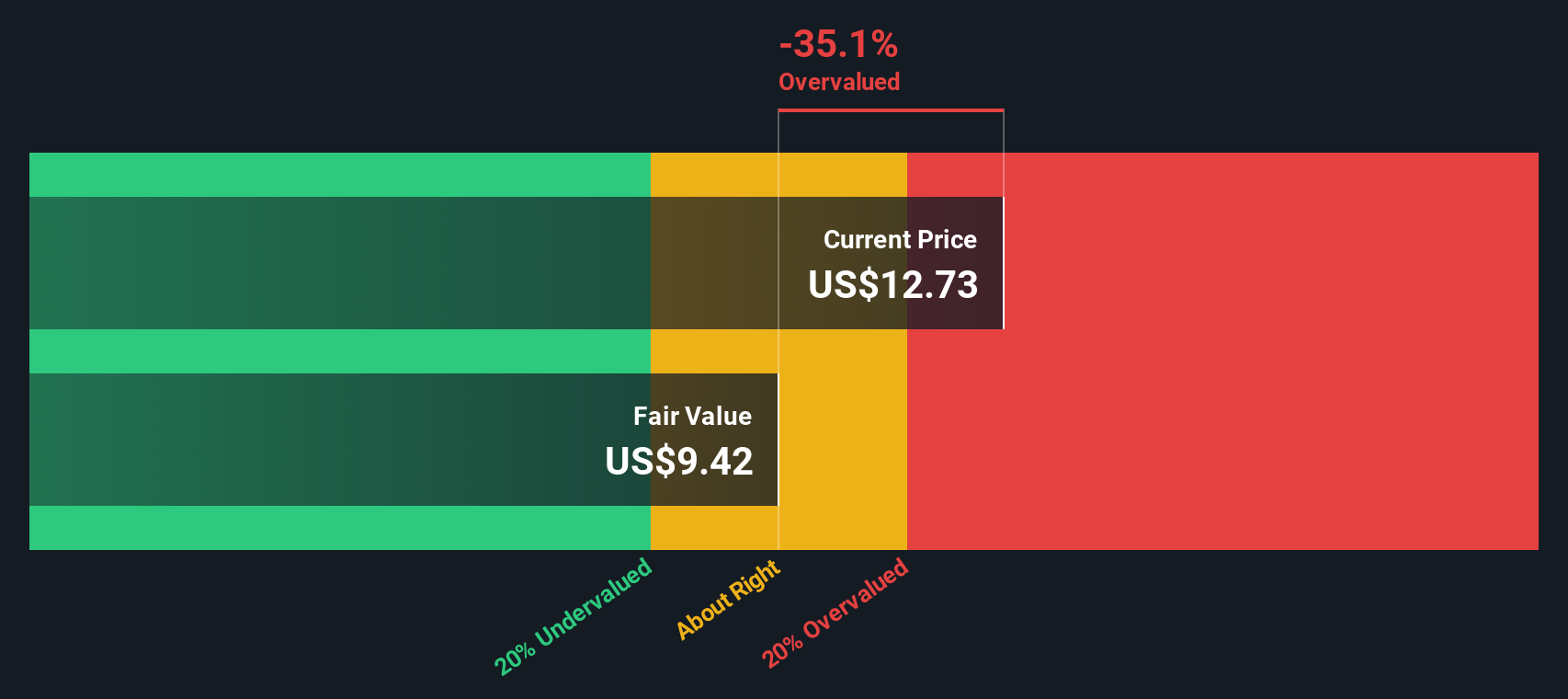

While the price-to-earnings metric paints Dynex Capital as undervalued, our SWS DCF model takes a more cautious stance. It currently estimates Dynex’s fair value at $9.03, which is well below the current market price of $13.23. This suggests the stock may be overvalued from a cash flow perspective. Could this difference signal a hidden risk or an opportunity for debate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dynex Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dynex Capital Narrative

If you want to take a different view or prefer to dig into the numbers yourself, you can build your own perspective quickly in just a few minutes, then Do it your way

A great starting point for your Dynex Capital research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't hold yourself back from what the market has to offer. Uncover the stocks making the biggest waves and fuel your portfolio with fresh potential.

- Pinpoint the latest income opportunities by checking out these 17 dividend stocks with yields > 3%, offering strong yields and financial resilience.

- Spot companies harnessing artificial intelligence by starting with these 27 AI penny stocks, which are positioned at the cutting edge of innovation.

- Unlock value plays you might have missed through these 876 undervalued stocks based on cash flows, based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DX

Dynex Capital

A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives